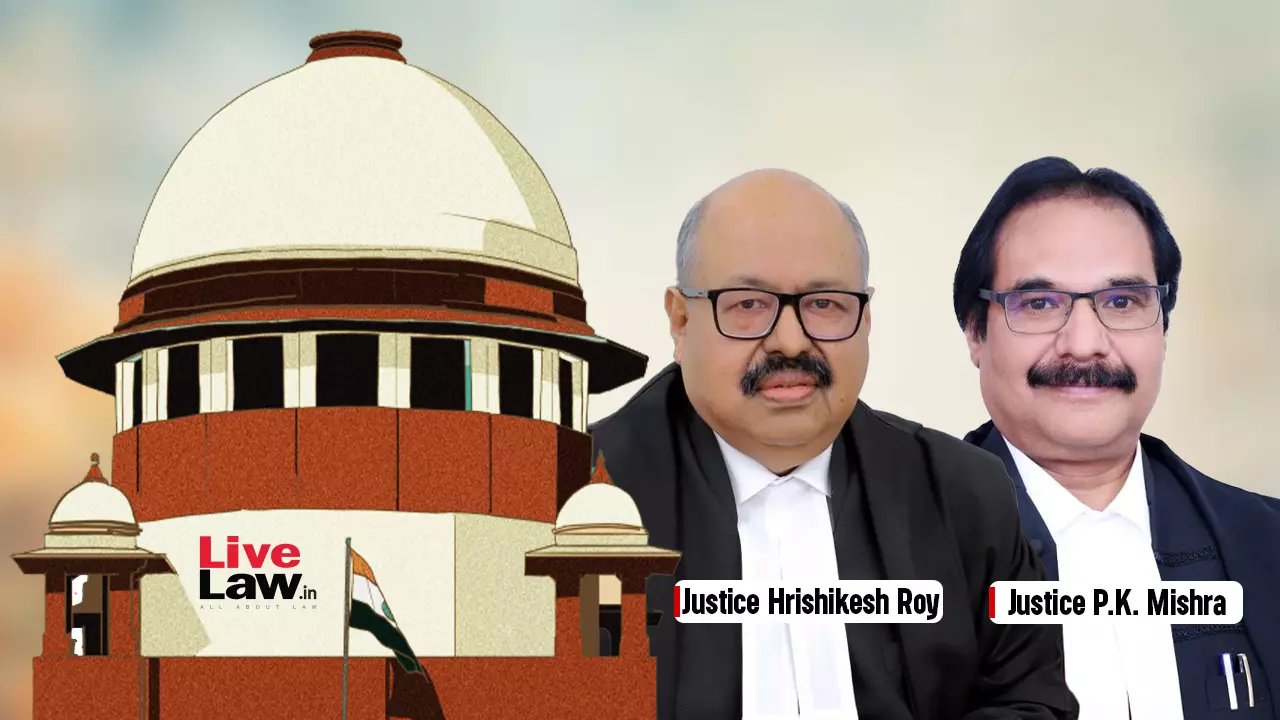

Pension Can Be Claimed Only When It Is Permissible Under Relevant Rules : Supreme Court

Debby Jain

28 July 2024 2:20 PM IST

Next Story

28 July 2024 2:20 PM IST

While dealing with a batch of civil appeals filed by former employees of Uttar Pradesh Roadways seeking pensionary benefits, the Supreme Court recently held that pension can be claimed only under relevant rules or scheme. If an employee is covered under the Provident Fund Scheme and is not holding a pensionable post, he cannot claim pension."pension is a right and not a bounty. It is...