News Updates

Interest Payment On Late Payment Of TDS Not Eligible For Deduction Under Business Expenditure: ITAT

The Delhi Bench of the Income Tax Appellate Tribunal (ITAT) has held that interest payment on late payment of TDS is not an eligible business expenditure for deduction and it is not compensatory in nature.The two-member bench of A. D. Jain (Vice President) and Dr. B. R. R. Kumar (Accountant Member) has observed that the payment of interest on late deposit of TDS levied u/s 201(1A) is...

No Customs Duty On Spare Parts Supplied For Warship: CESTAT

The Ahmedabad Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has held that the spare parts supplied for warships are exempt from customs duty.The two-member bench of Ramesh Nair (Judicial Member) and Raju (Technical Member) has observed that the interceptor boat supplied by the appellant was a warship. The intercepted boats used by the Coast Guard...

Bombay High Court Directs Grant Of Rs 2 Lakh Compensation To Nigerian National Jailed For 2 Years Due To Mistake In FSL Report

Observing that liberty under Article 21 is also available to foreign citizens, the Bombay High Court today ordered compensation and granted bail to Nigerian national incarcerated in 2020 on the basis of an erroneous forensic report. Justice Bharti Dangre said that the applicant cannot be kept in detention merely because he is a foreign citizen and has criminal antecedents if there...

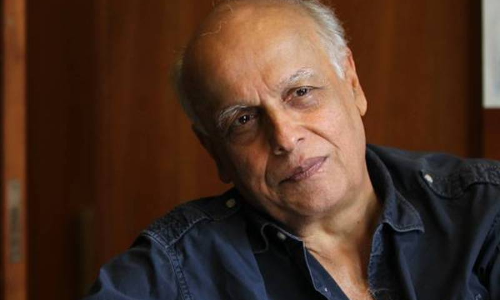

Bombay High Court Grants Bail To Man Accused Of Financing Attempt To Murder Mahesh Bhatt

The Bombay High Court on Thursday granted bail to Obed Radiowala, a close aide of gangster Ravi Pujari and accused of arranging for finances for the attempt to murder producer Mahesh Bhatt in 2014. Radiowala arrested in the USA in 2017 for living there as an illegal immigrant. He was subsequently in 2019 after a red corner notice was issued against him. Justice Bharati Dangre...

'Personnel Trained To Shoot Guns Made to Make Dosas For Higher Officials, Shameful Colonial Practice' : Madras HC On Orderlies System

The Madras High Court on Friday expressed deep dissatisfaction that even after 75 years of Independence, the State could not effectively eradicate the colonial practice of engaging uniformed officers as orderlies in the residence of higher officials. "We're approaching 75 years of Independence and yet you can't do away with this colonial system. Personnel who have been trained to shoot guns...

Salary Paid Overlooking Other Essential Expenses, Forced To Cut Down Trips: KSRTC Seeks 10 More Days To Disburse Pending Salary Before Kerala High Court

The Kerala State Transport Employee Association (KSRTC) has sought ten more days from the Kerala High Court to disburse salary yet to be paid to its employees. This comes after the Court directed KSRTC to disburse salary to its employees for the months of June and July before August 10 while adjudicating on a plea alleging that the employees were not being paid promptly. Although the...

Aircraft Operator To Transfer The Passenger's Information To Designated Customs Systems By Push Method: CBIC

The Central Board of Indirect Taxes and Customs (CBIC) has notified the Passenger Name Record Information Regulations, 2022.As per the Regulations, the National Customs Targeting Centre-Passenger was established by the Board to receive and process passenger name record information along with any other information relevant for risk analysis of passengers. It will be done for the purpose of...

Retracted Statement Cannot Simply Be Brushed Aside : CESTAT

The Mumbai Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has held that the contents of the retracted statement cannot simply be brushed aside to conclude that the assessee/appellant has indulged in the activity of undervaluation of goods.The two-member bench of S.K. Mohanty (Judicial Member) and P. Anjani Kumar (Technical Member) has observed that merely because...

Supreme Court Extends Time For Supertech Twin Tower Demolition

In connection with the Supertech Emerald Court project in Noida, the Supreme Court, on Friday, acceded to the request made by the New Okhla Industrial Development Authority (NOIDA) seeking time till 28th August, 2022 and a 'bandwidth of 7 days' thereafter to carry out demolition of the twin 40-storied towers. The Counsel appearing on behalf of NOIDA (Authority) stated...

Activity Of Mediator Cannot Fall Under Business Consultant Services, No Service Tax Under RCM Applicable: CESTAT

The Kolkata Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has held that the activity of a mediator cannot fall under business consultant services.The two-member bench of P. K. Choudhary (Judicial Member) and P. Anjani Kumar (Technical Member) has observed that the appellants/assessee are not liable to pay any service tax on the reverse mechanism on the...

GST On House Rent: Do All Tenants Have To Pay 18% GST?

The 47th GST Council meeting, presided over by Union Finance Minister Nirmala Sitharaman in June, approved a slew of changes to the taxing scheme. The modifications went into effect on July 18, 2022.One of the most significant changes was that a GST-registered tenant must pay Goods and Services Tax at the rate of 18% when renting a residential property. Earlier Regime Before June...