High Courts

Income Tax Act | Sikkim High Court Allows S.80P(2)(d) Deduction On Interest Earned From Co-operative Banks By Non-Bank Co-operative Society

The Sikkim High Court has held that a non-bank co-operative society is entitled to claim deduction under Section 80P(2)(d) of the Income Tax Act, 1961, on interest income earned from investments made with co-operative banks, and that Section 80P(4) does not bar such deduction. A Division Bench of Chief Justice Biswanath Somadder and Justice Meenakshi Madan Rai allowed the tax appeal...

BSF Rules | Court Of Inquiry Is Preliminary Fact Finding Exercise, Not Disciplinary Trial Which Can Cause Prejudice: J&K&L High Court

The Jammu & Kashmir and Ladakh High Court has held that such an inquiry is only a fact-finding mechanism intended to assist authorities in deciding the future course of action and does not amount to initiation of departmental proceedings.The Division Bench of Justice Sanjeev Kumar and Justice Sanjay Parihar underscored that the findings returned by the Court of Inquiry shall be in the...

Clause 8 Of Assam GST Reimbursement Scheme Prima Facie Ultra Vires: Gauhati High Court Stays SCN Against Patanjali Foods

The Gauhati High Court found that Clause 8 of the Assam Industries [Tax Reimbursement for Eligible Units] Scheme, 2017, which restricts input tax credit, runs contrary to the Constitutional framework and the provisions of the CGST Act. Consequently, the bench stayed the operation of the show-cause notices (SCN) issued to Patanjali Foods Limited. Justice Manish Choudhury was addressing...

Reviewing Court Must Defer To Scientific Wisdom Of Authorities, Ensure Only Procedural Compliance In Environmental Matters: Kerala High Court

The Kerala High Court on Tuesday (16 December) observed that the role of the reviewing court must be limited to ensuring the procedural compliance by the statutory authority while considering environmental litigation which involves compliance by statutory authority.The court made the observation while upholding the environmental clearance granted to the proposed...

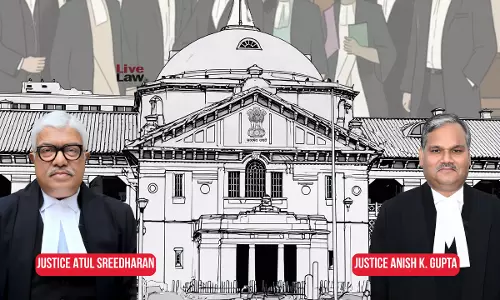

State Bar Council Can't Control Or Regulate District Bar Association Elections: Allahabad High Court

The Allahabad High Court recently held that the State Bar Council lacks authority to "control or regulate" the elections of Bar Associations as they are governed by their own bye-laws.A bench of Justice Atul Sreedharan and Justice Anish Kumar Gupta thus set aside a directive issued by the Bar Council of Uttar Pradesh (respondent no.3) placing a temporary embargo on holding elections for...

Bombay High Court Rejects Bail Plea Of Eight Accused In Pune Porsche Car Hit-And-Run Case

The Bombay High Court on Tuesday rejected the bail applications of 8 accused named in the Pune Porsche hit and run case, wherein two persons were killed in the tragic accident.Single-judge Justice Shyam Chandak dismissed the bail applications of eight accused including the father of the prime accused, a juvenile, who was driving the car at the time of the incident. "There is a strong prima...

PIL In Delhi High Court Seeks Compensation Over Indigo Ticket Cancellations, Judicial Enquiry Against DGCA

A PIL has been filed before the Delhi High Court seeking “four times” compensation of tickets recently cancelled by Indigo airlines and a judicial enquiry against Director General of Civil Aviation (DGCA) for alleged lapses. The matter will be heard tomorrow by a division bench comprising Chief Justice DK Upadhyaya and Justice Tushar Rao Gedela. The plea has been filed by Centre...

Rajasthan HC Refuses To Send Woman Back To Jail Despite Earlier Sentence Reduction Being Based On Erroneous Assumption Of Period Served

Rajasthan High Court denied sending a woman back to jail whose punishment for the offence of culpable homicide not amounting to murder was reduced by the division court 15 years ago based on an erroneous assumption that she was had already undergone a period of almost 8 years in jail, when in actuality she had been in prison for only around 2 years.The division bench of Justice Farjand Ali...

IBC | All Property, Including Alleged Benami Assets, Shielded From Action Over Pre-Resolution Offences: Madras High Court

The Madras High Court has recently held that once a resolution plan is approved under the Insolvency and Bankruptcy Code, authorities cannot proceed against any property standing in the name of a corporate debtor for offences committed before the insolvency process, even if such property is alleged to be held benami. A single bench of Justice G R Swaminathan ruled that Section 32A(2) of...

Cryptic Show Cause Notice Without Factual Details Invalidates GST Registration Cancellation: Gauhati High Court

The Gauhati High Court held that a GST registration cannot be cancelled on the basis of a cryptic show cause notice, which merely quotes statutory provisions without disclosing the factual grounds. Justice Sanjay Kumar Medhi noted that apart from stating the provisions of Section 29(2)(e) of the CGST Act, there are no facts or any details stated in the show cause notice. In the...

Punjab & Haryana High Court Asks DGP To Explain Why FIR Was Not Lodged Against Policemen Who Allegedly Assaulted Lawyer

The Punjab and Haryana High Court on Tuesday took suo motu cognisance of the alleged assault on an advocate, Amit, by Haryana Police personnel in plainclothes in Chandigarh neighbouring Nayagaon, Punjab on November 30. The Punjab & Haryana High Court Bar Association had resolved to go on strike from December 15 due to the undue delay in the lodging of FIR.The Court noted that an incident...

'Deepathoon' Is Figment Of Judge's Imagination: Madurai Authorities Tell Madras High Court Over Thiruparankundram Deepam Row

Opposing the single judge's order directing the lighting of a lamp at the stone pillar in Thiruparakundram Hills, Madurai district, and police authorities told the Madras High Court (Madurai bench) on Tuesday (December 16) that the deepathoon (stone pillar) is a figment of the judge's imagination or devotees' imagination, which the judge had latched on to.In doing so, the authorities told...