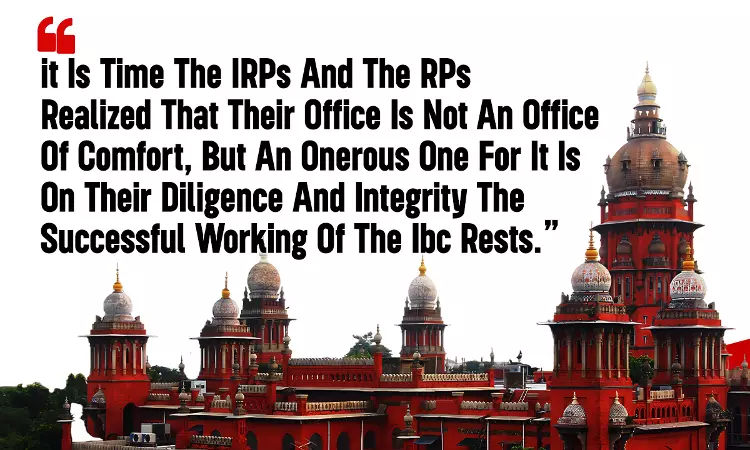

Madras High Court: The Successful Working Of IBC Rests On Diligence And Integrity Of IRP And RP

Sachika Vij

12 Jun 2024 7:30 PM IST

Next Story

12 Jun 2024 7:30 PM IST

The Madras High Court stressed and defined the role and responsibilities of the Interim Resolution Professional ('IRP') and Resolution Professional ('RP') to act fairly and transparently to secure the interests of all the stakeholders, particularly operational creditors. The single Judge Bench of Justice N. Seshasayee held: “It is time the IRPs and the RPs realized that...