News Updates

RSS Workers Move Madras High Court Seeking Permission To Conduct Route March

The members of the Rashtriya Swayamsevak Sangh (RSS) have moved the Madras High Court seeking permission to conduct a procession (Route March) wearing their uniform and led by a musical band on 2nd October 2022 and conduct a public meeting thereafter. When the seven petitions came up before the bench of Justice GK Ilanthiraiyan, the bench was informed that fifty more petitions are to be...

411 Deaths Due To Malnutrition: Bombay High Court Summons Nandurbar District Collector

The Bombay High Court on Monday summoned the Collector of Nandurbar district over high number of child and maternal deaths in the district due to malnutrition and lack of adequate medical facilities.Chief Justice Dipankar Datta and Justice M. S. Karnik were hearing a batch of PILs filed in 2007 related to death of several children, pregnant women and lactating mothers due to malnutrition in...

Orissa High Court Weekly Round Up: September 6 To September 11, 2022

Nominal Index:Ashok Kumar Gedi v. Jyotrimayee Behera & Ors., 2022 LiveLaw (Ori) 132Ashis Kerketta & Anr. v. State of Odisha, 2022 LiveLaw (Ori) 133Sanjit Kumar Mishra & Ors. v. Ranjit Mishra, 2022 LiveLaw (Ori) 134Cases Reported in the Week:O. 6 R. 17 CPC | Amendment To Election Petition Can't Be Permitted To Cure 'Inherent Defect' After Expiry Of Limitation Period: Orissa...

CBIC Prescribes New Procedure For Disposal Of Gold

The Central Board of Indirect Taxes and Customs (CBIC) has prescribed the new procedure for the disposal of gold.As per the new rules, the seized/confiscated gold (other than ornaments/jewellery/articles) shall be transferred to the Reserve Bank of India (RBI) through Security Printing and Minting Corporation of India Ltd. (SPMCIL). The implementation of the new procedure was by...

Cancellation Of GST Registration Ultimately Impacts Recovery Of Taxes: Calcutta High Court

The Calcutta High Court has held that if the registration of a dealer is cancelled, the dealer cannot carry on its business in the sense that no invoice can be raised by the dealer. This would ultimately impact the recovery of taxes.The division bench of Justice T.S. Sivagnanam and Justice Prasenjit Biswas has held that the suspension of the appellant's registration should be...

ITAT Allows Deduction On Residential House Built Up On 3 Adjacent Contiguous Plots

The Delhi Bench of the Income Tax Appellate Tribunal (ITAT) has allowed the claim of a deduction under section 54 of the Act for a residential house built on three adjacent contiguous plots. The principle of multiple residential houses/units holds good till the units are in the same physical location and contiguous to each other.The two-member bench of Astha Chandra (Judicial Member)...

Transporter Of Goods May Seek Release Of Only The Conveyance: Madras High Court

The Madras High Court has held that the transporter may seek release of only the conveyance upon satisfaction of the statutory conditions.The division bench of Justice Anitha Sumanth has observed that the phrase 'person transporting the goods' in Sections 129(1) and (6) to mean the owner or his agent who has contracted to supply the goods, and not the transporter who will provide...

No GST On Services Of Sweeping, Segregation And Transport Of Garbage: Karnataka AAR

The Karnataka Authority of Advance Ruling (AAR) has ruled that GST is not payable on the services of cleaning and sweeping of lawns and garden path areas and segregating and transporting garbage.The two-member bench of M.P. Ravi Prasad and T. Kiran Reddy has observed that no GST is payable on the supply of manpower for garden maintenance on an outsourced basis to the Department...

PCIT Failed To Recorded Satisfaction Under His Signature Prior To Issuance Of Reassessment Notice By AO: Allahabad High Court

The Allahabad High Court has held that the Principal Commissioner of Income Tax (PCIT) has not recorded satisfaction under his signature prior to the issuance of a reassessment notice by the Assessing Officer under Section 148 of the Act, 1961.The division bench of Justice Surya Prakash Kesarwani and Justice Chandra Kumar Rai has observed that subsequent to the issuance of the...

Litigation Expenditure Incurred To Protect Business Is Covered Under Revenue Expenditure: ITAT

The Jaipur Bench of the Income Tax Appellate Tribunal (ITAT) has held that when litigation expenditure is incurred to protect the business, the same is revenue expenditure.The two-member bench of Sandeep Gosain (Judicial Member) and Rathod Kamlesh Jayantbahi (Accountant Member) has observed that since the assessee has no interest in the ownership of the asset but he is in possession of...

Training Fee Paid To Professional Trainer Doesn't Amounts To Fees for Technical Services, No TDS Deductible: ITAT

The Bangalore Bench of the Income Tax Appellate Tribunal (ITAT) has held that TDS is not deductible on training fees paid to professional trainers as it does not amount to fees for technical services.The two-member bench headed by N.V. Vasudevan (Vice-President) and Chandra Poojari (Accountant Member) have observed that the nature of service rendered by the non-resident is neither in...

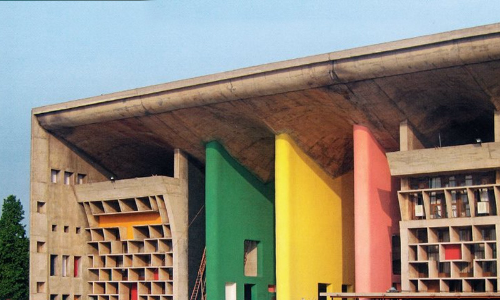

Supreme Court Collegium Proposes Elevation Of 9 Judicial Officers To Punjab & Haryana High Court

The Supreme Court Collegium has approved the proposal for elevation of the following Judicial Officers as Judges in the Punjab & Haryana High Court:1. Shri Gurbir Singh 2. Shri Deepak Gupta, 3. Ms. Amarjot Bhatti, 4. Ms. Ritu Tagore, 5. Ms. Manisha Batra, 6. Ms. Harpreet Kaur Jeewan, 7. Ms. Sukhvinder Kaur, 8. Shri Sanjiv Berry, and9. Shri Vikram Aggarwal.The approval was given in...