All High Courts

Arbitration Clause In GeM Contract Becomes Inoperative Once S.18 Of MSMED Act Is Invoked Before MSME Council: Gauhati High Court

The Gauhati High Court has held that once a supplier invokes Section 18 of the Micro, Small and Medium Enterprises Development Act, 2006 (MSMED Act), the statutory dispute-resolution mechanism under the Act overrides the arbitration clause contained in a Government e-Marketplace (GeM) contract, including the agreed seat of arbitration.The ruling was delivered by Justice Manish Choudhury,...

Income Tax Appeal Cannot Be Rejected Solely For Assessee's Non-Appearance Before CIT(A): Kerala High Court

The Kerala High Court has held that an Income Tax Appeal cannot be rejected solely for the assessee's non-appearance before the Commissioner of Income Tax (Appeals). Justice Ziyad Rahman A.A. stated that none of the provisions in Section 250 of the Income Tax Act permit the appellate authority to reject the appeal on the ground of non-appearance of the assessee/appellant,...

Calcutta High Court Says KMP Coconut Oil Packaging Looks Too Similar to Shalimar's, Upholds Injunction

The Calcutta High Court has upheld an interim injunction in favour of Shalimar Chemical Works Pvt. Ltd. that restrains Edible Products (India) Ltd., which sells coconut oil under the “KMP” brand, from using packaging the court found deceptively similar to Shalimar's long used trade dress. A division bench of Justice Sabyasachi Bhattacharyya and Justice Supratim Bhattacharya in an order...

Interest On Delayed Agricultural Income Tax Not Deductible U/S 37 Income Tax Act: Kerala High Court

The Kerala High Court has held that interest on delayed agricultural income tax is not deductible under Section 37 Income Tax Act. Section 37 of the Income Tax Act provides deductions on expenses which are directly related to a business's operations. Justices A. Muhamed Mustaque and Harisankar V. Menon examined whether the interest paid on account of the delayed payment...

Income From Public Religious/Charitable Trusts Not Eligible For Exemption U/S 10(23BBA) Income Tax Act: Kerala High Court

The Kerala High Court has held that income derived from public religious/charitable trusts is not eligible for exemption under Section 10(23BBA) of the Income Tax Act. Section 10(23BBA) of the Income Tax Act, 1961, provides a complete exemption from income tax for the income of a body or authority that has been established, constituted, or appointed under any Central,...

Re-Blocking Input-Tax Credit Beyond One Year Without New Material Is Unsustainable: Punjab & Haryana High Court

Holding that the tax authorities cannot indefinitely freeze Input Tax Credit (ITC) by repeatedly invoking the same allegations, the Punjab & Haryana High Court has ruled that blocking ITC beyond the statutory one-year period—without any fresh material or further proceedings—is “clearly unsustainable.”Justice Lisa Gill and Justice Pramod Goyal said, "However, a bare perusal of...

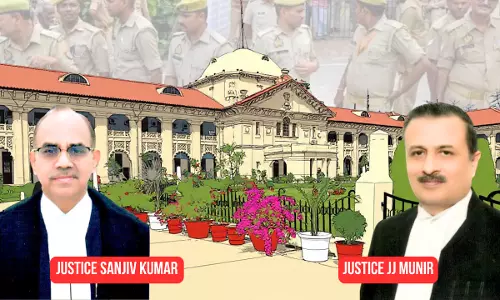

'Unexecuted NBW Justified Only If Convict Is Dead Or Fled Nation: Allahabad HC Asks UP Police To Trace Man In 1984 Appeal Across India

The Allahabad High Court has observed that a Non-Bailable Warrant (NBW) of arrest can be returned unexecuted in only two specific eventualities: if the fugitive is dead or if he has fled the country with tangible evidence to prove it. Noting thus, a Division Bench of Justice JJ Munir and Justice Sanjiv Kumar on Tuesday refused to accept a report by the Commissioner of...

Karnataka High Court Directs No Coercive Steps Against Aaj Tak, Journalist Sudhir Chaudhury Over Alleged Communal Coverage

The Karnataka High Court on Friday, by way of an interim order, directed the State government to not initiate any coercive steps against news channel Aaj Tak and its former editor Sudhir Chaudhury till January 13, 2026, in a case registered against them over alleged communal coverage of the State government's Svalambi Sarathi Scheme. Justice M. I. Arun, while disposing of the application...

Delhi Govt Needs To Look Into MCD's Financial Condition: High Court Directs Meeting Between MCD Commissioner & Chief Secretary

The Delhi High Court on Friday (December 5) asked the Delhi Government to look into the financial crunch faced by Municipal Corporation of Delhi and directed that a meeting be held between MCD Commissioner and the Chief Secretary to try resolve the issue.The court was hearing a plea concerning drainage and flooding issues at Maharani Bagh area. After hearing the matter for some time a...

Calcutta High Court Declines Stay On 'Babri Mosque' Program In Murshidabad By Suspended TMC MLA Humayun Kabir

The Calcutta High Court has declined to interfere with a program organised by suspended TMC MLA Humayun Kabir regarding the alleged 'foundation' of a Babri Masjid in Murshidabad on 6th December (tomorrow).Notably, 6th December is also the date on which the Babri Masjid in Uttar Pradesh was demolished during the riots of 1992.A division bench of Acting Chief Justice Sujoy Paul and Justice...

Banks Cannot Penalise Borrowers For Switching Lenders, Prepaying Loans: Orissa High Court

The Orissa High Court recently held that banks cannot impose charges that restrict a borrower's freedom to switch lenders, ruling that such practices undermine fair banking standards and violate binding directions of the Reserve Bank of India. A bench of Justice Sanjeeb K Panigrahi said banks must operate within regulatory limits set by the RBI and cannot create barriers that penalize...

HP High Court Issues Notice On Plea Challenging Validity Of S.8A MMDR Act & 1986 Mining Reservation Order

The Himachal Pradesh High Court has issued notice in a writ petition which raises substantial questions regarding the constitutional validity and interpretation of Section 8A of the Mines and Minerals (Development and Regulation) Act, 1957 (“MMDR Act”), as amended in 2015, and the legality of the State Government's 1986 reservation notification concerning limestone mining in...