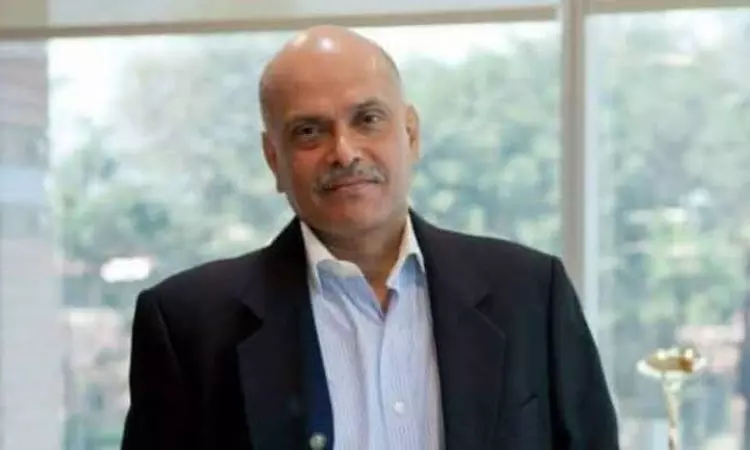

Delhi High Court Refuses To Quash Money Laundering Case Against Raghav Bahl, Calls Plea 'Premature'

Nupur Thapliyal

23 Jan 2023 1:03 PM IST

Next Story

23 Jan 2023 1:03 PM IST

The Delhi High Court on Monday refused to quash a money laundering case against The Quint's founder Raghav Bahl at this stage. The court also refused to quash the look out circular (LOC) against him at this stageDismissing the plea challenging registration of ECIR and proceedings initiated by ED, Justice Jasmeet Singh said:“The allegations (under the complaint) are yet to reach the stage...