Kerala High Court

Kerala High Court Weekly Round-Up : February 02 - February 08, 2026

Nominal Index [Citations: 2026 LiveLaw (Ker) 63 - 81]Kamal Kumar Mandal v. State of Kerala and Anr, 2026 LiveLaw (Ker) 63Suo Motu v Union Government and Ors, 2026 LiveLaw (Ker) 64 Lunar Rubbers v Kerala Head Load And Timber Workers And Factory Workers Union(KTUC and ors and connected matter, 2026 LiveLaw (Ker) 65M R Ajayan v Union of India, 2026 LiveLaw (Ker) 66Susan K. John v. National Board...

Kerala High Court Orders Reimbursement Of Expenses To Govt Employee Over Treatment Of Daughter's Rare Disease Outside State

In a recent ruling, the Kerala High Court ordered the state government to reimburse the treatment charges expended by a government school teacher for the treatment of his daughter's rare disease in a non-empanelled private hospital in Coimbatore.Justice Harisankar V. Menon relied on various decisions of the Apex Court and the judgment of the High Court in The General Manager and Anr. v. Rajam V.V., wherein the reimbursements not disbursed on technical grounds like treatment at non-empanelled...

'No RTE Act Recognition': Kerala High Court Orders Closure Of School Imparting Preschool Education On Quran

The Kerala High Court recently ordered closure of a school that was teaching Quran and allied subjects to its students since it was running without valid recognition as per Section 18 of Right of Children to Free and Compulsory Education Act, 2009.Justice Harisankar V. Menon was considering two connected writ petitions, one of which was preferred by two persons, who had complained against...

Managing Director Who Signed Dishonoured Cheques & Handled Day-To-Day Affairs Vicariously Liable U/S 141 NI Act: Kerala High Court

The Kerala High Court recently clarified that the managing director, who signed the dishonoured cheques and was in charge of the day-to-day affairs of a company accused of Section 138 of the Negotiable Instruments Act, is vicariously liable in the offence.Justice M.B. Snehalatha dismissed a revision petition filed by the 2nd accused in a cheque bounce case for which he was found guilty along...

Kerala High Court Expresses 'Exasperation' Over Reappearing Illegal Poles & Flags, Orders Statewide Drive To Prevent Reoccurrence

The Kerala High Court on Friday (February 6) directed the Joint Directors of Local Self Government Department (LSGD) to initiate a comprehensive drive within their respective jurisdictions and issue necessary instructions to the Secretaries ensuring no further illegal installations of flags, poles etc. occur in public places in the State.Justice Devan Ramachandran was considering a...

Kerala HC Reserves Verdict In Plea Challenging Centre's Order Allowing Old Labour Courts To Function After Enactment Of New Industrial Code

The Kerala High Court on Friday (06 February) reserved its judgment in the petition challenging a Central Government notification that permits Labour Courts and Industrial Tribunals constituted under the repealed Industrial Disputes Act, 1947 to continue adjudicating cases even after the Industrial Relations Code, 2020 came into force.Justice Gopinath P heard the arguments of both the parties...

UAPA | Order Barring Disclosure Of Witness Statements Must Record Reasons For Each Witness: Kerala High Court

The Kerala High Court has clarified that an order passed under Section 44 of the Unlawful Activities (Prevention) Act barring disclosure of witness statements must separately consider materials relating to each witness and record reasons for its decision.The Division Bench of Justice Sushrut Arvind Dharmadhikari and Justice P.V. Balakrishnan was considering a petition preferred under Section...

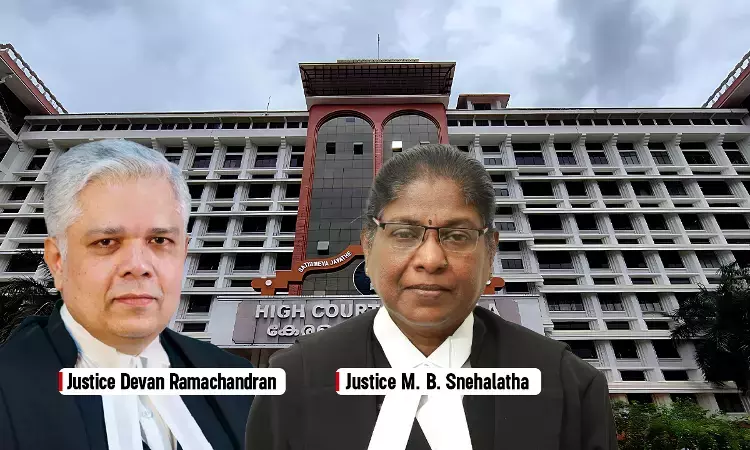

'He Could Have Been Alive': Kerala High Court Flags Systemic Failure After DNA Confirms Body Of Missing Deportee Suraj Lama

The Kerala High Court was on Friday (06 February) informed that the body recovered from Kalamassery belongs to Suraj Lama, an Indian citizen who was deported from Kuwait but went missing after arriving at Kochi.The division bench comprising Justice Devan Ramachandran and Justice M B Snehalatha which was considering the habeas corpus petition, has directed the Nedumbasery SHO to produce the...

Long Incarceration Alone Not Ground For Bail In Commercial Quantity NDPS Case If Accused Has Criminal Antecedents: Kerala High Court

The Kerala High Court has reiterated that a person found in possession of commercial quantity of narcotic drugs would not be eligible for grant of bail merely because of long incarceration if the twin conditions under Section 37 under the Narcotic Drugs and Psychotropic Substances Act are not satisfied or if he has criminal antecedents.As per Section 37 of the Act, in cases where the...

'Infructuous': Kerala High Court Dismisses Expelled CPI(M) Leader's Plea For Police Protection To Release Book On Fund Mismanagement By Party

The Kerala High Court on Friday (February 6) dismissed as infructuous the plea preferred by expelled Communist Party of India (Marxist) leader Kunhikrishnan V. seeking police protection due to the release of his book "Nethruthwathe Anigal Thiruthanam", which is stated to be an exposé on irregularities and mismanagement of martyrs funds and other funds by some of the leaders of CPI(M),...

'Every Movie May Be Inspired By Some Real Story': Kerala HC Remarks In Plea To Stall Film Allegedly Based On Venjaramoodu Mass Murder Case

The Kerala High Court on Thursday (February 5) orally asked how the movie Kaalam Paranja Kadha was defamatory to the family of the accused in the Venjaramoodu mass murder case when every movie is inspired by some real incident or story. Justice Bechu Kurian Thomas was considering a plea preferred by the father of the accused who stated that the movie may prejudice the trial in the case, which...

“Won't Tolerate NDPS Violations”: Kerala HC Examines If Repeated Drug Possession Amounts To 'Stocking', Attracts 'Goonda' Tag Under KAAPA

The Kerala High Court on Wednesday (04 February) said that it intends to send a strong message that it will not tolerate violation of the Narcotic Drugs and Psychotropic Substances Act (NDPS Act).A five-judge Full Bench comprising Justice Devan Ramachandran, Justice P Gopinath, Justice A Badharudeen, Justice MB Snehalatha, and Justice Jobin Sebastian were considering a reference to examine...