Supreme court

Supreme Court Monthly Round-up: March 2025

Nominal IndexCitationsIn Re Recruitment of Visually Impaired In Judicial Services v. Registrar General High Court of Madhya Pradesh, SMW(C) No. 2/2024 2025 LiveLaw (SC) 274Maatr Sparsh An Initiative By Avyaan Foundation v. Union of India & Ors. | Writ Petition (Civil) No.950/2022 2025 LiveLaw (SC) 275State of Goa & Anr. v. Namita Tripathi 2025 LiveLaw (SC) 276Sharmila Velamur v. v....

Supreme Court Weekly Digest March 2025 [March 17 - 23, 2025]

Supreme Court Weekly Digest March 2025 [March 17 - 23, 2025][2025 LiveLaw (SC) 311 to 2025 LiveLaw (SC) 338]AdministrationJudicial Review - Administrative Decisions - Courts should be cautious in interfering with the administrative decisions of the Governing Board, particularly when such decisions are in furtherance of implementing a statutorily approved Master Plan. (Para 16)...

Rule Of Law Has Responsibility To Protect Investment Of Foreign Investor: Supreme Court

While reviving criminal proceedings against a person accused of defrauding subsidiary of a foreign company, the Supreme Court recently remarked that rule of law has a responsibility to protect investments of foreign investors."The rule of law has a responsibility to protect the investments of foreign investors, while at the same time ensuring that any person accused of mishandling such funds...

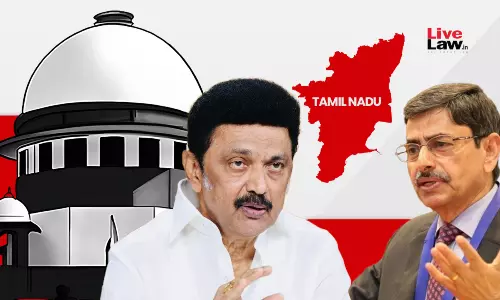

President Must Decide On Bills Reserved By Governor Within 3 Months; States Can Approach Courts Against President's Inaction : Supreme Court

In the landmark judgment in the 'State of Tamil Nadu vs Governor of Tamil Nadu' case, the Supreme Court has also set timelines for the President to act as per Article 201 of the Constitution on the Bills which the Governor has reserved for the President's assent.The Court held that the President must take a decision within 3 months on the Bills reserved. In the judgment, the Court has also...

Senior Citizens Act | Supreme Court Upholds Eviction Order Passed Against Son & Daughter-in-Law From Elderly Man's Property

Confirming the order of eviction passed under the Maintenance and Welfare of Parents and Senior Citizens Act, 2007 against a son and daughter-in-law, the Supreme Court recently held in favour of a 75-yr old man whose self-acquired property was encroached upon by the couple."It shall be a defeat of the purpose of the Act if Appellant is not granted the benefit of eviction against his son...

Supreme Court Criminal Digest- March 2025

BailAnticipatory Bail - Condition for Automatic Custody Upon Charge-Sheet Submission - Such a specific direction, mandating coercive steps for custody, was improper. When granting anticipatory bail, the court should leave it open for the trial court to decide on bail after the charge-sheet is filed and the accused appears. (Para 3) Ritesh Kumar v. State of Bihar, 2025 LiveLaw (SC) 326Arrest...

High Courts Shouldn't Order CBI Investigation In A Routine Manner Or On Basis Of Vague Allegations: Supreme Court

The Supreme Court recently reiterated that mere bald allegations against the incompetence of the local police to investigate the case without any kind of substantiation would not justify the transfer of the investigation to the Central Bureau of Investigation (“CBI”). Relying on the constitution bench decision of State of W.B. v. Committee for Protection of Democratic Rights, (2010) 3...

Suit Can Be Dismissed As Time-Barred Even If No Specific Issue Regarding Limitation Was Framed : Supreme Court

The Supreme Court observed that a Court can dismiss a suit as time-barred, even if no specific issue regarding limitation was framed.This is because of the mandate of Section 3 of the Limitation Act, as per which a Court must dismiss any suit, appeal, or application that is time-barred, even if the defendant has not specifically raised the issue in the pleadings.“The object of framing an...

XII Rule 6 CPC | Judgment On Admission Can Be Passed Even Dehors Pleadings : Supreme Court

The Supreme Court recently clarified the legal position under Order XII Rule 6 of the Civil Procedure Code (CPC), holding that a 'judgment on admission' may be delivered at any stage of the suit, relying on oral or written admissions even those made outside the pleadings and without the need for a separate application to invoke the provision. Order XII Rule 6(1) CPC empowers the court...

Supreme Court Monthly Digest March 2025

(Citations 2025 LiveLaw (SC) 274 to 2025 LiveLaw (SC) 372)AdministrationCompliance with Court Orders - Delay and Obstination - Harassment of Daily Wage Workers - The Supreme Court dismissed a Special Leave Petition filed by the Union Territory, observing that the case presented a "glaring and textbook example of obstination" by state officials who took 16 years to comply with a High Court...

Accused Who's Absconding Or Obstructing Warrant Executions Not Entitled To Anticipatory Bail : Supreme Court

The Supreme Court held that an accused person, who is creating hindrances in the execution of warrants or is absconding from trial proceedings, is not entitled to the privilege of anticipatory bail."When after the investigation, a chargesheet is submitted in the court, or in a complaint case, summons or warrant is issued to the accused, he is bound to submit himself to the authority of law. If...

![Supreme Court Weekly Digest March 2025 [March 17 - 23, 2025] Supreme Court Weekly Digest March 2025 [March 17 - 23, 2025]](https://www.livelaw.in/h-upload/2023/02/13/500x300_458803-supreme-court-weekly-digest.webp)