Delhi High Court

Delhi High Court Protects Personality Rights Of Actor Vivek Oberoi, Restrains Unauthorized Deepfake & Persona Misuse

The Delhi High Court has passed a john doe interim order protecting the personality rights of actor and entrepreneur Vivek Oberoi.Justice Tushar Rao Gedela granted an ex-parte ad-interim dynamic injunction in favour of the actor, while restraining multiple defendants and unidentified (John Doe) entities from misappropriating and exploiting his personality and publicity rights, including his...

Delhi High Court Upholds Termination Of Probationary DHJS Judge Over Viral Video, Says Action Not Stigmatic

The Delhi High Court has dismissed a petition filed by a probationary officer of the Delhi Higher Judicial Service (DHJS) challenging the termination of his services following circulation of a viral courtroom video, holding that the decision was a termination simpliciter based on overall unsuitability, and not a punitive or stigmatic action.A Division Bench comprising Justice Anil Kshetarpal...

Ensure Day-To-Day Recording Of Testimony In POCSO Trials To Prevent Witness Pressure: Delhi High Court To Trial Courts

The Delhi High Court has directed all trial courts in the national capital to ensure that testimony of witnesses already being examined should be recorded on day-to-day basis till its conclusion, in order to minimise the possibility of pressurising witnesses .Justice Girish Kathpalia said that the trial courts should also ensure that such trials should preferably be conducted on day-to-day...

Indiscriminate Freezing Of Bank Accounts Of Non‑Accused Violates Articles 19(1)(g), 21: Delhi High Court

The Delhi High Court has held that blanket and disproportionate freezing of bank accounts, especially where the account holder is neither an accused nor even a suspect, is “manifestly arbitrary” and violates Articles 21 and 19(1)(g) of the Constitution of India.“….any blanket or disproportionate freezing of bank accounts, particularly where the account holder is neither an accused...

High Court Refuses To Revise Final Result Of Delhi Judicial Services Exam 2023, Says Interference May Open Floodgates

The Delhi High Court has rejected a plea seeking revision of the final result of Delhi Judicial Services Examination, 2023, observing that judicial interference may open floodgates, leading to cascading consequences and rendering the process unworkable.A division bench comprising Justice C Hari Shankar and Justice Om Prakash Shukla said that Courts must exercise restraint and accord due...

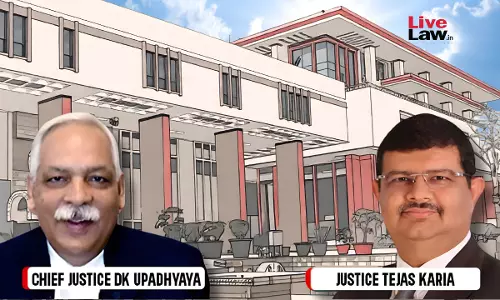

Child Custody Guidelines | Delhi High Court Refers PIL For 'Parenting Plan' To Administrative Side; Committee To Decide On Policy

The Delhi High Court on Wednesday asked a PIL petitioner, who sought the formulation of structured 'Child Access and Custody Guidelines' and a 'Parenting Plan', to approach the HC on its Administrative Side for policy formulation regarding the issue. A Bench of Chief Justice Devendra Kumar Upadhyaya and Justice Tejas Karia thus disposed of a PIL plea filed by the Ayushman Initiative...

Delhi High Court Calls For Integration Of Non-FIR Complaint Data, Pending & Decided Court Cases On NCRB Portal

The Delhi High Court has called for integration of data of complaint cases which do not result in FIRs as also cases which are pending or decided by the competent Courts on the National Crime Records Bureau (NCRB) portal. A division bench comprising Justice Prathiba M Singh and Justice Madhu Jain asked the Director of NCRB as also DDG of National Informatics Centre (NIC) to file status reports...

Delhi High Court Issues Directions To District Courts On Numbering Of Applications, Flags Lack Of Basic Details In Orders

The Delhi High Court has issued detailed practice directions to all the district courts in the national capital to ensure that every judicial order clearly reflects the numbers of applications decided, as well as the appearance of parties or their counsel.A division bench comprising Justice C Hari Shankar and Justice Om Prakash Shukla noted that it was coming across several cases in which...

'Half-Baked Petition': Delhi High Court Dismisses Centre's Plea With ₹25,000 Costs

The Delhi High Court has recently dismissed a petition filed by the Union Government challenging orders passed by the Central Administrative Tribunal (CAT), observing that it was filed after an inordinate delay of three years and was a “half-baked” attempt lacking the complete record.A Division Bench comprising Justice Anil Kshetarpal and Justice Amit Mahajan imposed costs of Rs....

Consenting Adults Don't Need Societal Approval For Choosing Life Partners; Even Parents Can't Interfere: Delhi High Court

The Delhi High Court has held that consenting adults do not need societal approval for choosing their respective life partners and that society or their parents cannot interfere in such matters.Justice Saurabh Banerjee said that sanctity has to be given to such decision of entering into marriage especially when the individuals are consenting adults, who incontrovertibly have the...

High Court Seeks Police Response On Accused Plea Seeking Bail In Delhi Riots Larger Conspiracy Case

The Delhi High Court on Friday issued notice on the bail pleas filed by two accused persons in relation to the 2020 North-East Delhi riots larger conspiracy case.A division bench comprising Justice Prathiba M Singh and Justice Madhu Jain issued notice on the bail pleas filed by accused Athar Khan and Saleem Malik.The Bench sought response of the Delhi Police and directed that status reports...

Exam Fairness Includes Mental Calm: Delhi High Court Allows JEE Aspirant To Reappear As Biometric Glitch Disrupted Exam

The Delhi High Court has recently permitted a JEE 2026 aspirant to reappear in the Main Session-I examination who faced repeated biometric authentication failures, observing that the prejudice suffered cannot be dismissed as insignificant.Justice Jasmeet Singh held that the legitimate fear of being declared ineligible, disqualified, or removed from the examination hall cannot be regarded...