Order Of ITAT Is Based On Evidence, Findings Based On Facts, Madras High Court Dismisses Tax Appeal

Upasana Sajeev

15 Jun 2022 6:00 PM IST

Next Story

15 Jun 2022 6:00 PM IST

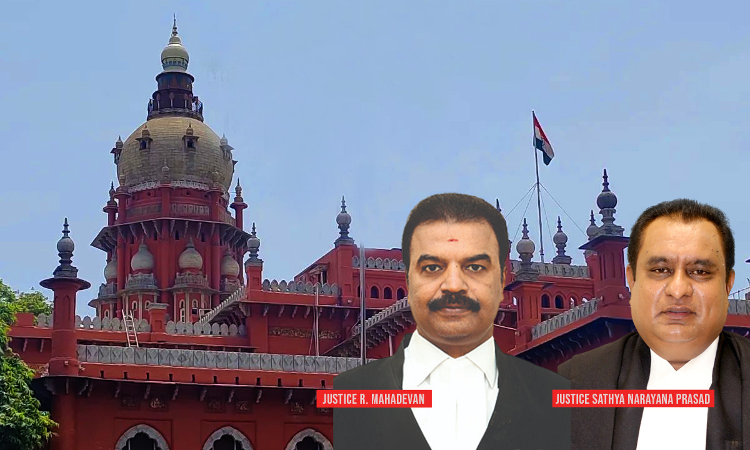

The Madras High Court recently dismissed a tax appeal observing that there were no substantial question of law arisen for consideration. The bench of Justice R Mahadevan and Justice Sathya Narayana Prasad were of the opinion that the order passed by the Commissioner of Income Tax (Appeals) which was confirmed by the Income Tax Appellate Tribunal was based on the evidence adduced before...