Need For Regulatory Oversight In India's Buy Now Pay Later Market

Rajesh Kumar & Smita Singh

20 May 2024 11:01 AM IST

In the vast tapestry of the world, where dreams and aspirations interweave, there exists a profound imbalance, a poignant disparity that hampers the path to prosperity for millions. For many decades, the banking sector has contributed to the Indian economy by promoting financial growth and development, however, India happens to be one of the seven countries collectively accommodating 50% of the world's 1.4 billion adults who lack the access to formal banking. Precisely, a staggering 190 million Indians continue to remain unbanked.

These numbers do not merely suggest the need for enhanced equality and accessibility within the banking sector, but also accentuate the urgency for effortless and prompt solutions which can grant people from different backgrounds access to products and services beyond their current means. That is precisely where the Buy Now, Pay Later (hereinafter referred to as 'BNPL') services step in. BNPL is an unsecured credit option for consumers and an increasingly prevalent fintech-enabled tool for payment, offered most frequently on e-commerce platforms. Typically, these services offer swift interest-free lending, allowing repayment in several instalments.

These easy and convenient loans catered the surge in online shopping during the Covid-19 pandemic, allowing not only adults but also a significant portion of millennials and young customers to seek credit options for expanding their budgets, as they faced the varying uncertainties during these challenging times. Bringing together the digital point-of-sale universality of credit cards, easy repayment conditions of conventional instalment loans, and the overarching appeal of no-interest costs, BNPL has gained traction with customers, even from Tier-2 and Tier-3 cities, who enjoy the convenience of e-commerce and the versatility of being capable of paying for services and goods over time.

By the same token, the trend in BNPL regime can be marked by the inability of mainstream financial institutions in India to provide reliable credit instruments for lower-end transactions, leaving a significant population with limited options. The BNPL model emerged to address this credit gap, primarily targeting individuals with incomes below 12,000 rupees per month. Traditional banks and NBFCs are governed by the guidelines issued by the Reserve Bank of India (hereinafter referred to as 'RBI') that restrict credit facilitation to high-risk consumers, leading to the exclusion of this sector. Credit cards have only been issued to 4.62% of the Indian population due to stringent criteria like 'Credit Information Bureau (India) Limited' credit scores and earnings, ensuring loan repayment through rigorous procedures and authentication.

This way, BNPL serves as a crucial credit option for many individuals residing in emerging economies, particularly those who are currently unbanked and underbanked. It offers a viable means of expanding financial inclusivity, granting people access to products that would otherwise be beyond their means. However, while BNPL facilitates easier credit accessibility, caution must be exercised by providers to prevent excessive debt accumulation, as this poses a significant risk. Due to the high risk posed by BNPL, it has been seen from a lens of suspicion, highlighted by the RBI Master Directions on Prepaid Payment Instruments dated August 27, 2021 (updated as on November 12, 2021). In the following sections, we will explore the drawbacks BNPL, as it stands today, and highlight key practices that can optimize its positive influence on consumers while mitigating potential downsides.

Beneath The Glitter: Unmasking The Hidden Perils Of Bnpl Schemes

In various regions globally, both in developed and developing economies, the integration of technology in the financial sector has been transforming the way industry, communities, and consumers engage with financial services. This trend of innovation has been experiencing significant growth in recent times. However, alongside the promising prospects of advancement in this lucrative market, there are also potential risks, such as consumer harm and unethical behaviour, particularly in an industry where regulations may struggle to keep up with the pace of innovation. As a result, the BNPL model has been met with scepticism and apprehension. This reaction is not unexpected, as the practice can be perceived as encouraging immediate satisfaction and a mindset of "buy now, worry later."

The primary concern with the BNPL model has centred around its impact on the consumer spending pattern. While offering convenient credit access, it can potentially encourage overspending and lead customers to purchase more than they can afford. SomeBNPL providers charge interest and penalty fees for late payment, catching customers off guard. Moreover, the ability to make multiple BNPL purchases with different providers can result in a larger debt that becomes difficult to manage and repay.

The secondary concern with the BNPL model pertains to its potential of unwelcomed risks. These risks mainly stem from the fact that a lot of BNPL operators do not adhere strictly to the Know Your Customer (hereinafter referred to as 'KYC') guidelines, acting against the mandatory guidelines of the RBI. In India, it is common for customers to undergo a minimal KYC process by submitting their Aadhar Card and Pan Card documents only. The central bank of India, the RBI has expressed caution and concern regarding BNPL schemes for such un-regularisation, given the multitude of players in this rising industry. In a study, it was found that Indian Android users have access to around 1,100 lending applications across more than 80 application stores. Out of these, approximately 600 were discovered to be operating illegally. The nonchalant approach towards the prescribed protocols has given rise to adverse outcomes, including instances of identity theft and fraudulent lending practices commonly referred to as "ghost lending".

India has already witnessed a slew of incidents highlighting failures in the digital lending and BNPL sector, with identity theft cases exposing vulnerabilities. One such case resurfaced when Indiabulls' digital lending platform Dhani faced allegations of fraudulent loan disbursements, where imposters used stolen PAN and personal information. Numerous victims expressed their frustration on Twitter, pointing out that digital lending companies often rely solely on PAN and address proof for customer verification. This incident reflected a failure on Dhani's part to adhere to KYC guidelines, as leaked private data can be accessed on the dark web. The victims rightly blamed the lenders for not independently verifying KYC details, leading to unauthorized loans that negatively impacted their credit records.

In addition to the non-adherence to regulatory frameworks, the BNPL model has frequently faced criticism in India due to inadequate financial literacy. Furthermore, the presence of potential hidden fees and penalties[1] within intricate terms and conditions may escape the attention of customers. Another concern is the way BNPL can discourage savings, which holds particular significance for individuals residing in low-income or middle-income nations. These obstacles pose a threat to the extent of financial inclusivity, undermining the very purpose of embracing the BNPL model, as it is frequently the uninformed and underprivileged population who are most vulnerable to being disproportionately affected.

There is a pressing need to establish regulations for the BNPL industry to unlock its full potential in catering to the unbanked and underbanked populations. It is essential to strike a balance between stringent oversight of this sector while ensuring that it retains its inherent attributes of simplicity and convenience.

Global Expansion Of BNPL

In 2022, the global market for BNPL reached a valuation of USD 23.22 billion. It is anticipated that the market will witness substantial growth, with a projected increase from USD 30.38 billion in 2023 to USD 122.19 billion by 2030, demonstrating a Compound Annual Growth Rate (CAGR) of 22.0% throughout the forecast period Sales and active customer numbers have also increased significantly, with the Australian BNPL payments (known to be excelling in the BNPL market) projected to reach $14,241.5 million by the end of 2023. These products are transforming societies, especially in countries like Indonesia and Bangladesh with low credit card usage.

In 2022, the value of buy now pay later (BNPL) services in India almost surpassed USD 7000 million. A considerable 22% of Indian consumers have utilized BNPL services for purchasing goods. The primary segment driving the BNPL market in India consists of individuals between the ages of 26 and 35. Approximately 70 million Indians currently possess credit accessibility, accounting for around 7% of the country's population. However, it is noteworthy that a significant majority of 93% of Indians still lack access to credit facilities. Although the Buy Now Pay Later (BNPL) industry in India is still in its early stages, it is important to examine the effective approaches taken in various jurisdictions to regulate this sector and promote favorable advancements in terms of financial inclusivity. The key players in this regard are the United Kingdom and Australia.

United Kingdom

Demand for BNPL deals has surged in the UK across all age groups. A survey revealed that nearly a fifth of over-65-year-olds have used or plan to use BNPL in the next year. While BNPL loans are interest-free when paid on time, some providers have removed late fees.

The UK government issued its official response on 20 June 2022 regarding the regulation of BNPL products, following a comprehensive consultation conducted in October 2021. This consultation brought attention to the potential hazards posed to consumers by BNPL loans. At present, the regulation of BNPL operates independently of the Financial Conduct Authority (FCA) guidelines. However, efforts are underway to incorporate this payment method within an updated edition of the Consumer Credit Act 1974. This amendment would necessitate lenders to obtain FCA approval and conduct affordability assessments for prospective customers. Moreover, advertisements and promotional offers related to BNPL loans will soon fall under the purview of the Financial Promotion Regime to ensure transparency and fairness, preventing any misleading practices. Lastly, consumers will have the option to raise complaints with the Financial Ombudsman Service in the event of any issues arising from a BNPL transaction.

Furthermore, the UK government has issued draft legislation in 2023 to regulate BNPL providers to address the concerns raised about BNPL, including the absence of formal contracts and creditworthiness assessments. The legislation will not affect existing agreements and is expected to be enacted this year.

Australia

In the context of Australia, the regulation of BNPL falls outside the scope of the National Consumer Credit Protection Act 2009, as specific short-term loans are exempt from credit licensing requirements. Nonetheless, it is subject to consumer credit regulation under the Australian Securities and Investments Commission(ASIC) Act 2001. Practically, this means that the Australian Securities and Investments Commission (ASIC) possesses authority to exercise product intervention powers, intervening in situations where concerns regarding substantial harm to consumers arise. Furthermore, In March 2021, the Australia Finance Industry Association (AFIA) introduced a voluntary set of guidelines called the 'AFIA Buy Now Pay Later Code of Practice' for providers of BNPL products. This code outlines nine overarching commitments that signatories are expected to adhere to, aiming to safeguard the interests and protection of customers.

Australia plans to regulate BNPL services as consumer credit products under new laws. This will require BNPL providers to conduct background checks before lending, imposing one of the world's toughest regulatory regimes in the startup sector. The regulations include the need for BNPL issuers to hold Australian Credit Licenses, comply with responsible lending obligations, meet statutory requirements for dispute resolution and hardship, provide product disclosure, abide by marketing restrictions, and adhere to other minimum conduct standards.

Regulatory Gaps And Consumer Protection In India's BNPL Market

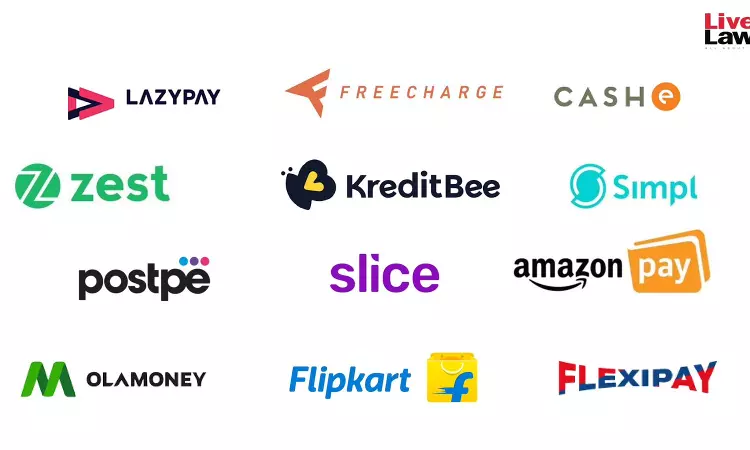

Presently, India grapples with an absence of comprehensive regulations governing the Buy Now Pay Later (BNPL) landscape. Nevertheless, the rapid emergence of numerous players, including LazyPay, Simpl, and others, coupled with growing concerns regarding transparency and consumer safeguarding, has compelled the Reserve Bank of India (RBI) to take action. In response, the RBI issued the RBI Master Directions on Prepaid Payment Instruments on August 27, 2021, triggering a transformative shift in the market dynamics. While these directions aimed to provide conceptual clarity regarding the definition of credit cards, the ambit of this term may now encompass certain BNPL models as well, provided they qualify as physical or virtual payment instruments featuring means of identification, are issued with pre-approved credit limits, and enable the acquisition of goods and services or cash advances. Through its Master Direction, the regulatory authority has prohibited Non-banking Institutions from endowing Prepaid Payment Instruments (hereinafter referred to as 'PPI') with credit lines. PPIs are prepaid instruments like digital wallets, cards, and accounts used for purchasing goods, services, and fund transfers. To provide PPI services, banks and non-bank entities must meet the eligibility criteria set by the RBI and obtain approval or authorization.

BNPL services function as credit lines or predetermined borrowing limits that enable customers to access credit within the set limit. Some PPIs collaborate with banks to provide these credit lines, while others obtain funds from Non-Banking Financial Companies (NBFCs). PPI operators have been facilitating small loans ranging from Rs 1,000 to Rs 500,000. However, the RBI, through a letter privately issued to all the authorized non-bank PPIs in June 2022, explicitly prohibited the loading of PPIs with credit lines and warned operators of potential penalties for non-compliance. According to the RBI, while PPIs can be loaded using cash, debits from bank accounts, credit cards, and debit cards, the existing regulatory framework does not allow for the loading of credit lines onto PPIs. Although the directive applies to all authorized non-bank PPIs, it remains uncertain whether PPIs partnering with banks are also affected by this directive.

Based on the information provided above, it becomes evident that India has initiated its path towards regulating the Buy Now Pay Later (BNPL) sector. However, it is crucial to emphasize that there is a pressing need for greater clarity (to understand whether if these guidelines are applicable on partnerships between banks and PPIs) in order to fully harness the potential of this industry and achieve comprehensive financial inclusion. There are several other basic reforms which the central bank may explore. Some of them are as follows:

(a) A separate Authority to check compliance:

India can draw inspiration from the regulatory frameworks in the UK and Australia, where the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC), respectively, have been entrusted with the responsibility of ensuring that BNPL lenders obtain proper authorization, comply with regulations, and prioritize consumer protection. In contrast, India currently lacks a similar dedicated authority or department under the RBI that can establish a robust system of checks and balances.

Establishing a specialized entity empowered to intervene in the realm of BNPL at the first sign of consumer protection concerns or reported instances of identity theft would guarantee prompt and efficient resolution of these issues. Such a dedicated department would ensure timely and effective measures are taken. Additionally, this department could conduct investigations into non-compliance with KYC guidelines, thereby upholding the integrity of the BNPL system.

(b) Amending the definition of 'credit'

At present, the Reserve Bank of India (RBI) does not regulate Buy Now Pay Later (BNPL) products. However, a working group established by the RBI has recommended the inclusion of BNPL within the definition of credit. The working group highlighted that BNPL platforms often resort to unconventional practices, such as retrospectively creating loans on the books of non-banking financial companies (NBFCs) when a loan turns non-performing. To address this, the RBI must clearly redefine the concept of credit to encompass BNPL and thereby subject it to regulatory oversight.

In the United States, the "Bureau of Consumer Financial Protection" defines "credit" as the granting of a right by a creditor to an applicant to defer debt payment, incur debt and defer its payment, or purchase property or services and defer payment for them. By applying this definition, the Buy Now Pay Later (BNPL) arrangement would qualify as credit since it enables the deferral of payment. However, in India, the absence of a comprehensive definition creates ambiguity regarding whether BNPL falls within the scope of "credit."

(c) Bringing specific regulations for the BNPL model to ensure consumer protection

In the absence of proper regulations, the proliferation of diverse BNPL products, with their varying designs showcased on websites and digital apps, can potentially bewilder consumers when it comes to understanding the loan terms, repayment schedules, and other essential attributes. This confusion can lead to inappropriate product choices and unsuspected backend fees and interest charges. Currently, there is no standardized format in place that mandates BNPL products to present loan terms in a consistent manner, thereby hindering consumers' ability to easily access the information necessary to comprehend how the loan functions and compare it with alternative options.

Furthermore, aside from the commonly imposed late fees levied by most BNPL providers, borrowers may encounter additional fees that are unforeseen. Some platforms impose penalty fees on a daily basis, catching borrowers off guard. Moreover, the late fees imposed by BNPL platforms vary based on the price of the product in question. For instance, for an amount exceeding Rs 5,000, a BNPL platform might charge approximately Rs 300-600, thereby introducing further unpredictability. It is crucial that all forms of Buy Now, Pay Later (BNPL) loans offer standardized, user-friendly disclosures pertaining to interest rates, fees, and payment terms. Having specific regulations would ensure information-symmetry among the customers.

In conclusion, India has taken steps towards regulating the BNPL sector, but there is a need for greater clarity and comprehensive reforms. Establishing a dedicated regulatory authority, redefining the concept of credit to include BNPL, and implementing specific regulations for the industry are essential. Standardizing disclosure requirements and ensuring consumer protection will foster transparency and empower customers to make informed choices. To complement these efforts, it is crucial to implement comprehensive financial education reforms and awareness campaigns, fostering alignment between customers, regulators, and service providers. This will empower customers with knowledge and understanding, ensuring they are well-informed and can actively participate in the BNPL landscape. These reforms will pave the way for a robust BNPL market that contributes to financial inclusion in India.

Rajesh Kumar and Smita Singh are students at National Law University, Delhi and legal correspondents at Live Law. Views are personal.