Madras High Court

Madras High Court Directs Producers Of Kochadaiyaan Movie To Pay ₹2.52 Crore Towards Unpaid Debt

The Madras High Court has directed Mediaone Global Entertainment, the production house engaged in the production of Rajnikanth starrer “Kochadaiyaan” movie, to pay Rs. 2.52 Crore towards unpaid debts. Though Justice Sunder Mohan observed that neither the production house nor the complainant had proved their case under the Negotiable Instruments Act, the court highlighted that the purpose of the law was to compensate the complainant. The court also noted that the alleged cheque was...

Madras High Court Permits 'Jana Nayagan' Movie Producer To Withdraw Plea Against CBFC

The Madras High Court on Tuesday (February 10) permitted KVN Productions, producers of Vijay starrer "Jana Nayagan" movie to withdraw their plea challenging the certification process of the Central Board of Film Certification. Justice PT Asha permitted a request made by Vijayan Subramaniam, advocate for the production company. The production company had sent a letter to the High Court registry expressing its intention to withdraw the case. The production company had informed the...

'Savukku Shankar's Claim Of Needing Continued Specialised Medical Treatment Is A Ruse To Escape Law': State Tells Madras High Court

The State of Tamil Nadu has argued that the claims made by Youtuber Journalist Savukku Shankar of requiring continuous specialised medical treatment is only a ruse to escape the clutches of law. Following the directions of Justice P Velmurugan and Justice M Jothiraman, the State had filed its objection to the Medical Board's report regarding Shankar's health status. It may be...

'Jana Nayagan' Movie Producer Decides To Withdraw Case In Madras High Court Against CBFC

The producers of Vijay starrer Jana Nayagan movie have submitted a letter to the Madras High Court registry informing their interest to withdraw the petition in connection the CBFC certification issue.The letter, sent by the counsel on record Vijayan Subramaniam on behalf of KVN Production states that the producers have decided to go ahead with the review of the movie and hence do not wish...

Recovery From Shirt Pocket Is 'Personal Search'; Non-Compliance With Section 50 NDPS Act Vitiates Prosecution: Madras High Court

The Madras High Court recently observed that when a recovery under the Narcotic Drugs and Psychotropic Substances (NDPS) Act is made from the shirt pocket of the accused, it would be seen as a personal search, and compliance with the statutory mandate under Section 50 of the Act would be mandatory during such a search."A shirt pocket is inseparable from the clothing worn on the body at...

Madras High Court Weekly Round-Up: February 02 to February 08, 2026

Citations: 2026 LiveLaw (Mad) 52 To 2026 LiveLaw (Mad) 56 NOMINAL INDEX Kottaisamy and Others v. The State of Tamil Nadu, 2026 LiveLaw (Mad) 52 C Joseph Vijay v. The Deputy Commissioner of Income Tax and others, 2026 LiveLaw (Mad) 53 Rathinam v. The Superintendent of Police and Others, 2026 LiveLaw (Mad) 54 Mukesh Sharma v. State of Tamil Nadu, 2026 LiveLaw (Mad) 55 Mr....

NDPS Act | Rigours Of Section 37 Applies To Bail, Not On Securing Presence Of Accused After Summons: Madras High Court

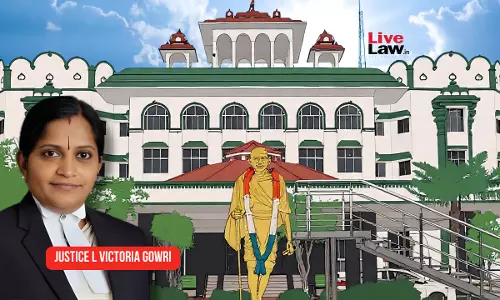

The Madras High Court recently observed that the rigours of Section 37 of the Narcotic Drugs and Psychotropic Substances (NDPS) Act would not come into play with respect to the acceptance of bond for appearance. Justice L Victoria Gowri remarked that Section 37 comes into play only when the liberty of a person from custody is sought and not when the accused is merely...

Resignation From Service Even On Medical Grounds Is Forfeiture Of Past Service, Not Eligible For Pension Benefits: Madras High Court

A full bench of the Madras High Court has clarified that resignation from service, even if for medical reasons, would result in forfeiture of past service and such a person would not be entitled to pensionary benefits. The bench of Justice SM Subramaniam, Justice D Bharatha Chakravarthy and Justice C Kumarappan held as under, “'Resignation' from a service or post as per Rule 23...

Temple Kumbabishekam Can't Be Conducted By Individual: Madras High Court Orders Multi-Community Committee

The Madras High Court has observed that Kumbabishekam festivals in a temple cannot be conducted by an individual, especially when there are multiple communities residing in a village. Justice S Srimathy thus directed the fit person appointed to the Sri Muniyandi Swamy temple, Sri Ayyanar Swamy temple, Sri Karuppa Swamy temple and Sri Muthumariamman Swamy Temple to form a...

Madras High Court Dismisses Plea By Actor Vijay Challenging 1.5 Crore Income Tax Penalty

The Madras High Court has dismissed a plea filed by Actor Vijay challenging the Rs. 1.5 crore penalty imposed on him by the Income Tax Department for undisclosed income of Rs 15 crore in the financial year 2015-16.Justice Senthilkumar Ramamoorthy noted that the show cause notice had been issued within the two-year limitation period prescribed under Section 263 of the Income Tax Act. As the...

Madras High Court Directs POCSO Accused To Pay ₹25K Cost To Victim After Advocate Names Her In Cause Title

The Madras High Court (Madurai Bench) recently imposed a cost of Rs 25,000 on the accused booked under the POCSO Act after finding that the name of the survivor/victim was explicitly mentioned by their counsel in the cause title of the criminal petition. A bench of Justice L Victoria Gowri strongly condemned the conduct of the petitioners' counsel and further directed that the said amount...

Chennai School Moves Madras High Court Against Notice To Host Seva Bharati Camp

Sri Saraswati Vidyalaya has approached the Madras High Court challenging a show cause notice issued by the Directorate of School Education (Private Schools) for allowing the Rashtriya Swayamsevak Sangh (RSS) to conduct their Seva Bharati camp in the school premises. Justice D Bharatha Chakravarthy has ordered notice in the plea. The plea states that RSS camps are foundational for its...

![Justice Sunder Mohan, Section 119 indian Evidence Act, Madras High Court, dum deaf witness, sign, writing, oral, unable to speak, interpreter, videograph, Ravichandran v. State [Crl.A.No.65 of 2020], Justice Sunder Mohan, Section 119 indian Evidence Act, Madras High Court, dum deaf witness, sign, writing, oral, unable to speak, interpreter, videograph, Ravichandran v. State [Crl.A.No.65 of 2020],](https://www.livelaw.in/h-upload/2022/10/08/500x300_438369-justice-sunder-mohan-and-madras-hc.jpg)