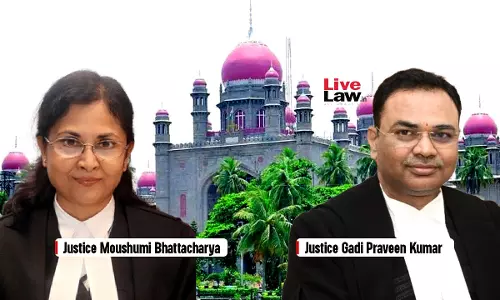

Telangana High Court

Telangana High Court Upholds Passport Revocation Of Urdu Journalist, Cites Allegations Of Material Against Sovereignity Of India

The Telangana High Court has dismissed a writ petition filed by an Urdu language journalist challenging a communication issued by the Regional Passport Authority following the revocation of his passport, holding that “renewal of passport is not automatic”, thus taking note of the material relating to activities prejudicial to the sovereignty and integrity of India that had been placed...

Frame Policy Regulating Sale & Consumption Of Non-Veg Food Within 100 Metres Of Temples, Schools, Hospitals: Telangana High Court To State

The High Court of Telangana, in a recent judgement, has directed the State and Greater Hyderabad Municipal Corporation (GHMC) to formulate a comprehensive policy regulating the sale and consumption of non-vegetarian and meat products within a 100 m radius of places of worship, educational institutions or hospitals within four weeks. Justice B. Vijaysen Reddy passed the directions while...

Marriage Under Hindu Marriage Act Unsustainable If Either Party Is Not Governed By The Act: Telangana High Court

The High Court of Telangana, in a recent judgement, declared the marriage between a tribal woman and an SC man to be void, holding that a marriage registered under the Hindu Marriage Act, 1955, “cannot be sustained in law if one of the parties is not governed by the Act”. A Division Bench of Justice K. Lakshman and Justice Vakiti Ramakrishna Reddy allowed an appeal filed by a Schedule...

Aadhaar & Voter ID Not Proof Of Citizenship; Compliance With Visa Rules Mandatory When Records Show Foreign Nationality: Telangana HC

The High Court of Telangana has declined to grant relief to a man who claimed Indian citizenship by birth and sought directions restraining the police and immigration authorities from compelling him to apply for a Long Term Visa (LTV). The Court held that documents such as Aadhaar card, voter ID, PAN card, driving licence and educational certificates cannot, by themselves, establish...

Illegal Adoption Cannot Be Regularised On Grounds Of Emotional Bonding With Child: Telangana High Court

The High Court of Telangana, in a recent judgment, rejected a plea filed by a man seeking restoration of custody of a minor girl child who had been taken from his care after police registered a case alleging illegal adoption and child trafficking. The Court held that custody could not be granted where the child was procured through a process not recognised by law, and that an emotional...

Forest Authorities Not 'Police Officers' Under CrPC, Cannot Investigate IPC Offences: Telangana High Court

The High Court of Telangana has held that forest officials are empowered to investigate offences under the Wild Life (Protection) Act, 1972, but do not have authority to investigate offences punishable under the Indian Penal Code (IPC). .Justice J. Sreenivas Rao passed the order while partly allowing a writ petition filed seeking quashing of a Preliminary Offence Report (POR) registered by...

Telangana High Court Annual Digest 2025

Citation: 2025 LiveLaw (Tel) 1 To 2025 LiveLaw (Tel) 144Telangana High Court Directs Cyberabad Police To Issue Advisory To Gated Communities, Flat Associations For Preventing Illegal ActivitiesCh Hari Govinda Khorana Reddy vs. State of Telangana and Others 2025 LiveLaw (Tel) 1 Justice B Vijaysen Reddy in his December 31 order passed a slew of directions while hearing a writ...

EPF Act | Quasi-Judicial Authority Can't Defend Its Own Order In Appeal By Stepping Into Shoes Of Party To The Lis: Telangana High Court

The Telangana High Court has held that Quasi-Judicial authorities under the Employees' Provident Funds and Miscellaneous Provisions Act cannot defend their own orders in appeal by stepping into the shoes of a party to the lis.The respondent (in the appeal) is an 'Employer' of an Establishment under section 2(e) of the Act. Proceedings were initiated against the employer under section 7A by...

Use of Tissue Culture Technology Does Not Bar Tax Exemption On Agricultural Income: Telangana High Court

The Telangana High Court has held that income earned from the sale of tissue-cultured plants qualifies as agricultural income and is therefore exempt from income tax, though advanced scientific techniques are used in their cultivation. The Bench of Justices P Sam Koshy and Narsing Rao Nandikonda heard a case where the assessee (appellant), who was engaged in the business of micropropagation...

Telangana High Court Acquits Accused In Ganja Cultivation Case; Says Oral Claims Can't Substitute Mandatory Compliance Under NDPS Act

The Telangana High Court has reiterated that oral claims of compliance by the Investigating Officer cannot substitute for the mandatory statutory requirement.Reiterating the ratio laid down by the Supreme Court in Karnail Singh v. State of Haryana, State of Punjab v. Baldev Singh, Vijaysinh Chandubha Jadeja and State of Gujarat v. Jagraj Singh, the Court has held that recovery under the NDPS...

S.118 Evidence Act Compliance Mandatory When Sole Reliance Is On Uncorroborated Testimony Of Child Witness: Telangana High Court

The Telangana High Court has reiterated that the competence assessment under section 118 of the Evidence Act, of a child victim is indispensable when the conviction of an accused is based solely on the uncorroborated testimony of the child.“As the trial Court similarly failed to conduct the mandatory competency assessment of the child witness under Section 118 of the Evidence Act and...

Police Must Show Arrest & Remand Of Accused In All Connected Cases: Telangana High Court Grants Doctor Bail In Surrogacy-Fraud FIRs

Granting bail to a doctor booked for surrogacy-related offences, the Telangana High Court said that once an accused is in judicial custody in the first case, then it is necessary for the investigating authorities to show the arrest and remand of the accused in all connected cases, from the respective dates of registration of FIRs.The petitioner contended that she was implicated in several...