News Updates

'No Vested Right Of Infinite Chances To Complete MBBS Degree': Delhi HC Upholds NMC Regulation Capping Number Of Attempts To 4 In First Year

Upholding the regulation issued by National Medical Commission (NMC) limiting the number of attempts for candidates to pass their first year (first professional examination) in MBBS course to four, the Delhi High Court has said that there cannot be a right to attempt an examination any number of times. A division bench of Chief Justice Satish Chandra Sharma and Justice Subramonium...

GST Payable On Medical insurance premium for employees and pensioners: Telangana AAAR

The Telangana Appellate Authority of Advance Ruling (AAAR) has ruled that no GST exemption is available on medical insurance premiums taken to provide health insurance to employees, pensioners, and their family members.The two-member bench of Neetu Prasad and B.V. Siva Naga Kumari has observed that the insurance services for employees and employees' family members received by the appellant...

Adopted Child Entitled To Seek Compassionate Appointment: Karnataka High Court

The Karnataka High Court has made it clear that an adopted child can seek compassionate appointment following the death of his/her adoptive parent who took care of the family.A division bench of Justices Suraj Govindaraj and G Basavaraja observed, "A son is a son or a daughter is a daughter, adopted or otherwise, if such a distinction is accepted then there would be no purpose served...

Blatant Violation Of Natural Justice: Karnataka HC Permits Dismissed Archak At Bhoga Nandishwara Temple To Perform Duties Until Enquiry Is Completed

The Karnataka High Court has quashed the order passed by the Endowment Commissioner, dismissing an Archak of the Bhoga Nandishwara Temple in Chikkaballapur Taluk, without holding an inquiry on charges of alleged misconduct. A single judge bench of Justice M Nagaprasanna directed the respondent-authority to afford an opportunity of hearing to the petitioner and complete the enquiry...

Can People Who Hold Honorary Positions Continue With Political Activities While In Office? Delhi HC On Jasmine Shah's Plea Against LG's order

The Delhi High Court on Tuesday asked the Lieutenant Governor Vinai Kumar Saxena and the planning department to respond to the Dialogue and Development Commission of Delhi (DDCD) Vice Chairperson Jasmine Shah's petition against Saxena's decision asking Chief Minister Arvind Kejriwal to remove Shah from the post, and restricting him from discharge of functions as the V-C in the meantime.In...

"Charge Only 50% Of Hostel Rent From Students For COVID Period": P&H High Court Directs RGNUL To Refund Additional Amount

The Punjab and Haryana High Court on Monday directed the Rajiv Gandhi National University of Law, Patiala to charge only 50% of the hostel rent from the students for the COVID period and would refund the remaining amount to the students (if so deposited) within a period of four weeks.The bench of Justice Augustine George Masih and Justice Vikram Aggarwal took note of the fact that the...

Gujarat HC Imposes ₹1 Lakh Cost On Undertrial Who Produced Fake Wedding Card To Secure Bail On Pretext Of Marriage

The Gujarat High Court recently pulled up an undertrial, accused in at least 7 FIRs, who produced a fake wedding card to secure bail on the pretext of marriage.The single bench of Justice Samir J. Dave imposed a cost of Rs. 1 lakh on the petitioner for abusing the process of the Court. The accused had approached the High Court and had prayed to release him on temporary bail for a period...

Calcutta HC Refuses To Quash Case Against Judicial Magistrate Accused Of Raping Litigant On False Promise To Marry Her

The Calcutta High Court on Monday refused to quash criminal proceedings initiated against a judicial officer accused of raping a litigant on a false promise to marry her.The matrimonial dispute of the complainant was pending before the petitioner herein, a member of the WB Judicial Service who held the post of Additional Chief Judicial Magistrate at the time, when the latter...

NCLT Mumbai Initiates Insolvency Process Against M/S S Kumars Ltd.

The National Company Law Tribunal ("NCLT"), Mumbai Bench, comprising of Justice P.N. Deshmukh (Judicial Member) and Mr. Shyam Babu Gautam (Technical Member), while adjudicating a petition filed in Edelweiss Asset Reconstruction Co. Ltd. v M/s. S. Kumars Limited, had initiated Corporate Insolvency Resolution Process ("CIRP") against the textile manufacturing company M/s S Kumars...

Physical verification of business premises; GST dept failed to issue notice : Delhi High Court

The Delhi High Court has held that the GST department failed to issue the notice to the person who must be present at the time of physical verification of business premises.The division bench of Justice Rajiv Shakdher and Justice Tara Vitasta Ganju has observed that the verification report, though generated, has not been uploaded, as required, in Form GST REG-30 on the common portal.A...

Madras High Court Recalls Order Quashing Sexual Harassment Case Against Godman Shiva Sankar Baba

The Madras High Court on Monday recalled its earlier order quashing a sexual harassment case against self-styled godman Shiva Sankar baba.On October 17, Justice RN Manjula had allowed a quashing petition filed by Baba after observing that no application to condone the delay was filed along with the complaint under Section 473 of CrPC.The case against Shiva Sankar Baba was that he had...

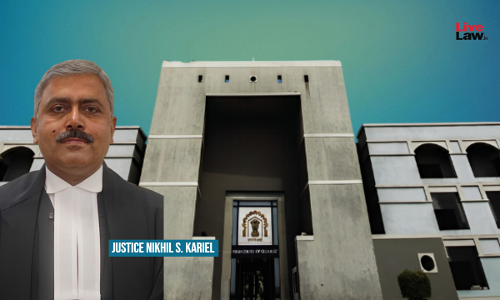

Justice Nikhil Kariel Transfer Row | Gujarat High Court Advocates' Association Calls Off Strike, To Resume Work From Tomorrow

The Gujarat High Court Advocates' Association (GHCAA) has decided to call off its strike which started on Thursday to oppose the proposed transfer of Justice Nikhil S. Kariel from the Gujarat High Court to the Patna High Court. The advocates are set to resume work tomorrow. The decision to call off the strike comes a day after the Chief Justice of India DY Chandrachud gave an assurance to...