Kerala High Court

Kerala High Court Strikes Down Rule 96(10) of CGST Rules Retrospectively, Finds Them Ultra Vires To CGST Act

The Kerala High Court struck down Rule 96(10) of the Central Goods and Service Tax Rules holding that it was ultra vires to the Section 16 of the Integrated Goods and Service Tax Act and was manifestly arbitrary.Justice P. Gopinath noted that Section 16 has not imposed any restriction in availing refund of taxes paid on input goods and input services or claiming refund of IGST after payment...

Centre Notifies Appointment Of Five Additional Judges To Kerala High Court

The Central government has notified the appointment of five additional judges to the Kerala High Court of Kerala.The following are the names:1. Shri Paramesara Panicker Krishna Kumar2. Shri Kodassery Veliyath Madom Jayakumar3. Shri Muralee Krishna Shankaramoole4. Shri Jobin Sebastian5. Shri Pandikkaran Varadaraja Iyer BalakrishnanThe Kerala High Court collegium had recommended their elevation...

Judicial Officer Cannot Be Browbeaten For Convenience Of A Party: Kerala High Court Dismisses Transfer Petition Alleging Bias, Imposes ₹15K Cost

The Kerala High Court has dismissed a transfer petition which was filed alleging bias of judicial officer with a cost of fifteen thousand rupees, finding that the petition was meritless and was used as a ploy to delay the court proceedings.In the facts of the case, the petitioner husband approached the High Court seeking the transfer of matrimonial dispute cases, alleging the Presiding...

Assessment Order Passed Before Expiry Of Time To File Reply Is Liable To Be Set Aside: Kerala High Court

The Kerala High Court stated that any assessment order issued before the time allowed for filing a reply has no legal validity and can be overturned.The Bench of Justice Gopinath P. observed that “…….the assessee had filed an appeal against the order is no ground to refuse relief to the assessee as the original order was clearly issued in violation of principles of...

Condonation Of Delay Application Should Focus On Sufficient Reason, Not Merits Of Claim U/S 119(2)(B) Of Income Tax Act: Kerala High Court

The Kerala High Court stated that an application for condonation of delay should focus on whether there was sufficient reason to condone the delay under Section 119(2)(B) of the Income Tax Act, rather than on the merits of the assessee's claim.Section 119(2)(B) of the Income Tax Act, 1961 empowers CBDT to direct income tax authorities to allow any claim for exemption, deduction, refund and...

Plea In Kerala High Court Seeks To Prevent 'Fake Doctors' By Establishing Centralized Portal For Verification, Conducting Inspections

A plea has been moved before the Kerala High Court urging the implementation of necessary measures to curb the increasing number of fake doctors practising in the state.Justice V G Arun has posted the matter to November 25 for instructions. The Petitioner, General Practitioners Association is a society registered under the Travancore Cochin Literary Scientific and Charitable...

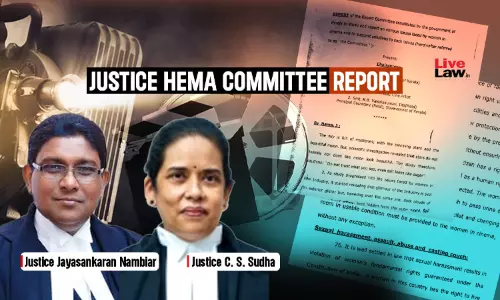

So Far 26 FIRs Registered Based On Justice Hema Committee Report: State Tells Kerala High Court

The Kerala government today informed the High Court that 26 FIRs have been registered based on the Justice Hema Committee Report, pursuant to Court's direction to the Special Investigating Team (SIT) to take necessary action as per Section 173 of the Bharatiya Nagarik Suraksha Sanhita, 2023.The State Government submitted the SIT's Action Taken Report to the Special Bench, Justice A....

Kerala High Court Calls For Protection Of Nurses From Malicious Medical Negligence Cases, Says They Deserve Moral Support

“They should be given moral support by the society and government. They should be allowed to work without fear of any prosecution and let them known as Indian nursing Nightingales.”

Scope of Judicial Review In Technical Matters Related To Infrastructure Projects, Land Acquisition Is Limited: Kerala HC Reiterates

Dismissing an appeal against an order rejecting the challenge to a land acquisition for construction of a Railway Over Bridge (ROB) at Edava in Thiruvananthapuram District, the Kerala High Court reiterated that the scope of judicial review in such technical matters like infrastructure projects and land acquisition is limited.In doing so the court underscored that a balance has to be...

Kerala High Court Weekly Round-Up: October 21 – October 27, 2024

Nominal Index [Citations: 2024 LiveLaw (Ker) 653 – 678]Ali @Aliyar v State of Kerala, 2024 LiveLaw (Ker) 653Sindhu Sivadas v State of Kerala and Another, 2024 LiveLaw (Ker) 654Sharun v State of Kerala and Others & Connected cases, 2024 LiveLaw (Ker) 655Vinil v State of Kerala , 2024 LiveLaw (Ker) 656Abhirami Girish v State of Kerala and Another, 2024 LiveLaw (Ker) 657Surendra Kumar v...

Failure To Consider Counsel's Medical Condition And Passing Ex-Parte Order Violates Natural Justice Warrants Setting Aside Appellate Authority's Order: Kerala HC

Kerala High Court: A Single Judge Bench of Justice N. Nagaresh set aside the Appellate Authority's ex-parte order in a gratuity dispute between HDFC Bank and its former Vice President. The court found that the Authority's failure to grant reasonable adjournments despite valid medical certificates violated principles of natural justice. The case concerned whether “personal pay”...

Dual Prosecution Under IPC And EPF Act For PF Defaults Valid; Serves Distinct Objectives: Kerala HC

Kerala High Court: A Single Judge Bench of Justice K. Babu upheld the trial court's refusal to discharge S. Mohammed Nowfal, proprietor of Tasty Nuts Factory. The Court held that prosecution under Section 406 IPC for criminal breach of trust involving PF defaults does not require prior sanction under Section 14-AC of the EPF Act. The Court emphasized that the 1973 addition of Explanation...