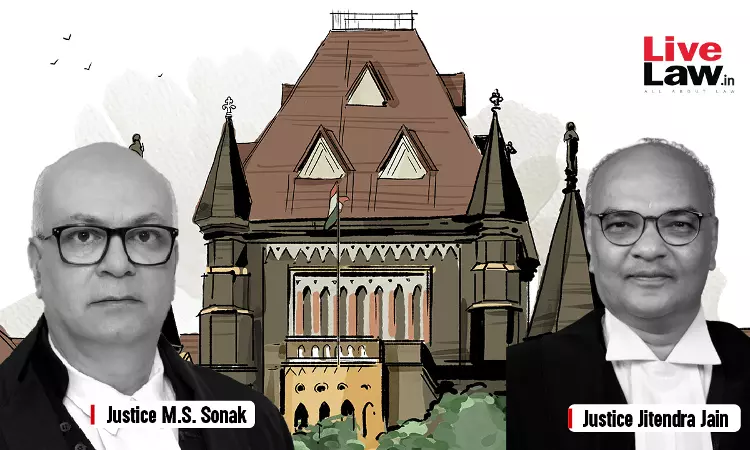

Bombay HC Imposes ₹1 Lakh Cost On 'Venus Entertainment' For 'Taking Chance' By Filing Writ Plea Avoiding Alternate Remedy

Sparsh Upadhyay

17 Dec 2024 9:42 PM IST

Next Story

17 Dec 2024 9:42 PM IST

The Bombay High Court recently imposed a cost of ₹1 lakh on 'Venus Worldwide Entertainment Pvt. Ltd.' for "taking a chance" by filing a writ petition challenging a review order passed under the Maharashtra Value Added Tax Act, 2002, despite having a remedy of appeal under the 2002 Act. “The Petitioner was required to explain why the practice of exhausting alternate remedies should...