Tax

In Tiger Global Case, Supreme Court Explains Distinction Between 'Tax Planning' & 'Tax Evasion'

The Supreme Court has held that while an assessee is permitted in law to plan transactions to avoid tax, such planning must strictly conform to the framework of the Income Tax Act, the applicable rules, and notifications. The Court said that once a transaction structure is found to be illegal, sham, or lacking commercial substance, it ceases to be permissible tax avoidance and...

'Tax Sovereignty Must Not Be Compromised' : Supreme Court Suggests Safeguards While Entering Into International Tax Treaties

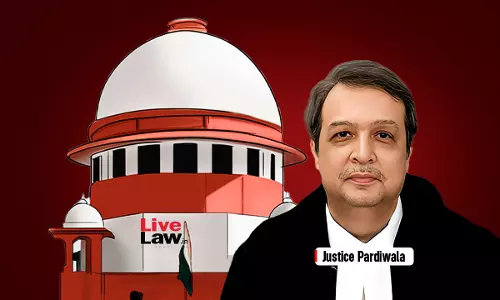

In his concurring opinion in the Tiger Global–Flipkart tax dispute, Justice JB Pardiwala stressed that tax sovereignty is an essential facet of India's economic independence and warned against ceding taxing rights through international treaties or external pressures.Justice Pardiwala fully agreed with the reasoning and conclusions reached by Justice R Mahadevan, who authored the main...

Contract To Hire Global Speakers For Media Summit Not Subject To Service Tax As 'Event Management' : Supreme Court

In a major relief for the media and event organizers, the Supreme Court on Friday (January 16) held that the fees paid to high-profile speakers through international booking agencies do not attract Service Tax under the category of "Event Management Service". A bench of Justices JB Pardiwala and KV Viswanathan set aside the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) order...

Supreme Court Annual Digest 2025: Central Excise, Customs, CGST & Finance Laws

Distinction between 'Levy' (Section 3) and 'Measure of Tax' (Section 4)– Valuation cannot determine Excisability- Held, Section 3 creates the charge and defines the nature of the levy (manufacture of excisable goods), whereas Section 4 provides the measure (value) for the levy- The Revenue Court erred by conflating the two- The "transaction value" under Section 4 is relevant...

When Can Shares Received After Company Amalgamation Be Taxed As Business Income : Supreme Court Explains

The Supreme Court has ruled that shares received in a corporate amalgamation are immediately taxable as business income under Section 28 of the Income Tax Act if they represent a "real, commercially realizable benefit." “where the shares of an amalgamating company, held as stock-in-trade, are substituted by shares of the amalgamated company pursuant to a scheme of amalgamation, and such...

Delhi High Court Orders Release of Seized Jewellery, Cash After Family Agrees To Pay ₹2.5 Crore Advance Tax

The Delhi High Court has directed the Income Tax Department to release the jewellery and cash seized from a family's house, after the latter agreed to deposit advance tax towards their probable tax liability arising from a search operation.A division bench of Justices Dinesh Mehta and Vinod Kumar passed the order while disposing of writ petitions filed by members of a family whose jewellery...

ITAT Jaipur Gives Taxpayer One More Chance To Disown Account Linked To His PAN In Unexplained Cash Deposit Case

The Income Tax Appellate Tribunal (ITAT) at Jaipur has remanded a case involving a Rs 76.31 lakh tax addition, holding that the taxpayer should be given one more opportunity to establish that a disputed bank account linked to his PAN did not belong to him. A coram of Judicial Member Narinder Kumar and Accountant Member Annapurna Gupta said the issue warranted closer examination, and...

ITAT Mumbai Strikes Down ₹2.70-Crore Reassessment Against Kalpataru Based On Employee Statements

The Mumbai Bench of the Income Tax Appellate Tribunal has deleted a Rs 2.70-crore income tax addition made against Kalpataru Projects International Ltd, holding that purchases cannot be treated as bogus only on the basis of employee statements recorded years later, without any incriminating material being found in a search. The bench, comprising Accountant Member Om Prakash Kant and...

ITAT Allows ₹772 Crore Business Loss Claim Of Flipkart Group Firm Instakart

The Bengaluru Bench of the Income Tax Appellate Tribunal (ITAT) has allowed Instakart Services Pvt. Ltd., a Flipkart group logistics company, to claim Rs 772.25 Crore in business losses. The ruling sets aside tax disallowances for Assessment Years 2016-17 to 2018-19. In an order dated December 18, 2025, Judicial Member Keshav Dubey and Accountant Member Waseem Ahmed held that the losses...

GST Payable On Reimbursed Foreign Patent Attorney Fees For Overseas Patent Filings: West Bengal AAR

The West Bengal Authority for Advance Ruling (AAR) has clarified that reimbursement of fees paid to foreign patent attorneys for overseas patent filings constitutes a taxable 'import of legal services' and attracts GST in India.A coram comprising Shafeeq S, Joint Commissioner (Member- Central Tax) and Jaydip Kumar Chakrabarti was examining a dispute arising from patent filings made in Japan,...

GST Not Payable On Waste Management Services Provided To Govt-Owned Clean Kerala: AAR

The Kerala Authority for Advance Ruling (AAR) has ruled that solid waste management work carried out for Clean Kerala Company Limited is not taxable under GST, after finding that Clean Kerala is a government-owned company performing municipal functions. The ruling came on an application filed by Tiffot Private Limited, which handles the collection, transport, processing and disposal...