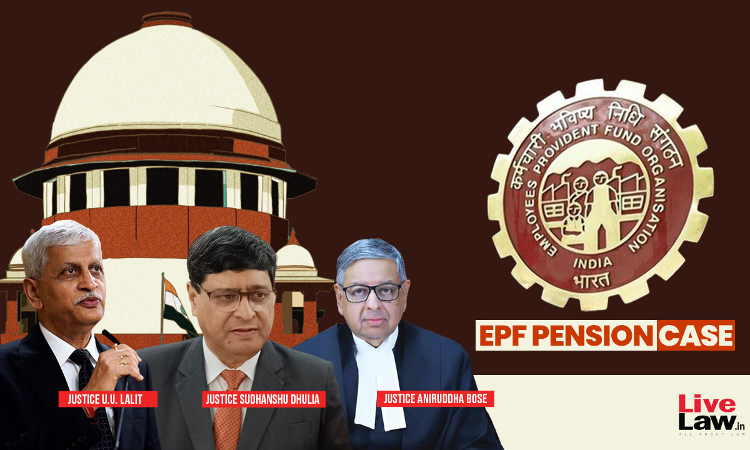

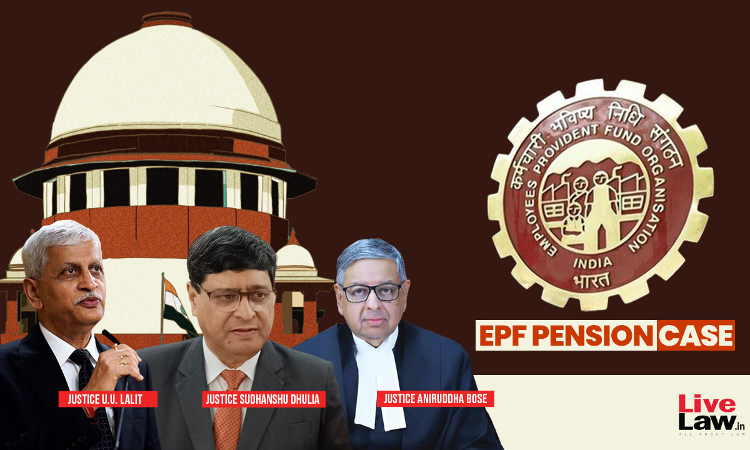

In a significant judgment impacting lakhs of workers across the country, the Supreme Court on Friday upheld the Employees' Pension (Amendment) Scheme 2014, which, among other things, capped the maximum salary for joining the EPF Pension Scheme as Rs 15,000 per month with effect from September 1, 2014. However, the Court has allowed an additional window of four months period for those who...