News Updates

Kerala High Court Dismisses PIL Against Use Of Star Plates And Flags On Cars Of Senior Police Officers

The Kerala High Court recently dismissed the Public Interest Litigation challenging the display of star plates and the use of flags on the cars of senior police officers. The division bench of Chief Justice S. Manikumar and Justice Shaji P. Chaly observed that symbols and markings are used by the high ranking police officers for the identification purpose by the other police officers and...

Inconclusivity Of Blood Stains Not Relevant When Disclosure Statement & Link Of Other Circumstantial Evidence Stands Proven: Punjab & Haryana HC

The Punjab and Haryana High Court while dealing with a case of murder based on circumstantial evidence, affirmed lower court's decision finding chain of circumstances conclusively proving the guilt of accused-Appellant. The bench comprising Justices Sureshwar Thakur and N.S.Shekhawat observed that inconclusivity of serologist's opinion about blood stains on the murder weapon and clothes...

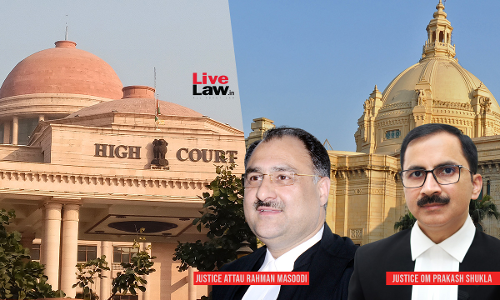

Recognition Of LoP By Speaker/Chairman Is A Part Of Convention Not Governed By 'UP State Legislature Act': Allahabad High Court

The Allahabad High Court has held that there is no provision in the Uttar Pradesh State Legislature (Members' Emoluments and Pension) Act, 1980 which mandates the Speaker/Chairman of the house to recognize the leader of a party having the greatest numerical strength, to be the leader of the opposition.The court further observed that if the Speaker recognizes any person who is the leader of...

Rajasthan High Court Stays Pali District SP's Order To Seize 'DJ' Vehicles Used During Religious Festivals, Seeks State's Reply

The Rajasthan High Court recently stayed an order issued by the Superintendent of Police, District Pali to the district police officials to seize vehicles carrying the Disk Jockey system if the same are used during the upcoming religious festivals in the district.In a prima facie observation, the Bench of Justice Dinesh Mehta also remarked that neither the Rajasthan Noises Control Act, 1963...

CCI Imposes Penalty Of Rs. 1337.76 Crore On Google For Anti-Competitive Practices In Relation To Android Mobile Devices

The Competition Commission of India (CCI) has imposed a penalty of Rs. 1337.76 Crore on Google under Section 27 of the Competition Act, 2002, for abusing its dominant position in multiple markets in the Android Mobile device ecosystem. The Commission has also issued a cease and desist order against Google. The Commission has laid down a slew of measures which Google has to...

Arbitration Clause In The Initial Agreement Binding Even If Subsequent Settlement Doesn't Have It: Delhi High Court

The Delhi High Court has ruled that an arbitration clause contained in a rent agreement would continue to be binding upon the parties, despite the fact that after the expiry of the agreement the parties had entered into a 'Terms of Settlement' and 'Addendum to Settlement', which did not contain an arbitration clause. The Court observed that the relationship between the parties came...

GST Council Notifies Authorities On Actions To Be Taken Consequential To The Issuance Of A Show Cause Notice And Recurring SCNs In The Case Of Enforcement Actions

The Goods and Service Tax Council has notified the authorities regarding action consequential to the issuance of a Show Cause Notice and for the issuance of a recurring Show Cause Notice in the case of an enforcement action initiated by the Central authorities against a taxpayer assigned to a State and vice versa.It has been noted that varied practices are followed by the field...

Govt Servant Turning Hostile In Criminal Trial Does Not Amount To Misconduct, May Be Unethical: Bombay High Court

The court clarified that appointing authority can proceed against the employee departmentally for turning hostile in a criminal trial based on conviction under Section 191 IPC, without conducting any departmental inquiry.

MSO Liable To Pay Service Tax For Providing Cable Operator Services To LCO: CESTAT

The Chandigarh Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has held that Multi System Operators (MSOs) are liable to pay service tax for providing cable operator services to Local Cable Operators (LCOs).The two-member bench of Ajay Sharma (Judicial Member) and P.V. Subba Rao (Accountant Member) has observed that owing to the business model of the cable...

ITAT Deletes Disallowance u/s 14A Against Toyota As No Exempted Income Was Earned

The Banglore Bench of the Income Tax Appellate Tribunal (ITAT) has deleted the disallowance under section 14A of the Income Tax Act against Toyota as no exempted income was earned.The two-member bench headed by N.V. Vasudevan (Vice President) and Padmavathi S (Accountant Member) has noted that the AO has made the disallowance on the basis that the investment could potentially earn income,...

CESTAT Allows CENVAT Credit On Welding Electrodes And Dissolved Acetylene Gas As Inputs In Cement Manufacturing Process

The Mumbai Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) consisting of Suvendu Kumar Pati (Judicial Member) has allowed the CENVAT Credit on Welding Electrodes and Dissolved Acetylene Gas (D.A. Gas) as inputs in the Cement Manufacturing Process.The appellant/assessee is a manufacturer of cement and clinker having a Central Excise registration. For the process...