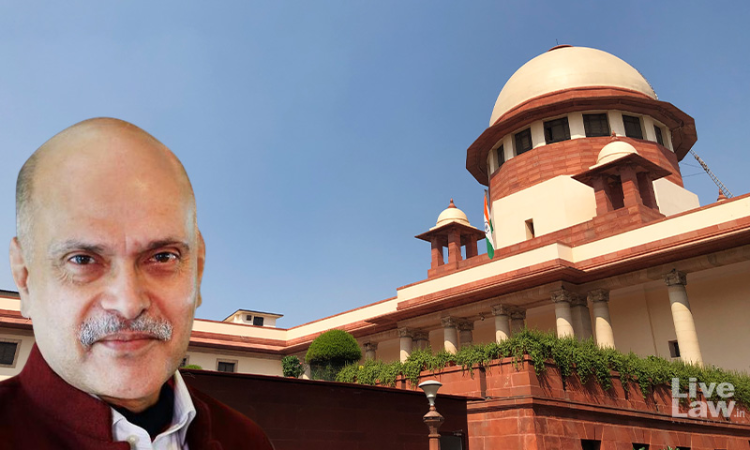

Supreme Court Grants Interim Protection To Raghav Bahl In Money Laundering Case

Srishti Ojha

15 Dec 2021 3:01 PM IST

Next Story

15 Dec 2021 3:01 PM IST

The Supreme Court of India on Thursday agreed to grant interim protection to media baron Raghav Bahl in relation to money laundering case filed against him by the Enforcement Directorate.The Bench issued notice and directed no coercive steps to be taken against Bahl (interim direction).A Bench comprising CJI NV Ramana, Justice AS Bopanna and Justice Hima Kohli was hearing special leave...