All High Courts

Delhi High Court Summons Woodland's MD and Senior Manager In Trademark Infringement Suit

The Delhi High Court has summoned Woodland (Aero Club) Pvt. Ltd.'s Managing Director Harkirat Singh and Senior Manager Madan Kalra to personally appear and file affidavits explaining why key correspondence with rival manufacturer Speedways Tyre Treads was not disclosed in Woodland's trademark infringement suit. Justice Manmeet Pritam Singh Arora issued the direction on December 01, 2025...

Kerala High Court Weekly Round-Up: December 01 - December 07, 2025

Nominal Index [Citations: 2025 LiveLaw (Ker) 787 - 813]South Indian Bank Ltd. and Anr. v. Rahim H K and Anr., 2025 LiveLaw (Ker) 787Anish Anand v. State of Kerala and Ors., 2025 LiveLaw (Ker) 788Shijo Mon Joseph v. State of Kerala and Anr., 2025 LiveLaw (Ker) 789Kerala State Medical Councils v Daleel Ahmmed and Ors., 2025 LiveLaw (Ker) 790Save A Family Plan (India) v. The Deputy Commissioner...

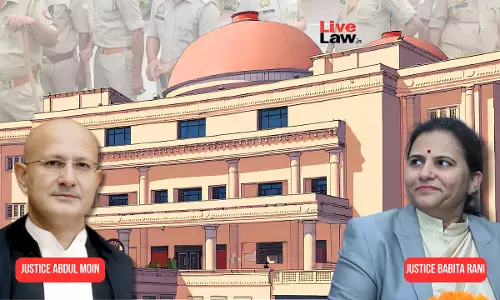

'Distributing Bible, Preaching Religion No Crime': Allahabad High Court Pulls Up UP Police For Overreach In Conversion Case

In a strongly worded order, the Allahabad High Court recently observed that the mere distribution of the Bible or the act of preaching a religion does not constitute an offence under the Uttar Pradesh Prohibition of Unlawful Conversion of Religion Act, 2021. A bench of Justice Abdul Moin and Justice Babita Rani also admonished the UP Police for what it termed as "bending backward"...

S. 35 BNSS | Arrest Is An 'Individualized Act'; Distinct Reasons Backed By Material Mandatory For Each Co-Accused : Bombay HC

In a significant observation, the Bombay High Court has ruled that arrest is an 'individualized' act and therefore, the investigating agencies cannot justify the arrest of multiple suspects using 'collective' or 'group-based' reasons. Interpreting the mandate of Section 35 BNSS, the Court held that reasons for arrest cannot be a "mechanical reproduction" of statutory clauses; instead, they...

GST Demand Cannot Exceed Amount Mentioned In Show Cause Notice: J&K&L High Court

The Jammu & Kashmir and Ladakh High Court has held that a tax demand under GST cannot exceed the amount mentioned in the show cause notice and that doing so violates basic principles of fairness. The Division Bench of Justice Sanjeev Kumar and Justice Sanjay Parihar set aside a GST demand raised against a goods transport agency (GTA), after finding that the final demand was...

ITAT Cannot Re-Adjudicate Issues Under Guise Of Rectification U/S 254(2) Income Tax Act: Madras High Court

The Madras High Court has held that the rectification power under Section 254(2) of the Income Tax Act is akin to the review power under Order 47 Rule 1 CPC and is limited to rectifying any mistake apparent on the face of the record. The Tribunal cannot re-adjudicate issues or modify its original order under the guise of rectification. Section 254(2) of the Indian Income Tax Act,...

University Cannot Reject Candidate's Degree For Recruitment After Accepting Him For PhD Based On Same Qualification: HP High Court

The Himachal Pradesh High Court held that a university can't apply inconsistent standards by treating a candidate's Master's degree as an eligible subject for PhD admission but ignoring the same qualification during selection for the post of Assistant Professor.Justice Sandeep Sharma remarked that: “...respondents are estopped from adopting different yardsticks while considering M.Sc....

Civil Courts Cannot Interfere In Agrarian Resumption Cases, Only Revenue Authorities Have Jurisdiction: J&K&L High Court

“Matters arising out of the Agrarian Reforms Act especially resumption proceedings fall exclusively within the domain of Revenue Authorities, and civil courts lack jurisdiction to interfere, even at the injunction stage,” held the High Court of Jammu & Kashmir and Ladakh while dismissing a petition filed by two litigants challenging concurrent findings of the courts below.Reaffirming...

'Used Excessive Speed': Gujarat High Court Declines To Discharge Accused In Iskcon Bridge 'Hit & Run' Case

The Gujarat High Court refused to discharge Tathya Patel for culpable homicide not amounting to murder (IPC Section 304 part 2) accused in the 2023 Iskcon Bridge hit and run case which claimed nine lives in Ahmedabad, observing that there was a strong prima facie case against him. The court said that this was not a simple case of rash and negligent driving, wherein the applicant was under...

Interpreting Property's 'Built-Up Area Wall-To-Wall' As Carpet Area Is Commercially Sound: Bombay High Court

The Bombay High Court has dismissed a petition under section 34 Arbitration and Conciliation Act, 1996 (Arbitration Act) filed by the Developer-partners of Lukhi Associates challenging a 2020 arbitral award arising out of disputes under a 2010 Development Agreement with the Saini family. Justice Somasekhar Sundaresan upheld the award, holding that “what the Learned Arbitral Tribunal...

Caregiver Of Disabled Dependent Entitled To Transfer Exemption; Interests Of PwD Prevail Over Administrative Convenience : Delhi HC

A Division Bench of the Delhi High Court comprising Justice C. Hari Shankar and Justice Om Prakash Shukla held that the interests of a disabled dependent prevail over administrative convenience, and caregivers of persons with disabilities are entitled to exemption from routine transfers, and reasonable accommodation is mandatory. Background Facts The petitioner is an...

'Implementation Is Executive's Domain': Allahabad High Court Disposes PIL Claiming Laws Against Denigration Of Hindu Deities Are 'Ineffective'

The Allahabad High Court (Lucknow Bench) on Thursday disposed of a Public Interest Litigation (PIL) plea seeking a review of the effectiveness of the current legal framework regarding the protection of Hindu deities and religious books from denigration. A bench of Justice Rajan Roy and Justice Indrajeet Shukla observed that while the making or amending of laws lies strictly within...