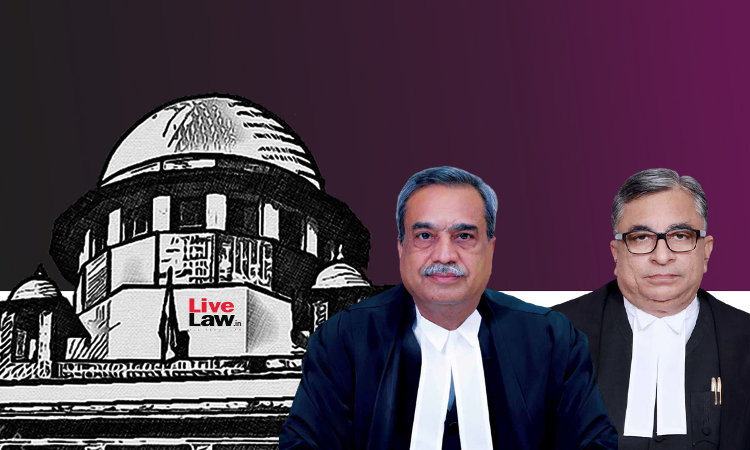

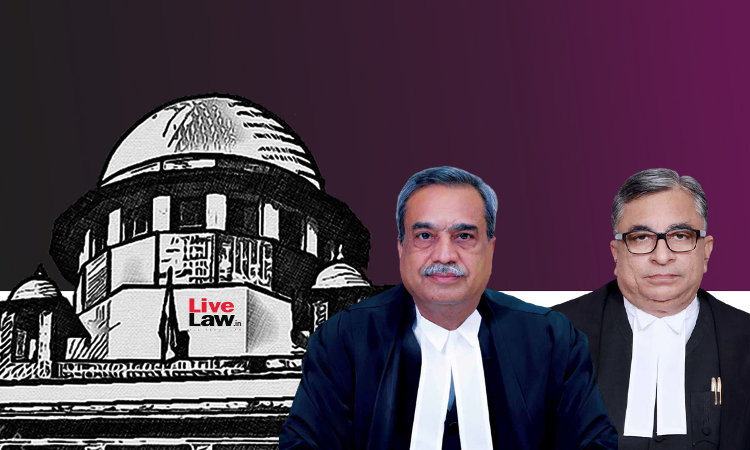

The Supreme Court bench comprising Justices M.R. Shah and Krishna Murari has rendered a split verdict on the issue concerning the applicability of the doctrine of legitimate expectation where a tax holiday/ sales tax exemption granted to the appellant- manufacturer was stopped pursuant to the amendments made to the West Bengal Sales Tax Act, 1994.Pursuant to the amendments made by the West...