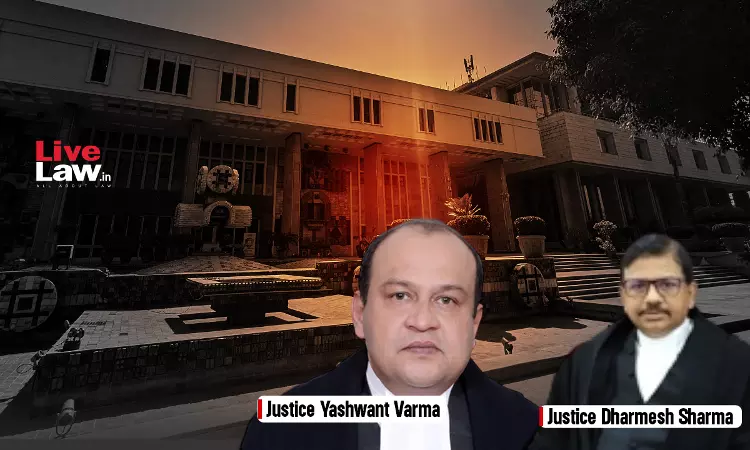

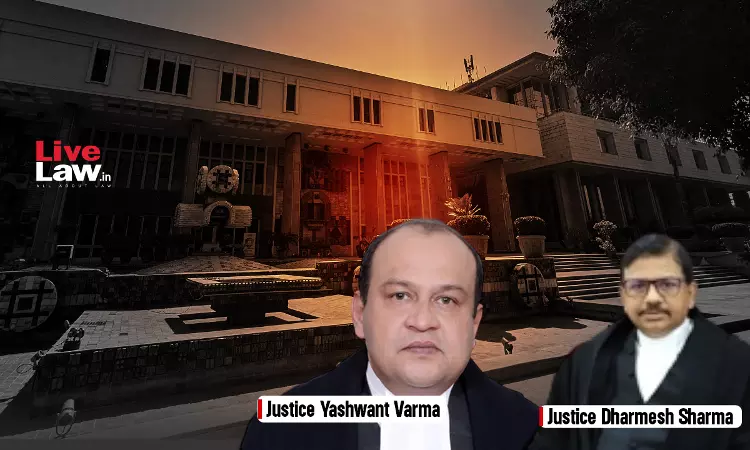

The Delhi High Court has made it clear that neither Section 160 nor Section 87 of the Central Goods and Services Tax Act, 2017 enable the Department to issue notice in the name of an entity which ceased to exist post amalgamation. Section 160 is pari materia to Section 292-B of the Income Tax Act, 1961 which provides that no notice or assessment or any proceedings can be deemed to...