Service Tax Liability Cannot Be Fastened On Implementation Of Govt Projects: Calcutta High Court

Kapil Dhyani

14 Jan 2025 11:41 AM IST

Next Story

14 Jan 2025 11:41 AM IST

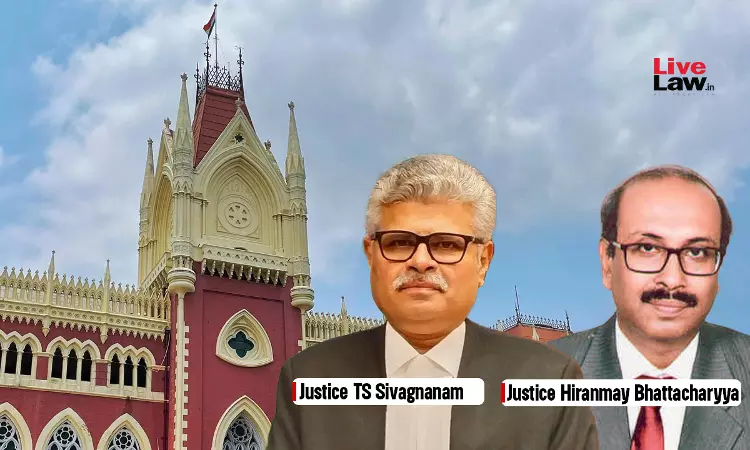

The Calcutta High Court has held that construction of canals/ pipelines/ conduits to support irrigation, water supply or for sewerage disposal, when provided to the Government, cannot be exigible to service tax. A division bench of Chief Justice TS Sivagnanam and Justice Hiranmay Bhattacharyya relied on two Circulars issued by the Central Board of Indirect Taxes and Customs...