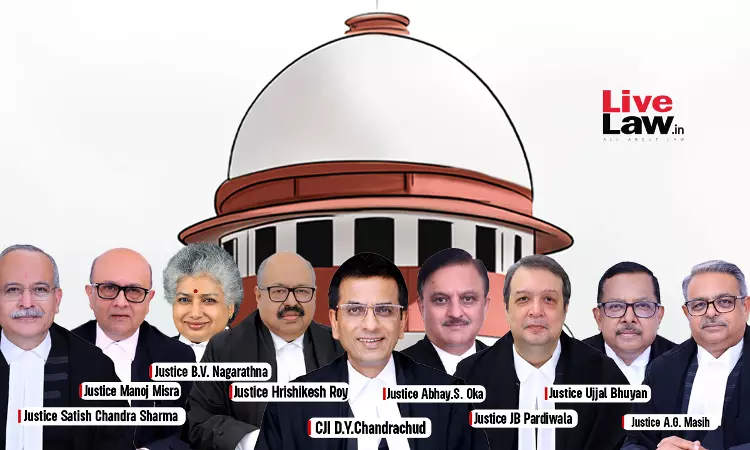

States' Power To Tax Mining Rights & Mineral-Bearing Lands Not Limited By MMDR Act; Royalty Not Tax: Supreme Court Holds By 8 :1

Anmol Kaur Bawa

25 July 2024 10:56 AM IST

States have the legislative competence to tax mineral-bearing lands, the Court held.

Next Story