'Distributor Not Agent, Independent Contractor': Supreme Court Elaborates Law On Agency

Debby Jain

29 Feb 2024 2:53 PM IST

Next Story

29 Feb 2024 2:53 PM IST

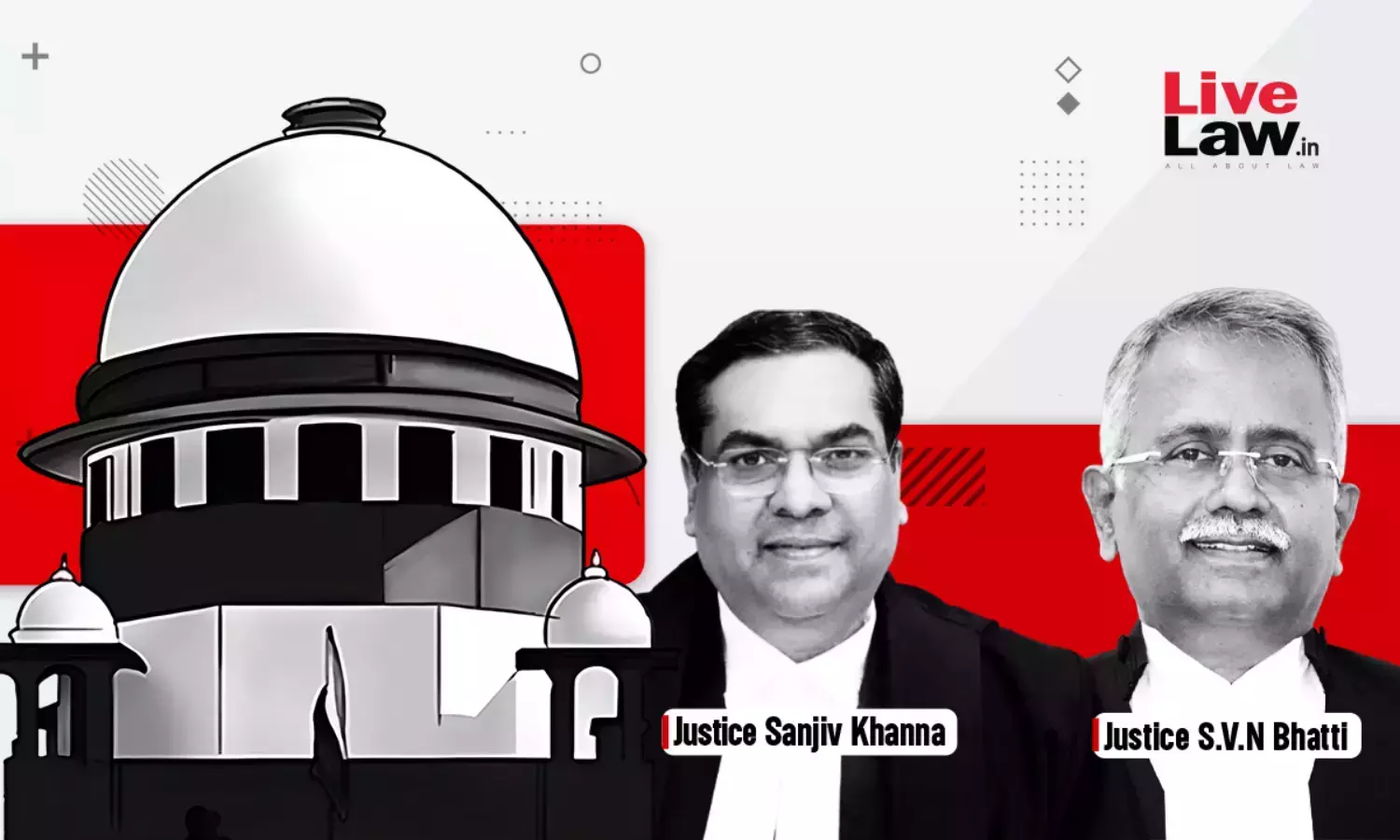

While deciding the question of cellular mobile service providers' liability to deduct tax at source under Section 194-H of the Income Tax Act, 1961, the Supreme Court recently summarized aspects that must be kept in mind by Courts while examining whether principal-agent relationship exists in particular case.The factors/aspects enunciated by the Bench of Justices Sanjiv Khanna and SVN...