Top Stories

Important MCQs Based On Latest Supreme Court Judgments For Law Examinations

1. A, B, and C are three brothers who constitute a Hindu joint family. B executes a registered release deed in favour of A, relinquishing all his rights and interests in the joint family property for valid consideration. Later, an unregistered family settlement memorandum was also entered, proving C's severance from the joint family property.When a dispute arises years later, the trial...

CJI BR Gavai Flags Off Supreme Court Bar Association's 'Justice For All' Walkathon Event

The Supreme Court Bar Association (SCBA) on Sunday hosted the inaugural “Justice for All” Run/Walkathon and Tree Plantation Drive, an event that brought together judges, lawyers, and citizens in a collective call for a more accessible and sustainable justice system.The 8 KM run/walk event began at the Supreme Court of India campus and concluded at India Gate. It was inaugurated and flagged...

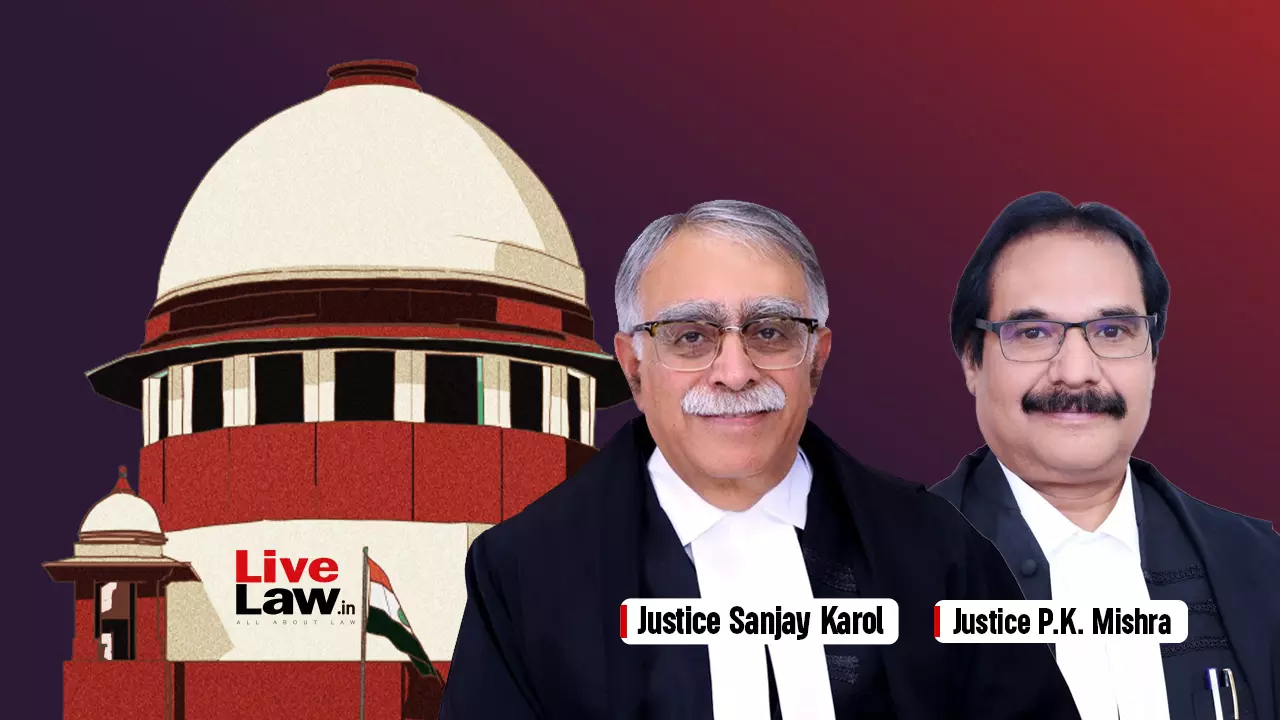

Can State File Appeal In CBI Cases When Investigation Was Partly Done By State Police? Supreme Court Leaves Question Open

The Supreme Court recently reaffirmed its judgment in Lalu Prasad Yadav and Anr. v. State of Bihar and Anr. (2010) 5 SCC 1 which held that a State Government cannot file appeal against a judgment in a criminal case which was prosecuted by the Central Bureau of Investigation.The Court chose not to go into the question whether a State Government can file appeal when the investigation was...

CJI BR Gavai Recalls Visit To Manipur Relief Camp, Says True Reward Of Legal Service Lies In Citizens' Gratitude

Chief Justice of India BR Gavai on Saturday recalled his March visit to a relief camp in Churachandpur district of Manipur while delivering his address at the National Conference on “Strengthening Legal Aid and Delivery Mechanisms” organised by the National Legal Services Authority (NALSA) at the Supreme Court.Speaking about the visit, during which he along with other Supreme Court...

Judgments Should Speak To Everyone, Ordinary People Must Be Able To Read And Follow: Justice Vikram Nath

Delivering the Second Ashoke Kumar Sen Memorial Lecture, Justice Vikram Nath of the Supreme Court drew from the life and legacy of Ashoke Kumar Sen to underline the importance of clarity, civility, and accessibility in judicial functioning.Praising the late jurist's abilities, Justice Nath said Sen exemplified how clarity in speech and writing reflects respect for the law, for institutions,...

'Ease Of Justice' Important For 'Ease Of Living' & 'Ease Of Doing Business' : PM Narendra Modi At NALSA Event

Speaking at an event celebrating the legal aid services, Prime Minister Narendra Modi today said that technology is indisputably a disruptive force, but with a pro-people focus, the same can serve as a tool for democratization.PM Modi opined that “ease of doing business” and “ease of living” would remain incomplete without “ease of justice.”The PM was addressing the...

Supreme Court Weekly Digest [October 8 - 15, 2025]

Army Act, 1950 - Sections 63, 69, 70, 162 - Armed Forces Tribunal Act, 2007 - Section 15(6) - Arms Act, 1959 - Sections 3, 25(1-B) - Code of Criminal Procedure, 1973 - Section 222 - Substitution of Conviction - Act Prejudicial to Good Order and Military Discipline - Possession of Ammunition - Scope of AFT's Power to Substitute Finding – Held, Section 15(6)(a) of the Armed...

Supreme Court Delivers Split Verdict On ISKCON Mumbai's Review Plea Against ISKCON Bangalore

The Supreme Court has delivered a split verdict in a review petition filed by the International Society for Krishna Consciousness (ISKCON) Society Mumbai against the Court's judgment delivered in May this year, which held that the ISKCON temple in Bengaluru belonged to ISKCON Society Bangalore.In view of the divergence of opinion in the two-judge bench, the matter has now been placed before...

Supreme Court Dismisses Rs 244 Crore Service Tax Plea Against Bharti Airtel Over Employee Scheme

The Supreme Court has recently dismissed a nearly Rs 244 crore service tax appeal filed by the Commissioner of Central Goods and Service Tax, Gurugram, against telecom giant Bharti Airtel Ltd. The dispute concerned the company's Airtel Employees Services Scheme (AESS), which offered free or discounted telecom services to its employees.The appeal challenged a January 27, 2025 order of the...

![Supreme Court Weekly Digest [October 8 - 15, 2025] Supreme Court Weekly Digest [October 8 - 15, 2025]](https://www.livelaw.in/h-upload/2023/02/13/500x300_458804-supreme-court-weekly-digest.webp)