News Updates

Insurance Company Cannot Escape Liability Just Because Driver Died of Heart Attack In Parked Vehicle: Karnataka HC

The Karnataka High Court has held that an insurance company is not absolved of its liability to pay compensation, in case the driver of an insured vehicle dies of heart attack during the course of employment, only on the ground that the tipper lorry was not in use at the time of his death.Referring to an earlier ruling in which the court held that driving is undoubtedly a tension-filled...

Kerala High Orders Status Quo In Renaming Kaloor-Kadavanthra Road

The Kerala High Court recently, issued an interim order directing that status quo ought to be maintained in the re-naming of the Kaloor-Kadavanthra Road for a period of one month. Justice N. Nagaresh passed the above order while admitting the petition. In the petition moved through M/S Basil Mathew, Ninan John, Sanjana Sara Varghese Annie, and Ajay Krishnan S., it was averred that...

CBDT Notifies ITR-A Under Section 170A For Filing Modified Return Pursuant To Business Reorganisation

The Central Board of Direct Taxes (CBDT) has notified Form ITR-A for filing the modified income tax return under Section 170A of Income Tax Act, 1961 pursuant to business reorganisation. The CBDT, vide Notification No. G.S.R 709(E), dated 19.09.2022, introduced Rule 12AD to the Income Tax Rules, 1962 through the Income Tax (31st Amendment) Rules, 2022. As per the newly inserted Rule...

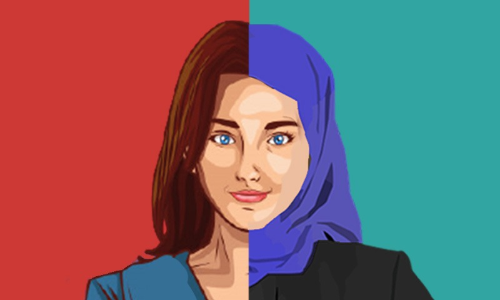

UP Court Sentences Man To Five Years In Jail In First Conviction Under UP 'Anti Love Jihad' Law

An Uttar Pradesh Court last week sentenced a 26-year-old Carpenter named Afzal to 5 years in prison under The Uttar Pradesh Prohibition of Unlawful Conversion of Religion Act, 2021' (Anti-Love Jihad Act). Kapila Raghav, the Additional District Judge (Pocso Court), Amroha observed that the prosecution had proved its case that the accused (Afzal) concealed his real identity regarding his name...

Writ Not Maintainable Against Admission Of Petition Under Section 34 Of A&C Act Without Pre-Deposit : Orissa High Court

The Orissa High Court has ruled that the Court cannot entertain a writ petition against an order passed by the lower court admitting the application under Section 34 of the Arbitration and Conciliation Act, 1996 (A&C Act) to set aside the arbitral award, despite the fact that the award debtor had failed to deposit 75% of the awarded amount, as mandated by Section 19 of the...

Failed To Retain Clerical Post In 1989, Cannot Claim Benefits Now: Meghalaya High Court To Assam Rifles Jawan

The High Court of Meghalaya recently ruled that merely because a personnel of Assam Rifles occupied a clerical post for a few months, would not make him entitled to the benefits which people on such positions in the central armed force gained on account of a judgement passed on August 23 in 2012.The division bench of Chief Justice Sanjib Banerjee and Justice W. Diengdoh said: "Merely...

Supply Of Ayurvedic Products Under AYUSH Department Licences Attracts 12% GST: AAR

The Telangana Authority of Advance Ruling (AAR) has ruled that 12% GST is payable on the supply of ayurvedic products under AYUSH department licences.The two-member bench of B. Raghu Kiran and S.V. Kasi Visweswara Rao has observed that the products which are used for care are treated as "cosmetics" and therefore taxed at 18% GST. 12% GST is payable on the products which are used for cure and...

Basic Customs Duty Exemption On Import Of Colour Data Projectors: CESTAT

The Delhi Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has held that the import of colour data projectors is exempted from basic customs duty.The two-member bench of Justice Dilip Gupta (President) and P.V. Subba Rao (Technical Member) has observed that for the period prior to 01.01.2017, all goods falling under CTSH 8528 41, 8528 51, or 8528 61 were...

TDS Exemption On Payments To Agents Of Foreign Shipping Companies: ITAT

The Delhi Income Tax Appellate Tribunal (ITAT) has held that the payments to agents of foreign shipping companies are exempt from TDS deduction.The two-member bench of Saktijit Dey (Judicial Member) and N.K.Billaiya (Accountant Member) has observed that provisions of section 172 of the Income-tax Act, 1961 apply to payments made to agents of foreign shipping companies; therefore, provisions...

Uddhav Thackeray-led Shiv Sena Approaches Bombay HC For Permission To Hold Dussehra Rally At Shivaji Park Ground

Former Chief Minister Uddhav Thackeray-led Shiv Sena has approached the Bombay High Court seeking directions to the Municipal Corporation of Greater Mumbai for permission to hold the party's annual Dussehra rally at the Shivaji Park ground on October 5, 2022.The plea states that despite 20 days having lapsed since an application was made to the BMC, the civic body is yet to take a decision...

'Top Secret' Communication Sent To District Police Chief Leaked, Kerala HC Orders DGP To Probe

The Kerala High Court recently directed the State Police Chief to investigate how Fasalu Rahman, an accused in a gold smuggling case, obtained a 'Top Secret' communication sent by the DGP to the District Police Chief Malappuram. The Division Bench of Justice Anil K Nareendran and Justice P.G. Ajithkumar, observed that State Police, which is the executing agency in preventive detentions...

Works Contract Services Executed To State Government For Construction Of Airport Terminal Building Attracts 18% GST: AAR

The Karnataka Authority of Advance Ruling (AAR) has ruled that 18% GST is payable on the work contract services executed for the state government for the construction of the airport terminal building and greenfield airport.The two-member bench of M.P. Ravi Prasad and T. Kiran Reddy has observed that work contract services executed for Karnataka State Police Housing and Infrastructure...