News Updates

Person Facing Sexual Harassment Enquiry Can't Be Represented By Lawyer Or Next Friend Before ICC, Will Prejudice Complainant: Delhi HC

The Delhi High Court has said that allowing a person, who is facing a sexual harassment enquiry before the Internal Complaints Committee (ICC), to be represented through someone with legal background will create a prejudice for the complainant, whose case is also being considered by the committee without aid of a legal practitioner or next friend.Rule 7(6) of the Sexual Harassment of Women...

'Hardship No Ground To Question Validity Of A Provision': Gujarat HC Upholds Amendment To Medical PG Eligibility Criteria

The Gujarat High Court, while dealing with two writ petitions, held the notification amending the eligibility criteria for participating in the admission process of various postgraduate medical courses within the State, to be constitutionally valid. The petitioners, who were qualified NEET PG candidates seeking admission to postgraduate medical courses, filed the petition challenging...

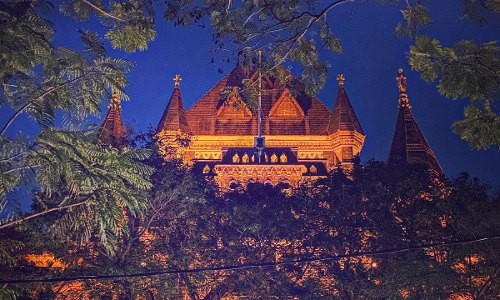

"Being Targeted": NCP Leader Approaches Bombay High Court Against Revocation of Chhath Pooja Permission By BMC

Just a day after the Bombay High Court paved the way for two members from CM Eknath Shinde's faction to host a musical event for Diwali in Thane, another petition was filed by a corporator of the Nationalist Congress Party (NCP) against revocation of permission for their 'Chhath Pooja' in Ghatkopar, Mumbai. The petitioner alleged that while their permission was cancelled, the...

Adjudicating Authority Can Invoke Inherent Powers To Replace The Liquidator: NCLAT

The National Company Law Appellate Tribunal ("NCLAT"), Principal Bench, comprising of Justice Ashok Bhushan (Chairperson), Dr. Alok Srivastava (Technical Member) and Mr. Barun Mitra (Technical Member), while adjudicating an appeal filed in Subrata Maity v Mr. Amit C. Poddar & Ors., has held that the Adjudicating Authority can invoke its inherent powers to replace the Liquidator and...

How Should Courts Determine If An Authority Is A State Under Article 12? Delhi High Court Answers

The Delhi High Court has discussed in detail the guidelines that must be borne in mind by the courts while adjudicating the question as to whether an authority can be termed as a "State" within the meaning of Article 12 of the Constitution of India.A division bench of Chief Justice Satish Chandra Sharma and Justice Subramonium Prasad said that the control exercised by the State over an...

5% GST Payable On GTA Services Availed For Transporting Cotton Seed: Punjab AAR

The Punjab Authority of Advance Ruling (AAR) has ruled that the 5% GST is chargeable on goods transport agency (GTA) services availed by the applicant for transporting cotton seed (Banaula) provided that the credit of input tax charged on goods and services used in supplying the service has not been taken, else 12% GST is applicable.The two-member bench of Varindra Kaur and Viraj Shyamkarn...

Service Tax Demand Can't Be Sustained On Ocean Freight Under RCM: CESTAT

The Delhi Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has held that the service tax demand is not sustainable as the appellant has purchased fertilisers, which are their inputs, at cost, insurance, and freight (CIF) value, which includes the ocean freight element.The appellant has paid custom duty on CIF value, which includes ocean freight, according to the...

Uttarakhand High Court Bans Storage, Sale Of Fire Crackers In Haldwani's Ramlila Maidan For Safety Of Residents

The Uttarakhand High Court today directed the state authorities to forthwith stop the storage or retail sale of firecrackers in the Ramlila maidan area of Haldwani in the Nainital district in view of the grave danger to the life and property of the residents of the area.The bench of Chief Justice Vipin Sanghi and Justice R. C. Khulbe has directed the District Magistrate of Nainital District...

Failure To Issue ASMT 10 In Respect Of Aspects Forming Subject Matter Of Proceedings Vitiates Entire Proceedings: Madras High Court

The Madras High Court has held that ASMT 10 is mandatory before proceeding to issue GST DRC-01. Failure to issue ASMT 10 in respect of the discrepancies forming the subject matter in GST DRC-01 culminating in GST DRC-07 would vitiate the entire proceedings.The single bench of Justice Mohammed Shaffiq has observed that any proceeding in GST DRC-01A/1 culminating in an Order in GST DRC-07,...

Related Party Of Financial Creditor Not Barred U/S 29A To Submit A Resolution Plan: NCLT Cuttack

The National Company Law Tribunal ("NCLT"), Cuttack Bench, comprising of Shri P. Mohan Raj (Judicial Member), while adjudicating an application filed in Trimex Industries Pvt. Ltd. v M/S. Sathavahana Ispat Ltd. & Ors., has held that the IBC does not bar a related party of the Financial Creditor from submitting a resolution plan for the Corporate Debtor. Further, an...

Appellate Authority To Bear In Mind The Predicaments Faced By Taxpayers On Introduction Of GST Procedures: Orissa High Court

The Orissa High Court has held that the Appellate Authority should have borne in mind the predicament faced by taxpayers on the introduction of a new set of procedures by way of the promulgation of the CGST Act and rules and that time is required to be taken to get acquainted.The division bench of Justice Jaswant Singh and Justice Murahari Sri Raman has observed that it preferred to exercise...

Operation And Maintenance Of Municipal Wet Waste Processing Facility Attracts 18% GST: West Bengal AAR

The West Bengal Authority of Advance Ruling (AAR) has ruled that the 18% GST is payable on the operation and maintenance of municipal wet waste processing facilities.The two-member bench of Varindra Kaur and Viraj Shyamkarn Tidke observed that the supply of services to be provided to the State Urban Development Agency for the design, build, finance, operation, and transfer of municipal wet...