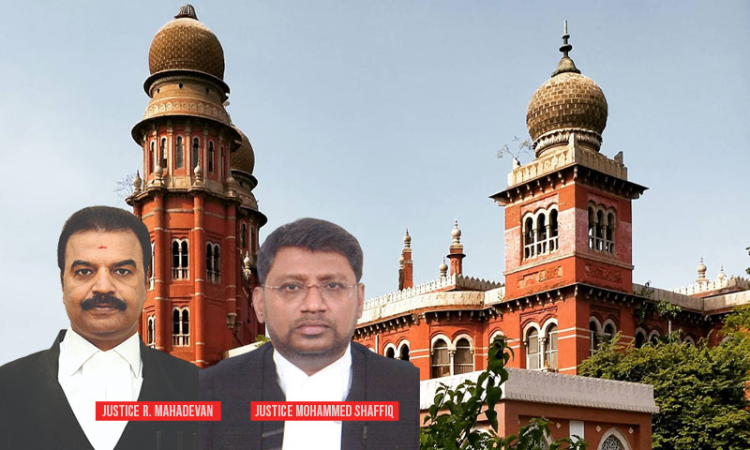

Madras High Court Upholds Validity Of Section 6 Of The Tamil Nadu Value Added Tax Act 2006

Upasana Sajeev

28 May 2022 1:55 PM IST

Next Story

28 May 2022 1:55 PM IST

The Madras High Court recently upheld the validity of amendments made to Section 6 of The Tamil Nadu Value Added Tax Act, 2006. The court observed that in matters relating to tax, the interest of the State must be considered as against the interest of certain individuals. The court also discussed the power of the legislature in taking decisions with respect to tax "The hardship that...