News Updates

Byju's RP Moves NCLAT After Aakash Withholds Rights-Issue Shares Over FEMA Concerns

The resolution professional of debt-laden ed-tech Think and Learn Pvt Ltd (Byju's) has moved an application before the National Company Law Appellate Tribunal (NCLAT), Chennai after Aakash Educational Services refused to allot shares to the company in its recently concluded rights issue, even though forums from NCLT to Supreme Court had earlier declined to halt the process. Aakash has...

NCLT Bar Condemns ED Search at Lawyers' Residence In Probe Into Allegedly Undervalued Land Sale

The National Company Law Tribunal Bar Association (NCLTBA) has condemned the Enforcement Directorate's search at the residence of two members of their bar, conducted as part of an investigation into an allegedly undervalued land sale during the CIRP of Universal Buildwell. In a resolution issued on November 25, the Bar Association said the search was without due compliance of the law...

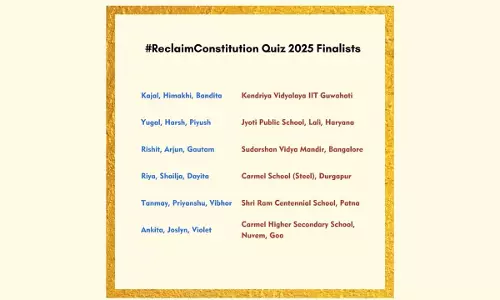

Reclaim Constitution Quiz Sees Enthusiastic Participation From Over 1500 Students Across India

In an effort aimed at engaging and inspiring young minds to critically examine our Constitution, #ReclaimConstitution, under the aegis of the International Institute for Art, Culture & Democracy (IIACD Foundation), launched a nationwide quiz competition for students of grades 8 to 12 on 22 July 2025. The initiative aims to bring the Indian Constitution alive for young minds - not just as a document, but as a living, breathing promise.The online preliminary round of the quiz was held on 26...

Malappuram District Legal Service Authority Ranked As Best Performing DLSA In Kerala

Malappuram District Legal Service Authority has been ranked the best performing legal service authority in the State in 2024-25. The achievement has been announced at the Annual meeting of the Kerala Legal Service Authority (KELSA) held in Kerala High Court Auditorium on Friday. Mr. K Sanil Kumar, Chairman DLSA and Principal District & Session Judge and Mr. Shabin Ibrahim, Secretary DLSA...

Kerala Court Acquits Actor Dileep In Actress Rape & Abduction Case, Six Including Pulsar Suni Found Guilty

The Principal District and Sessions Court, Ernakulam on Monday (December 8) acquitted prominent Malayalam actor Dileep in the 2017 actress rape and abduction case.Smt. Honey M. Varghese pronounced the verdict today in open court, giving a conclusion to the trial that spanned over a period of 8 years.The judge found Pulsar Suni (A1), Martin Antony (A2), B Manikandan (A3), V.P. Vijeesh (A4),...

Senior Advocate Milind Sathe Appointed As New Advocate General Of Maharashtra

Senior Advocate Milind Sathe has been appointed as the Advocate General (AG) for Maharashtra and will be taking charge from Monday (December 8).Maharashtra Chief Minister Devendra Fadnavis posted on X (earlier Twitter) confirming about the appointment of Sathe as the AG. The CM's official handle, while confirming the development, said, "The State Cabinet approved the appointment of Milind...

Srinagar Court Convicts Guardian Of Minor Found Driving Vehicle, Says Allowing Minors To Drive Produces Victims

Reasserting that it is the “first and foremost duty of parents not to provide their minor children any vehicle unless they attain majority,” the Special Mobile Magistrate (Traffic), Srinagar convicted the guardian of a minor who was found driving a vehicle in violation of the Motor Vehicles Act, 1988.The Court coupled the conviction with strong, community-oriented observations on the...

NGT Holds Regional Environment Conference In Chennai

The Regional Conference on Environment – 2025, organized by the National Green Tribunal, Southern Zone Bench, Chennai, in collaboration with the Southern State Pollution Control Boards and Committees, was held on 6 December 2025 at Kalaivanar Arangam, Chennai. The event was conducted under the leadership of Justice Prakash Shrivastava, Chairperson, NGT, with the guidance of Justice...

MCA Redefines Small Company Criteria, Raises Paid Up Capital Cap To Rs 10 Crore and Turnover Cap To Rs 100 Crore

The Ministry of Corporate Affairs has revised the definition of small companies by increasing the turnover ceiling from Rs 40 crore to Rs 100 crore and the paid-up capital threshold from Rs 4 crore to Rs 10 crore.The notification was issued on December 1, 2025 which took effect immediately. The amendment updates the Companies (Specification of Definition Details) Rules, 2014. These rules...

Income Tax Act | Documents Seized From Actor Yash's Residence Make Him 'Searched Person': Karnataka High Court Quashes Order U/S 153C

The Karnataka High Court has held that the search conducted at Actor Yash's residence makes him a 'searched person' under the Income Tax Act, as documents were seized from him, during the search and a panchanama was drawn. Hence, the order under Section 153C of the Act, which applies to persons other than the one originally searched, is without jurisdiction. Section 153C of the...

Central Govt Ensuring GST Rate Cuts Are Passed On To Consumers: Finance Ministry Tells Lok Sabha

The Ministry of Finance has informed the Lok Sabha that, where several GST rates were rationalised, the Central Government has put in place a coordinated tax-administration mechanism to ensure that businesses actually pass on the GST rate-cut benefits to consumers. CBIC Monitoring Prices After GST Rate Cuts The Finance Ministry stated that the CBIC has been monitoring prices of...

NGT Regional Conference On Environment To Be Held In Chennai On December 6 & 7

The Zonal Bench of the National Green Tribunal (NGT), Chennai, is organizing the Regional Conference on Environment – 2025 on the 6th and 7th of December 2025. The conference is being held under the leadership of Mr. Justice Prakash Shrivastava, Chairperson, National Green Tribunal, and under the guidance of Mrs. Justice Pushpa Sathyanarayana, along with other esteemed Members of the NGT. ...