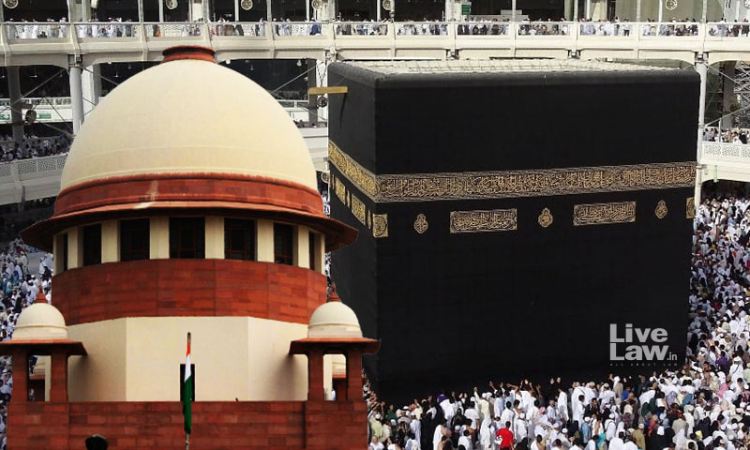

Can Haj & Umrah Services Be Exempted From GST? Supreme Court Starts Hearing Tour Operators' Plea

Mehal Jain

7 April 2022 7:18 PM IST

Next Story

7 April 2022 7:18 PM IST

The Supreme Court on Thursday commenced hearing on a string of petitions filed by various private tour operators seeking exemption from the Goods and Services Tax for the Haj and Umrah services offered by them to pilgrims travelling to Saudi Arabia.The tour operators are challenging the levy of GST on Hajis who avail themselves of services offered by registered private tour operators on...