News Updates

[Latching On] Does 'More Sellers' Feature On E-commerce Websites Amount To Passing Off? Delhi High Court To Consider

The Delhi High Court is set to consider whether latching on another seller's products - an option provided by e-commerce websites by having 'more sellers' feature under the original seller's product - amounts to passing off and infringes any law.A division bench comprising of Justice Vibhu Bakhru and Justice Amit Mahajan observed that the assumption about "latching on" feature falling foul of...

Test Identification Parade Can't Be Permitted After Lapse Of Several Years: Karnataka HC

The Karnataka High Court has made it clear that Test Identification Parade is to ascertain the identity of accused persons and cannot be conducted after lapse of several years, as there is risk of the witnesses having lost proper memory.It thus set aside an order passed by the trial court permitting the investigating officer to conduct a TIP of an accused after 11 years of filing...

Litigant Entitled To Refund Of Court Fees If Matter Settled Outside Court Even Without Invocation Of S.89 CPC: MP High Court

The Madhya Pradesh High Court recently held that a Litigant shall be entitled to refund of court fees if the matter in issue has been settled by the parties outside the Court, even without invocation of Section 89 CPC.Deciding the question of law, Justice D.D. Bansal observed-In view of the aforesaid, I am of the considered opinion that even if the matter is settled by the parties outside...

Senior Advocate Mohit Mathur Re-Elected As President Of Delhi High Court Bar Association

Senior Advocate Mohit Mathur has been re-elected as the President of Delhi High Court Bar Association for the term 2022-23. Mathur, elected with a total of 2318 votes, defeated Senior Advocates N Hariharan and Ramesh Gupta and Advocate Rajiv Khosla. Advocate Jatan Singh has been elected as vice president with 2378 votes. Other elected members are as follows:- Honorary Secretary: Sandeep...

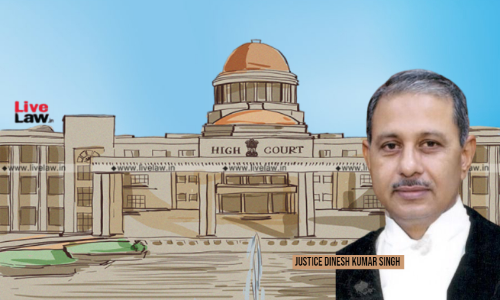

Litigants File Forged Documents In HC | Allahabad High Court Initiates Suo Moto Criminal Contempt Proceedings, Orders Their Arrest

The Allahabad High Court on Wednesday initiated suo moto criminal contempt proceedings against two litigants for filing forged documents before the HC. Issuing non-bailable warrants of arrest against the petitioners/litigants, the bench of Justice Dinesh Kumar Singh directed the Director General of Police, U.P. and Director General of Police, Uttarakhand to ensure the arrest of...

RSS Route March: Contempt Plea Moved In High Court Over TN Govt's Refusal To Grant Permission, State Seeks Review

The Rashtriya Swayamsevak Sangh (RSS) has moved the Madras High Court initiating contempt proceedings against the state government for its refusal to grant permission for a route march that the party intends to conduct on October 2nd. Earlier, the High Court had directed the authorities to grant permission for the same before the 28th of September. Senior Counsel Prabhakaran requested for...

Hughes Hall's New 'Honorary Fellow' Justice Pratibha M Singh Visits Cambridge University College Campus

Delhi High Court judge, Justice Pratibha M Singh, who was elected as an Honorary Fellow of Hughes Hall in July, visited the college last week for first time since the announcement.Justice Singh, a Hughes Hall alumna, is the first Indian judge to enter the list of Hughes Hall Honorary Fellows. The decision to elect a person as an Honorary Fellow is taken by the Governing Body of the college....

After Bombay HC Nudge, Dr. Ambedkar's MSc Thesis To Be Published

The Maharashtra government informed the Bombay High Court on Thursday that it will publish Dr. B. R. Ambedkar's M. Sc. thesis. A division bench of Justices Prasanna Varale and Kishore Sant was hearing a suo moto PIL taking cognizance of government's earlier decision to halt a project for preservation and publication of Ambedkar's works. On Thursday, the state informed that court that...

Where Allegations Are Against A Partnership Firm Then Its Partner Is Jointly & Severally Liable For The Same: Jharkhand High Court

The Jharkhand High Court has recently observed that even if a charge sheet is not filed against a partner of a firm in an individual capacity, and all the allegations are against the firm only, then also, the partner of the firm and he is jointly and severally liable for the same in view of Section 25 of the Indian Partnership Act, 1932. The bench of Justice Subhash Chand observed...

Blood Relatives Can Share Employer-Employee Relationship Under Workmen's Compensation Act: Karnataka HC

The Karnataka High Court has reiterated that under the Workmen's Compensation Act, there are no provisions prohibiting blood relatives to be employer and employee.A single judge bench of Justice H P Sandesh sitting at Dharwad dismissed the appeal filed by the Divisional Manager of Oriental Insurance, questioning the order of Workmen's Compensation Commissioner at Koppal by which it...

Counsellors In Family Courts Be Provided Computers For Preparing Conciliation Reports: Delhi High Court

Observing that counsellors are an integral part of the family court system, the Delhi High Court has stressed upon the need of providing them computers and printers to ensure that settlements or conciliation agreed before them can be recorded in right perspective.Justice Sudhir Kumar Jain noted that at present, the settlements are prepared by them are either hand-written or filed in a...

CBI Gets Sanction From Maharashtra Govt To Prosecute Former Home Minister Anil Deshmukh In Corruption Case

The Central Bureau of Investigation (CBI) has received a sanction to prosecute former Maharashtra Home Minister Anil Deshmukh from the new state government in Maharashtra, in a case under the Prevention of Corruption Act. The agency submitted the sanction order during proceedings before the special CBI court on Wednesday. The court has now sought response from Deshmukh's lawyer.CBI...

![[Latching On] Does More Sellers Feature On E-commerce Websites Amount To Passing Off? Delhi High Court To Consider [Latching On] Does More Sellers Feature On E-commerce Websites Amount To Passing Off? Delhi High Court To Consider](https://www.livelaw.in/h-upload/2020/03/01/500x300_370786-image-courtesy-business-today.jpg)