High Courts

Mills Cannot Go Back On Price Change Agreed For Sugarcane In Meeting Convened By CM, With Farmers: Karnataka High Court

The Karnataka High Court has permitted the South Indian Sugar Mills Association (Karnataka) and individual members of the association and factory owners to submit a representation to the Sugarcane Control Board, as regards the additional sugarcane price, which has now been fixed.Justice Suraj Govindaraj however noted that after agreeing in the meeting convened by the Chief Minister with regard...

Income Tax Act | Bombay High Court Allows Treaty-Based Cap Of 10% On DDT For Foreign Shareholder; Sets Aside BFAR Ruling

The Bombay High Court (Goa Bench) has held that Dividend Distribution Tax (DDT) paid by an Indian subsidiary to its foreign shareholder must be restricted to the treaty rate of 10% under Article 11 of the India-UK India Double Taxation Avoidance Agreement (DTAA) A Division Bench of Justice Bharati Dangre and Justice Nivedita P. Mehta allowed the appeal filed by the assessee,...

Kerala High Court Directs Suchithwa Mission To Frame Sustainable Sanitation Plan For Chottanikkara Temple

The Kerala High Court on Wednesday (17 December) directed the Suchithwa Mission, the State's nodal agency for sanitation and waste management, to play a proactive role in restoring and maintaining cleanliness at the Chottanikkara Bhagavathi Temple, following serious concerns over environmental and public health issues in and around the temple premisesA Division Bench comprising Justice...

GST | Court Should Not Presume Denial Of Bail Is Rule: Punjab & Haryana High Court Grants Bail In ₹23.66 Cr Fake ITC Case

The Punjab and Haryana High Court held that even in cases involving economic offences under the CGST Act, courts must not proceed on the presumption that “Denial of Bail is the Rule and grant being the exception”. Justice Aaradhna Sawhney stated that even in cases involving economic offences, the Court seized of the matter has to go through the gravity of the offence, the object...

'Enormity' Of Codeine Syrup 'Racket': Allahabad High Court Rejects Quashing Pleas Of Alleged Kingpin, Co-Accused; Upholds NDPS FIR

The Allahabad High Court today refused to quash multiple FIRs lodged against multiple persons accused of their involvement in the interstate trafficking of Codeine-based cough syrup, specifically 'Phensedyl'. Dismissing a batch of 23 writ petitions, including that of the alleged Kingpin of the suspected Codeine Cough Syrup Racket, a Division Bench of Justice Siddhartha Varma and...

Prosecution Can Be Initiated Without Waiting For ITAT Penalty Confirmation In High-Value Cases: Delhi High Court

The Delhi High Court has made it clear that approval of collegium of two CCIT/DGIT rank officers is only required in cases where tax evaded is less than the threshold limit of ₹25 Lakh.A division bench of Justices V. Kameswar Rao and Vinod Kumar held, “the appropriate authority for initiating the prosecution proceedings would be the sanctioning authority i.e., the PCIT and not the...

Gujarat High Court Restores GST Registration Noting Payment Of Outstanding Tax, Interest, Late Fee In Electronic Cash Ledger

The Gujarat High Court has restored GST registration subject to compliance with filing of pending returns and payment of outstanding tax with interest, late fee and penalty. A Division Bench comprising Justice A.S. Supehia and Justice Pranav Trivedi permitted filing of GST returns for past period after noting copy of GST Returns for the period from April 2022 to December...

Trimurti Films Sues Dharma, Saregama In Bombay High Court Over 'Saat Samundar Paar' Song In Upcoming Film

Trimurti Films Pvt. Ltd., the producer of the 1992 film Vishwatma, has moved the Bombay High Court seeking to restrain the use of its iconic song “Saat Samundar Paar” in the upcoming Hindi film "Tu Meri Main Tera Main Tera Tu Meri", alleging unauthorised remixing and incorporation of the song without its consent. The suit has been filed against Dharma Production, Namah Pictures...

When Agreement Gets Extended By Conduct Of Parties, Arbitration Clause Also Gets Extended: Allahabad High Court

The Allahabad High Court has recently held that when an agreement is extended by the conduct of the parties, though it may have expired on paper, the applicability of the arbitration clause is also extended.Relying on the decision of the Supreme Court in Bharat Petroleum Corporation Ltd. vs. Great Eastern Shipping Co. Ltd., the bench of Chief Justice Arun Bhansali and Justice Kshitij...

'Left Alone To Endure An Unspeakable Destiny': Kerala High Court Flags Systemic Failure In Handling Of Deported Indian Citizen

The Kerala High Court has expressed concern over the manner in which the authorities have handled Suraj Lama, an Indian citizen deported from Kuwait who allegedly went missing after landing at Kochi International Airport.A Division Bench comprising Justice Devan Ramachandran and Justice M B Snehalatha, while considering a habeas corpus petition filed by the son of the missing person observed...

'Cut-Off Date In Welfare Scheme Not Sacrosanct': Bombay High Court Allows Monetary Benefit Claim By Heirs Of Deceased COVID Frontline Staff

The Bombay High Court has held that the cut-off date prescribed under a welfare scheme meant for COVID-19 frontline workers cannot be applied in a rigid or technical manner so as to defeat the very object of the scheme. The Court observed that such schemes must receive a liberal and beneficial interpretation, particularly where a frontline worker contracted COVID-19 during the currency of...

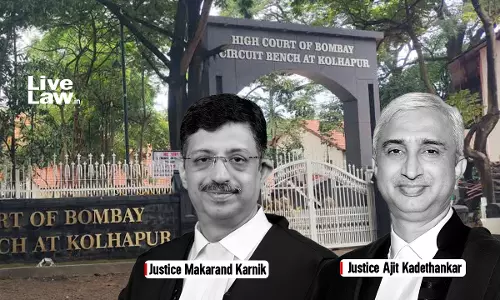

Bombay High Court Quashes Tax Notices Issued Against Mumbai Company After SVLDRS Settlement

The Bombay High Court has held that once a dispute is settled under the Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019 and a Discharge Certificate is issued, tax authorities cannot reopen the matter. A Division Bench of Justice M S Sonak and Justice Advait M Sethna set aside two show cause notices issued by officers of the Central GST Audit-II wing, Mumbai, after the dispute was...