News Updates

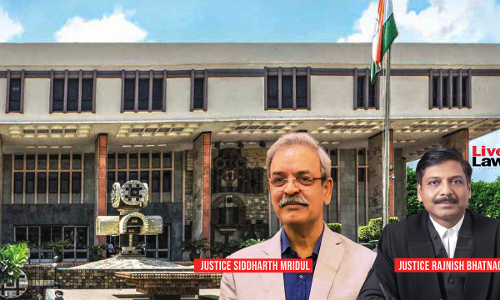

Delhi Riots Larger Conspiracy Case: Justice Mridul-led Special Bench Of High Court Says May Transfer Bail Appeals To Roster Bench

Adjourning the bail pleas moved by accused in a case alleging larger conspiracy behind 2020 North-East riots, a special bench of the Delhi High Court on Friday observed that adjudication in the individual appeals was "likely to take a long time".A special bench of Justice Siddharth Mridul and Justice Rajnish Bhatnagar will now hear the matter next on November 21 "to take a call" as to how...

FIR Lodged For Alleged Offences Does Not Bar Preventive Detention U/S 3 Blackmarketing Act To Prevent Future Crimes: MP High Court

The Madhya Pradesh High Court recently clarified that even if the FIR is lodged against the alleged act of an accused, the Authority concerned would not be barred from ordering preventive detention under Section 3 of the Prevention of Blackmarketing and Maintenance of Supplies of Essential Commodities Act, 1980. The division bench of Chief Justice Ravi Malimath and Justice Vishal...

P&H High Court Dismisses Husband's Plea Seeking Appointment Of Local Commissioner In Divorce Case For Wife's Medical Test

The Punjab and Haryana High Court has rejected a husband's petition seeking appointment of a Local Commissioner in divorce proceedings for getting expert opinion with regard to an illness of his wife.Justice Manjari Nehru Kaul said it is trite law that a party cannot be allowed to collect evidence through the court."Each party has to lead evidence in support of its case and it cannot be...

Kerala High Court Takes Suo Motu Case Over Child Falling Into Drainage, Directs Cochin Corporation To Slab Uncovered Drains In 2 Weeks

The Kerala High Court on Friday took suo motu cognizance of the incident wherein a three-year old child had fallen into an uncovered drain in Panampilly Nagar on Thursday evening. The child had been walking with his mother when he fell into the drain, and had a narrow escape due to the timely intervention of his mother and other local persons. Justice Devan Ramachandran was informed about...

Kerala High Court Rejects State's Appeal Against Order Quashing Its Decision To Halt Grant Of Pension To Paravur Ruler's Legal Heirs

The Kerala High Court on Wednesday held that the Constitution of India's 26th Amendment would not alter the obligation of the State under Article 295 (2) to pay annuity to the legal heirs of the Malayala Brahmin family that possessed sovereign rights over the territory of Paravur, which now falls under Ernakulam district.The court was dealing with a matter relating to pension of the...

VC Facility Not Being Provided To Foreign Prisoners Due To Security Reasons: Tihar Jail To Delhi High Court

The Superintendent of Tihar Jail has told the Delhi High Court that the facility of video calling or e-mulaakats are not being extended to the foreign prisoners due to security reasons. However, the Superintendent said telephonic voice calls are allowed once a week to inmates whose family members are residing abroad, on request.The submissions were made in a status report filed by the...

NCLT Delhi Initiates Insolvency Process Against Ansal Properties & Infrastructure Ltd.

The National Company Law Tribunal ("NCLT"), New Delhi Bench, comprising of Shri Bachu Venkat Balaram Das (Judicial Member) and Shri L.N. Gupta (Technical Member), while adjudicating a petition filed in Bibhuti Bhushan Biswas & Ors. v M/s Ansal Properties and Infrastructure Ltd., has initiated Corporate Insolvency Resolution Process ("CIRP") against Ansal Properties and Infrastructure Ltd....

Delhi High Court Rejects JeM Militant's Plea For Transfer From Tihar To Srinagar Jail

The Delhi High Court has rejected the petition filed by a Jaish-e-Mohammad (JeM) militant Abdul Majeed Baba, who is serving life imprisonment in a UAPA case, for transfer from Tihar jail to his native state jail in Srinagar.Justice Poonam Bamba however directed the Superintendent of Tihar Jail to ensure that requisite treatment and medical care be continued to be provided to Baba, who is 66...

Kerala High Court Calls For Strict Action Against Unauthorised Use Of National And State Emblems On Vehicles

The Kerala High Court on Tuesday directed the police and the Enforcement Wing of Motor Vehicles Department to take strict action against the unauthorised use of national and state emblems as well as government boards on vehicles. The division bench of Justice Anil K. Narendran and Justice P.G. Ajithkumar said many vehicles ply in the state carrying the name board 'Government of...

J&K Road Transport Corporation Employees Not Entitled To Pensionary Benefits: High Court

The Jammu & Kashmir and Ladakh High Court on Wednesday declined pensionary benefits to the retired employees of J&K State Road Transport Corporation (JKSRTC) while holding that the employees appointed by the Corporation were not entitled to the same at par with the government employees. The ruling was pronounced in two appeals filed by the government challenging single...

2017 PM Modi BA Degree Case: Listed Only Twice In 2022, Delhi High Court Adjourns RTI Case To May 3 Next Year

Pending for more than five years in Delhi High Court, the case related to Prime Minister Narendra Modi's academic degree has been adjourned to May 3 next year.Delhi University in 2017 had challenged an order of the Central Information Commission (CIC) directing the varsity to allow inspection of records of the students who had passed BA programme in 1978, when Prime Minister Narendra Modi is...

Madras High Court Quashes ED's Money Laundering Proceedings Against DMK MP Jagathrakshakan

The Madras High Court recently quashed Enforcement Directorate proceedings against DMK MP S Jagathrakshakan. A bench of Justice PN Prakash and Justice RMT Teeka Raman allowed the petition filed by the Minister after observing that the FIRs in the predicate offense were already quashed by a single judge.A case was registered against Jagathrakshakan in 2007 for forgery and cheating. The CBCID...