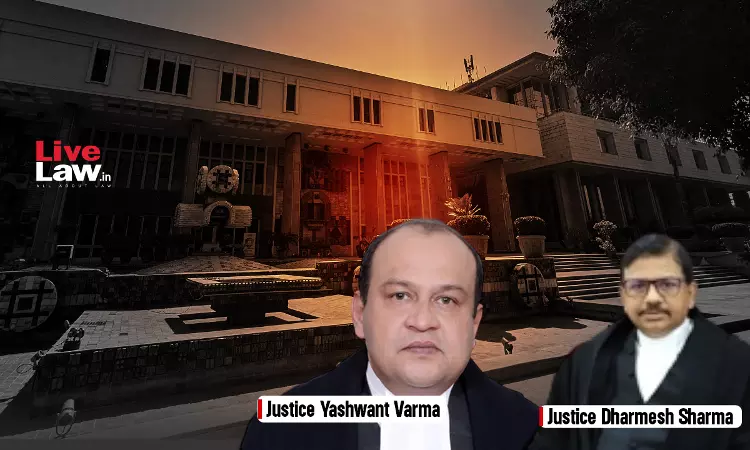

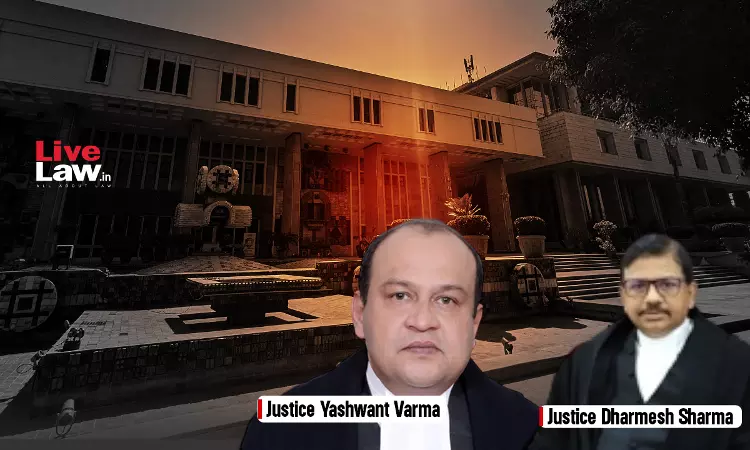

The Delhi High Court has made it clear that amounts received by the Electricity Regulatory Commissions under the heads of filing fee, tariff fee, license fee, annual registration fee and miscellaneous fee are not exigible to tax. A division bench of Justices Yashwant Varma and Dharmesh Sharma thus allowed the petitions filed by the Central Electricity Regulatory Commission as well as...