News Updates

Senior Advocate Birendra Saraf To Be Maharashtra's New Advocate General

Senior Advocate Dr Birendra Saraf is set to become the next Advocate General of the Maharashtra Government and a notification in this regard is likely to be issued soon.The CM Eknath Shinde-led Cabinet has approved Saraf's name according to officers in the meeting, however, an official notification by the Governor is awaited. Earlier, the cabinet accepted the resignation of outgoing AG...

Uddhav Thackeray Moves Delhi High Court Against Rejection Of Plea Challenging ECI's Freezing Order On Shiv Sena Party Symbol

Former Maharashtra Chief Minister Uddhav Thackeray has approached the Delhi High Court against a single judge order dismissing his plea against Election Commission of India (ECI)'s decision to freeze Shiv Sena's 'bow and arrow' party symbol.The ECI on October 8 directed both Thackeray and Eknath Shinde's faction to not use the name "Shiv Sena" or symbol "bow and arrow" till their rival claims...

In Quarantine Or On Marina Beach? Delhi High Court Says FB Posts Can't Be Treated As Determinative Of A Person's Location, Grants Relief To Lawyer

The Delhi High Court has said that posts on Facebook cannot be treated as determinative of a person's location at a particular point of time, at least by a court.Justice C Hari Shankar made the observation while dealing with a case wherein the Intellectual Property Appellate Board (IPAB) in December 2020 had asked the Bar Council of India to take action against two lawyers for allegedly...

ITAT Deletes Addition On Account Of Cash Deposited In The Bank Accounts During Demonetisation Period

The Raipur Bench of the Income Tax Appellate Tribunal (ITAT) has deleted the addition on account of cash deposited in bank accounts during the demonetization period.The bench of Ravish Sood (a judicial member) has observed that the AO, by not rejecting the books of account, has clearly accepted that the cash deposited in the bank accounts by the assessee firm during the year under...

No Fraudulent Intention Established: Gujarat High Court Quashes Penalty

The Gujarat High Court has held that the department could not establish any element of tax evasion with fraudulent intent or negligence.The division bench of Justice Sonia Gokani and Justice Mauna M. Bhatt has observed that the delay was of almost 4 1⁄2 hours before the e-Way bill could expire. It appeared to be bonafide and without establishing any fraudulent intention.The...

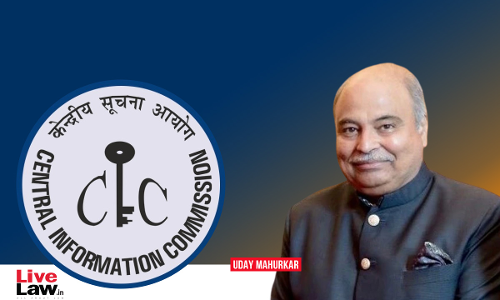

SC-Lawyer Requests CJI To Initiate Suo Moto Contempt Action Against Info. Commissioner For 'Lowering' Supreme Court's Authority

Supreme Court Advocate-On-Record, Aldanish Rein has written a letter to the Chief Justice of India and other judges of the Supreme Court to initiate a Suo Moto criminal contempt proceedings us/ 15 of the Contempt of Courts Act) against Information Commissioner, CIC-Uday Mahurkar claiming that he lowered the authority and scandalized the Supreme Court of India in one of his orders.Calling...

Interest Income Earned By Co-Operative Society From Investments Made With Co-Operative Banks Is Eligible For Section 80P Deduction: ITAT

The Mumbai Bench of the Income Tax Appellate Tribunal (ITAT) has allowed the deduction under section 80P(2)(d) of the Income Tax Act in respect of interest earned by cooperative societies from investments made with cooperative banks.The two-member bench of Aby T. Varkey (Judicial Member) and Amarjit Singh (Accountant Member) has relied on the decision of the Karnataka high court in the case...

Hold Meeting With Insurance Companies, Ensure Products Are Designed For Persons With Disabilities: Delhi High Court To IRDAI

The Delhi High Court on Tuesday directed the Insurance Regulatory and Development Authority of India (IRDAI) to call a meeting of all insurance companies to ensure that the products are designed for persons with disabilities so as to enable them to obtain health insurance coverage.Observing that there is no doubt that persons with disabilities would be entitled to health insurance coverage...

ITAT Allows Section 80G Deduction To The Trust Which Is Not Substantially Religious

The Pune Bench of the Income Tax Appellate Tribunal (ITAT) has allowed the deduction under Section 80G of the Income Tax Act to the trust, which is not substantially religious.The two-member bench headed by R.S. Syal (Vice President) and Partha Sarthi Chaudhury (Judicial Member) has observed that if a trust or institution incurs expenses for religious purposes, which are inclusive and only...

Maharashtra Cabinet Accepts Senior Advocate Ashutosh Arvind Kumbhakoni's Resignation As Advocate General

Senior Advocate Ashutosh Arvind Kumbhakoni's resignation as Advocate General has been accepted by the new Chief Minister - Eknath Shinde led cabinet paving the way for a new AG to be appointed. The Maharashtra cabinet had earlier deferred consideration of the AG's resignation till December 31, 2022 and requested him to continue to hold office till then. Kumbhakoni confirmed...

Even If Dowry Is Not Demanded Before Or At The Time Of Marriage, Subsequent Demand Is Sufficient To Attract Dowry Prohibition Act: Kerala High Court

The Kerala High Court on Tuesday, while dismissing the application filed by Kiran Kumar, the convict in the Vismaya dowry death case, seeking an interim order for suspension of his 10 years sentence, observed that even if there was no demand for dowry before or at the time of marriage, the subsequent demand made is sufficient to attract the definition of dowry under Section 2 of the...

Lease Charges Paid By The Railways Department Not Subjected To Levy Of VAT: Chhattisgarh High Court

The Chhattisgarh High Court has held that the lease charges paid by the Railways Department are not subject to the levy of value-added tax (VAT).The single bench of Justice P. Sam Koshy has observed that the right to use goods or the use of goods is not the relevant factor to justify the levy of taxes.The Indian Railways had floated a Scheme known as the "Own Your Wagon Scheme" to which...