Exclusion Clauses In Insurance Contracts To Be Construed Strictly & Against Insurer : Supreme Court

Debby Jain

27 May 2024 12:02 PM IST

Next Story

27 May 2024 12:02 PM IST

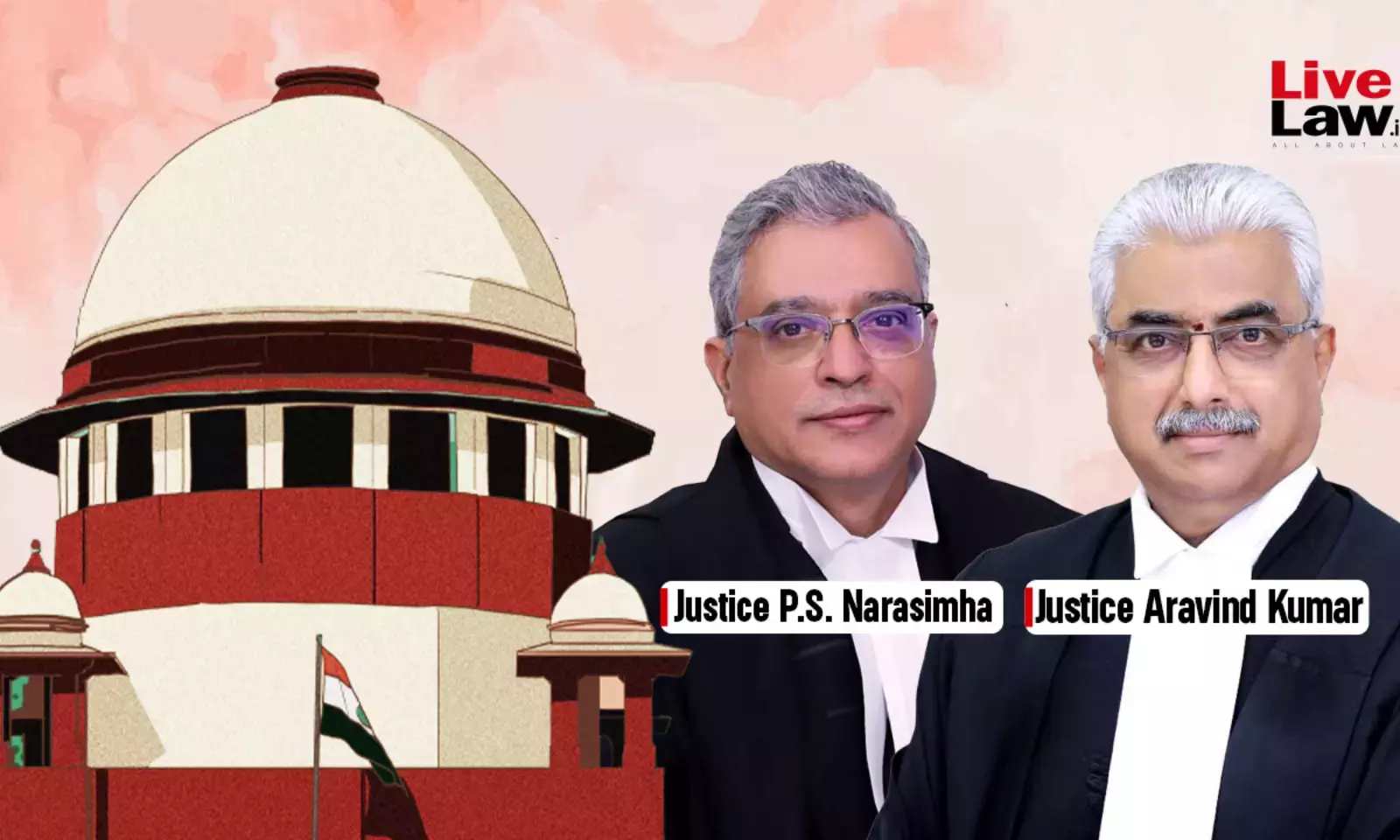

In a recent ruling, the Supreme Court reiterated that the burden of proving applicability of exclusionary clauses in insurance contracts is on the insurer and such clauses must be interpreted strictly against the insurer, as they may completely exempt the insurer of its liability.The bench of Justices PS Narasimha and Aravind Kumar was dealing with an insurance company's appeal against an...