All High Courts

SC's 2016 Verdict Exempts 'Sensitive' FIRs From Mandatory Online Uploading; 'Aggrieved Person' May Seek Copy From SP/CP: Allahabad HC

Clarifying the procedure for obtaining a copy of First Information Report (FIR) in 'sensitive' cases where they are not uploaded online, the Allahabad High Court recently noted that in such cases, an "aggrieved person" can apply directly to the Superintendent of Police (SP) or Commissioner of Police, as the case maybe, seeking a copy of the FIR. HC referred to the exceptions carved...

Complete Violation During Bhajans, Azans & Club Events : High Court Registers Suo Motu PIL On Recurring Noise Pollution In Nagpur

The Bombay High Court (Nagpur Bench) recently took Suo Moto cognizance of the 'recurring' issue of noise pollution in Nagpur city and explicitly named prominent clubs, temples and Dargahs adding that activities like 'bhajans', 'azans' and various celebrations and events are conducted in violation of the law. A bench of Justice Anil L Pansare and Justice Raj D Wakode said that state...

'X' Posts On Pahalgam Attack 'Against PM', His Name Used Disrespectfully: Allahabad HC Denies Anticipatory Bail To Singer Neha Rathore

The Allahabad High Court (Lucknow Bench) today rejected the anticipatory bail application filed by folk singer Neha Singh Rathore in connection with an FIR lodged against her for allegedly making objectionable posts on social media regarding Prime Minister Narendra Modi and Pahalgam terror attack. A bench of Justice Brij Raj Singh observed that the 'X' Posts/tweets posted by...

State Cannot Deny Increment & Benefits To Chief Justice's Staff Once CJ Grants Extension Of Service Under Article 229: HP High Court

The Himachal Pradesh High Court has held that once the Chief Justice grants extension of service to his Principal Private Secretary with full consequential benefits under Article 229 of the Constitution, the administrative establishment does not have any right to seek further clarification from the State.Further, the Court remarked that there is a clear distinction between extension in...

Arbitration Clause In GeM Contract Becomes Inoperative Once S.18 Of MSMED Act Is Invoked Before MSME Council: Gauhati High Court

The Gauhati High Court has held that once a supplier invokes Section 18 of the Micro, Small and Medium Enterprises Development Act, 2006 (MSMED Act), the statutory dispute-resolution mechanism under the Act overrides the arbitration clause contained in a Government e-Marketplace (GeM) contract, including the agreed seat of arbitration.The ruling was delivered by Justice Manish Choudhury,...

Income Tax Appeal Cannot Be Rejected Solely For Assessee's Non-Appearance Before CIT(A): Kerala High Court

The Kerala High Court has held that an Income Tax Appeal cannot be rejected solely for the assessee's non-appearance before the Commissioner of Income Tax (Appeals). Justice Ziyad Rahman A.A. stated that none of the provisions in Section 250 of the Income Tax Act permit the appellate authority to reject the appeal on the ground of non-appearance of the assessee/appellant,...

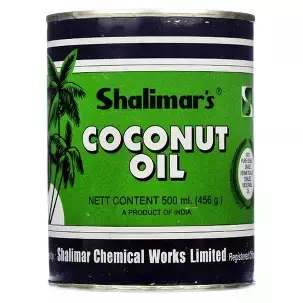

Calcutta High Court Says KMP Coconut Oil Packaging Looks Too Similar to Shalimar's, Upholds Injunction

The Calcutta High Court has upheld an interim injunction in favour of Shalimar Chemical Works Pvt. Ltd. that restrains Edible Products (India) Ltd., which sells coconut oil under the “KMP” brand, from using packaging the court found deceptively similar to Shalimar's long used trade dress. A division bench of Justice Sabyasachi Bhattacharyya and Justice Supratim Bhattacharya in an order...

Interest On Delayed Agricultural Income Tax Not Deductible U/S 37 Income Tax Act: Kerala High Court

The Kerala High Court has held that interest on delayed agricultural income tax is not deductible under Section 37 Income Tax Act. Section 37 of the Income Tax Act provides deductions on expenses which are directly related to a business's operations. Justices A. Muhamed Mustaque and Harisankar V. Menon examined whether the interest paid on account of the delayed payment...

Income From Public Religious/Charitable Trusts Not Eligible For Exemption U/S 10(23BBA) Income Tax Act: Kerala High Court

The Kerala High Court has held that income derived from public religious/charitable trusts is not eligible for exemption under Section 10(23BBA) of the Income Tax Act. Section 10(23BBA) of the Income Tax Act, 1961, provides a complete exemption from income tax for the income of a body or authority that has been established, constituted, or appointed under any Central,...

Re-Blocking Input-Tax Credit Beyond One Year Without New Material Is Unsustainable: Punjab & Haryana High Court

Holding that the tax authorities cannot indefinitely freeze Input Tax Credit (ITC) by repeatedly invoking the same allegations, the Punjab & Haryana High Court has ruled that blocking ITC beyond the statutory one-year period—without any fresh material or further proceedings—is “clearly unsustainable.”Justice Lisa Gill and Justice Pramod Goyal said, "However, a bare perusal of...

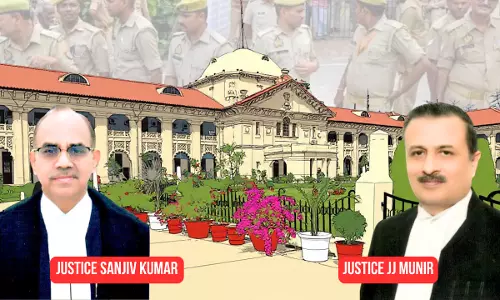

'Unexecuted NBW Justified Only If Convict Is Dead Or Fled Nation: Allahabad HC Asks UP Police To Trace Man In 1984 Appeal Across India

The Allahabad High Court has observed that a Non-Bailable Warrant (NBW) of arrest can be returned unexecuted in only two specific eventualities: if the fugitive is dead or if he has fled the country with tangible evidence to prove it. Noting thus, a Division Bench of Justice JJ Munir and Justice Sanjiv Kumar on Tuesday refused to accept a report by the Commissioner of...

Karnataka High Court Directs No Coercive Steps Against Aaj Tak, Journalist Sudhir Chaudhury Over Alleged Communal Coverage

The Karnataka High Court on Friday, by way of an interim order, directed the State government to not initiate any coercive steps against news channel Aaj Tak and its former editor Sudhir Chaudhury till January 13, 2026, in a case registered against them over alleged communal coverage of the State government's Svalambi Sarathi Scheme. Justice M. I. Arun, while disposing of the application...