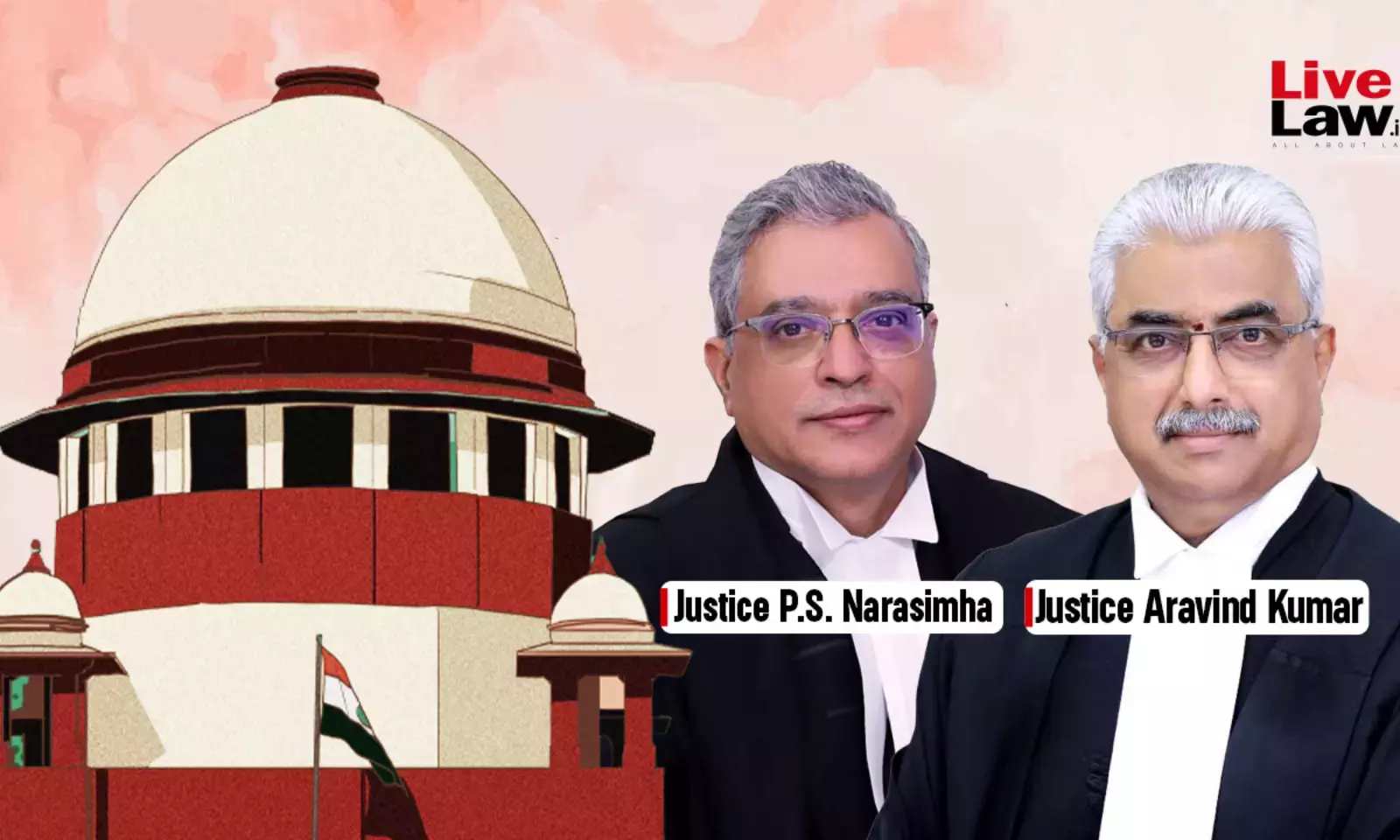

How To Determine Conversion Of Arbitral Award In Foreign Currency To Indian Currency? Supreme Court Explains

Yash Mittal

9 Aug 2024 7:46 PM IST

Next Story

9 Aug 2024 7:46 PM IST

In a significant judgment relating to International Commercial Arbitration, the Supreme Court has decided the two important questions on the enforcement of an arbitral award expressed in foreign currency to Indian Currency.The two questions that appeared for the Court's consideration were:Firstly, what is the correct and appropriate date to determine the foreign exchange rate for converting...