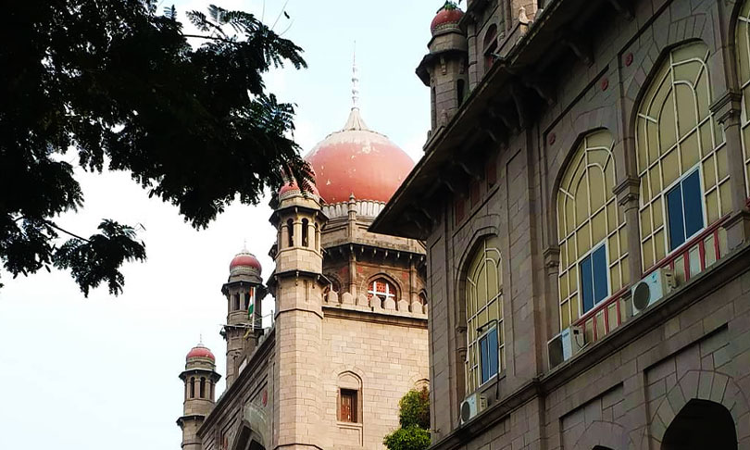

No Borrower Has Right To Grant Of One Time Settlement Scheme: Telangana High Court

Jagriti Sanghi

3 Dec 2022 3:00 PM IST

Next Story

3 Dec 2022 3:00 PM IST

The Telangana High Court relying on decision of Apex Court in Bijnor Urban Cooperative Bank Limited, Bijnor v. Meenal Agarwal, (2021) ruled that Banks have the freedom to accept or reject One-Time Settlement (OTS) proposals as per their commercial wisdom. "No bank can be compelled to accept a lesser amount under the One Time Settlement scheme despite a bank is able to...