Jharkhand High Court

Objections Regarding Delay In 'Reference' Under Industrial Disputes Act, 1947 Ought To Be Raised Before Final Award: Jharkhand High Court

The Jharkhand High Court division bench of Justice Rongon Mukhopadhyay and Justice Deepak Roshan held that the objection regarding the 'Reference' under the Industrial Disputes Act, 1947, should be raised before the final Award. The High Court held that the Industrial Tribunal, being a statutory creation, derives its jurisdiction from the reference and is not empowered to scrutinize the...

Dowry Death | Prosecution Must First Show All Ingredients Of S.304-B IPC To Attract Presumption Of Guilt Against Accused: Jharkhand High Court

The Jharkhand High Court has clarified that once all the ingredients of an offence under Section 304-B are shown by the prosecution, only then the presumption of innocence fades, shifting the burden of proof to the accused under Section 113-B of the Evidence Act.The Division bench of Justices Sujit Narayan Prasad and Pradeep Kumar Srivastava observed, “Being a mandatory presumption on...

S.202 CrPC | Enquiry Court Must Examine All Complaint Witnesses In Cases Exclusively Triable By Sessions Court: Jharkhand High Court

The Jharkhand High Court has emphasized that when a case falls under the exclusive jurisdiction of the court of sessions, it is essential for the Enquiry Court to summon the complainant to examine all the witnesses supporting the allegations in the complaint.Justice Subhash Chand, presiding over the case, observed, “proviso of this Section 202(a) and Section 202(b) and Section 202 (2)...

Consider Magnitude & Degree Of Misconduct Before Imposing Punishment: Jharkhand HC Reinstates CRPF Personnel Dismissed For Absence, Orders Reconsideration

In a recent case, the Jharkhand High Court emphasized the importance of considering various factors before imposing punishment in disciplinary proceedings. The Court highlighted that while the petitioner had exceeded the leave period, it was important to acknowledge the circumstances surrounding this action.Justice S.N. Pathak, presiding over the case, observed, “the overstay of leave by...

'Not Bonafide Passenger': Jharkhand High Court Denies Compensation For Death Of Unlicensed Vendor Who Fell From From Moving Train

The Jharkhand High Court has refused to grant compensation to the family members of a Litti-Chatni vendor who fell from a moving train at Jasidih Station and lost his life due to overcrowding and a sudden jolt. The court stated that he was not a 'bona fide passenger' as he was boarding the train to sell Litti-Chatni without a proper license or authority issued by the Railway Administration or...

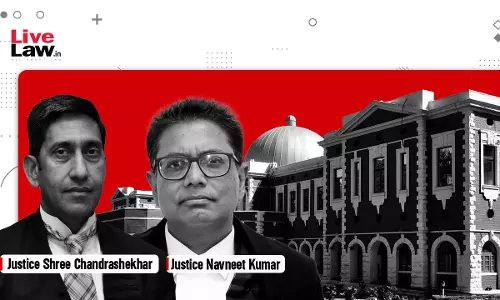

Pensionary Benefit Earned On Account Of Meritorious Past Services, Is A Constitutional Right Of An Employee Under Article 300-A Of The Constitution: Jharkhand High Court

A division bench of the Jharkhand High Court comprising of Shree Chandrashekhar, A.C.J. and Navneet Kumar, J., while deciding Letters Patent Appeals in the case of Birsa Agricultural University vs State of Jharkhand, has held that denying pensionary benefits to an employee is to rob them of a constitutional right under Article 300A of the Constitution, as pension is earned by the employee...

Placement Agency To Be Given Proper SCN On Alleged Failure To Perform Duties Coupled With Monetary Loss To JSBCL: Jharkhand High Court

The Jharkhand High Court has held that Rule 15 of the Jharkhand Excise (Operation of Retail Product Shops through Jharkhand State Beverages Corporation Limited) Rules, 2022, and the corresponding clauses of the contract have to be restricted only to those situations where the placement agency has been found, albeit after hearing the agency, to have failed to provide manpower to Jharkhand...

Proclamation | Before Exercising Powers U/S 82, 83 CrPC Court Should Be Satisfied That Accused Is Absconding: Jharkhand High Court Reiterates

The Jharkhand High Court has made it clear that before issuing a proclamation under Section 82 of the Cr.P.C, Court must adequately record satisfaction regarding the accused's absconding status or that accused is concealing themselves to evade arrest. It thus quashed an order passed by a Special POCSO Court.Justice Anil Kumar Choudhary observed, “the learned Special Judge, POCSO Act...

Jharkhand HC Imposes Rs 1.25 Lakh Fine On Union Minister Arjun Munda For Failure To Rectify Errors In Quashing Plea But Stays Coercive Action

The Jharkhand High Court has imposed a fine of Rs 1.25 lakh on Union Minister Arjun Munda for his failure to rectify errors in a quashing petition filed by him. During the hearing of Munda's petition, the court observed that the errors remained uncorrected despite being pointed out. Consequently, the court levied a fine of Rs 1,25,000 on Munda and directed him to deposit the amount with...

Decision On A Question Of Law That Is Later Overturned Or Modified By The Superior Court In Another Case Does Not Form A Ground For Review: Jharkhand High Court

The Jharkhand High Court has recently clarified the criteria for reviewing judgments in tax appeal cases, particularly regarding decisions based on legal questions. According to the explanation to Rule 1 of Order 47 of the Code of Civil Procedure, the court stated that if a decision on a legal question forming the basis of a court judgment is later reversed or modified by a higher court in...

Jharkhand High Court Quarterly Digest [Jan – Mar 2024]

Nominal Index [Citations: 2024 LiveLaw (Jha) 1-54]Rahul Yadav @ Hari Kumar Yadav, vs. The State of Jharkhand & Anr 2024 LiveLaw (Jha) 1Gautam Kumar Banarjee vs. Dr. C.P. Vidyarthi & Anr 2024 LiveLaw (Jha) 2Steel Authority of India Ltd vs. The State of Jharkhand and others 2024 LiveLaw (Jha) 3CTET Utteern Abhiyarthi Sangh vs. State of Jharkhand 2024 LiveLaw (Jha) 4Branch Manager,...

Jharkhand High Court Allows Application for Revocation of Cancelled GST Registration Despite Expiry of Limitation Period

In a recent ruling, the Jharkhand High Court has permitted the filing of an application for revocation of cancelled GST registration, despite the expiration of the limitation period. The decision stemmed from a petition filed by a proprietor aggrieved by the dismissal of their petition under section 107 of the Central Goods and Services Tax Act, 2017 (GST Act). The petitioner sought to...

![Jharkhand High Court Quarterly Digest [Jan – Mar 2024] Jharkhand High Court Quarterly Digest [Jan – Mar 2024]](https://www.livelaw.in/h-upload/2024/04/02/500x300_531720-jharkhand-high-court-quarterly-digest-2024.webp)