Jharkhand High Court

'Unbecoming' Of Police Personnel To Be In Live-In Relationship Despite Being Married: Jharkhand High Court Upholds Constable's Dismissal

The Jharkhand High Court has affirmed the dismissal of a police constable who, despite being married, was involved in a live-in relationship with another woman. The Court stated that such behaviour is inappropriate for a police officer and violates the rules governing his service conditions.Justice SN Pathak presiding over the case, ruled, "It is unbecoming of a police personnel who was...

S. 65-B Of Indian Evidence Act Only Pertains To Production Of Electronic Records, Not Physical Documents: Jharkhand High Court Clarifies

The Jharkhand High Court has clarified that Section 65-B of the Indian Evidence Act, 1872 applies to the presentation of electronic evidence, and not physical documents.Justice Sujit Narayan Prasad, presiding over the case observed, “Section 65 of the Indian Evidence Act is mainly for the purpose of treating the document as secondary evidence depending upon the availability of the...

'Lawyers Not Getting Justice': Jharkhand High Court Calls For Comprehensive Insurance Benefits For Lawyers

The Jharkhand High Court has called upon the Central and State governments to make provisions for extending insurance benefits to the lawyers community in the state. Bench of Chief Justice Dr. B.R. Sarangi and Justice Sujit Narayan Prasad said often lawyers are not able to maintain themselves properly and it is for the government to formulate guidelines with regard to grant of life and...

Jharkhand High Court Refers Contempt Case Against Advocate General To Larger Bench Amid Claims Of False Affidavits, Procedural Complexities

The Jharkhand High Court has referred a pending contempt case involving the state's Advocate General, accused of filing false affidavits, to a larger bench for further deliberation. The Court emphasised the importance of judicial propriety and the binding nature of decisions from a coordinate bench, stating that differing views should be referred to a larger bench.Justice Sanjay Kumar...

Jharkhand High Court Half Yearly Digest: January - June 2024

Nominal Index [Citations: 2024 LiveLaw (Jha) 1- 103]Rahul Yadav @ Hari Kumar Yadav, vs. The State of Jharkhand & Anr 2024 LiveLaw (Jha) 1Gautam Kumar Banarjee vs. Dr. C.P. Vidyarthi & Anr 2024 LiveLaw (Jha) 2Steel Authority of India Ltd vs. The State of Jharkhand and others 2024 LiveLaw (Jha) 3CTET Utteern Abhiyarthi Sangh vs. State of Jharkhand 2024 LiveLaw (Jha) 4Branch Manager,...

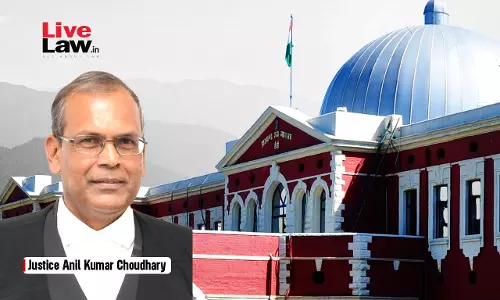

Discharge Of Debt By Drawer To Be Determined At Trial, Can't Be Ground For Quashing Cheque Bounce Case U/S 138 NI Act: Jharkhand HC

The Jharkhand High Court has dismissed a petition to quash a cheque bounce case, emphasizing that determining whether the petitioner had settled the debt for which the cheques were issued is a factual matter requiring a full trial. Justice Anil Kumar Choudhary, presiding over the case, observed, “Now whether or not the petitioner has discharged the debt for which the cheques were issued is...

Private Medical Negligence Complaint Not Maintainable Without Expert Opinion Of Another Doctor Supporting Allegations: Jharkhand High Court

The Jharkhand High Court has ruled that a private complaint against a doctor cannot be considered unless there is prima facie evidence supported by a credible opinion from another doctor indicating medical negligence by the accused.Single Bench of Justice Sanjay Kumar Dwivedi said, "it is crystal clear that a private complaint may not be entertained unless the complainant has produced prima...

Jharkhand High Court Weekly Roundup: June 30 - July 7, 2024

Nominal Index [Citations: 2023 LiveLaw (Jha) 104-108]Brajkishore Sao V. The State of Jharkhand 2024 LiveLaw (Jha) 104Anil Kumar Singh vs State of Jharkhand and Ors 2024 LiveLaw (Jha) 105Tata Steel Utilities and Infrastructure Services Limited vs Jharkhand Urban Infrastructure Development Company Limited 2024 LiveLaw (Jha) 106 Abhishek Kumar v. The State of Jharkhand 2024 LiveLaw (Jha)...

Justice BR Sarangi Takes Oath As Jharkhand High Court Chief Justice, To Have 15 Days Tenure As CJ

Justice Bidyut Ranjan Sarangi was sworn in as the 15th Chief Justice of the Jharkhand High Court on Friday, in a ceremony at the state Raj Bhavan, with Governor C P Radhakrishnan administering the oath of office and secrecy. Justice Sarangi's tenure will be notably brief, as he is scheduled to retire on July 19, just days after assuming his new role.Before his elevation to the judiciary,...

Deceased Employee's Wife Entitled For Compensation From Date Of Death, Irrespective Application: Jharkhand High Court

A single judge bench of the Jharkhand High Court, comprising Justice Deepak Roshan, while deciding a Writ Petition held that the wife of a deceased employee is entitled for compensation from the date of employee's death, regardless of whether an application for compensation was submitted or not. Background Facts The deceased employee was employed by BCCL as a Tyndal in the...

Jharkhand High Court Bids Farewell to Acting Chief Justice Shree Chandrashekhar

The Jharkhand High Court on Thursday bid adieu to Acting Chief Justice Shree Chandrashekhar, who is being transferred to the Rajasthan High Court after an 11-year tenure as a Judge. The ceremonial bench held in his honour was filled with appreciation for his warm personality and calm demeanour.Justice Chandrashekhar was appointed as an Additional Judge of the Jharkhand High Court on January...