News Updates

Lease Charges Paid By The Railways Department Not Subjected To Levy Of VAT: Chhattisgarh High Court

The Chhattisgarh High Court has held that the lease charges paid by the Railways Department are not subject to the levy of value-added tax (VAT).The single bench of Justice P. Sam Koshy has observed that the right to use goods or the use of goods is not the relevant factor to justify the levy of taxes.The Indian Railways had floated a Scheme known as the "Own Your Wagon Scheme" to which...

[Gujarat Riots Case] High Court Adjourns Hearing Of Teesta Setalvad's Regular Bail Plea In State Police FIR To January 4

The Gujarat High Court today adjourned to January 4 the regular bail plea filed by social activist Teesta Setalvad in connection with State Police FIR against her for allegedly fabricating documents so as to implicate high government functionaries in relation to the 2002 Gujarat riots. When the matter came up for hearing before the bench of Justice Hemant M. Prachchhak, Senior Advocate...

Supreme Court Issues Notice On Tour Operator's Plea For Being Considered For Listing As Private Tour Operator for Hajj-2023

The Supreme Court, on Tuesday, issued notice in a plea preferred by Al Islam Tours Corporation seeking direction to the Union Government to, inter alia, dispose of the "frivolous" complaint against it and set aside the show cause notice so that it can be considered for being listed as a Private Tour Operator (PTO) for the Hajj-2023. The petition also seeks direction to place Al Islam...

S.17A PCA | Special Court Can Initiate Enquiry U/S 156(3) CrPC But Without Taking Assistance From Police: MP High Court

The Madhya Pradesh High Court recently held that a special court constituted under the Prevention of Corruption Act is not barred under Section 17-A of the Act from initiating an enquiry on receipt of complaint under Section 156(3) CrPC. Section 17-A of the Act statutorily prohibits the police from conducting enquiry/inquiry/investigation into any offence punishable under the Act...

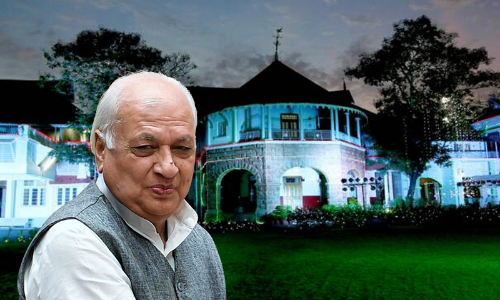

Kerala Assembly Passes Bill To Remove Governor As Chancellor Of Universities

The Kerala Legislative Assembly on Tuesday passed a bill to remove Governor as the Chancellor of eight state universities.The University Laws (Amendment) (No. 2) Bill, 2022 seeks to amend eight Acts relating to different universities to remove Governor as the ex-officio Chancellor of the Universities and to empower the State Government to appoint a Chancellor."The Government shall appoint...

Not Mandatory For Each Partner In A Firm To Contribute Towards Share Capital: Karnataka High Court

The Karnataka High Court has said that it is not necessary that there must be an investment (share capital) by each partner to constitute a partnership firm and it cannot be presumed that a partner who does not contribute is a co-worker and not a partner in the firm. A single judge bench of Justice Umesh M Adiga made the observation while setting aside an order of appellate court...

Delhi High Court Dismisses Nokia's Plea Seeking Deposit Of 'Royalty' By Oppo For Alleged Infringement Of Cellular Technology Patents

The Delhi High Court recently dismissed Nokia's application seeking a direction to Chinese smartphone manufacturer Oppo for deposit of an amount with the court as "royalty" for alleged infringement of its patents in cellular technology.Nokia owns three Standard Essential Patents (SEPs) which are stated to be necessary to make cellular systems 2G, 3G, 4G or 5G compliant. The Finnish...

Allahabad High Court Directs State Govt, DGP To Ensure Criminal History Of Accused Is Available At One Stroke

The Allahabad High Court has directed the State's Principal Secretary Home and DGP to take necessary steps so that the criminal history of an accused is available in one stroke. The Court has also asked the authorities to fix the responsibility of the person responding in Court(s) through instructions/reply/affidavit or otherwise for disclosing the entire criminal history of the accused."With...

CJI DY Chandrachud Inaugurates 10 District Court Digitization Hubs In Odisha; Lauds E-Initiatives Of Orissa HC

On Monday, Chief Justice of India Dr Justice D.Y. Chandrachud virtually inaugurated District Court Digitization Hubs (DCDH) in 10 districts of Odisha, in the presence of Dr. Justice S. Muralidhar, Chief Justice of Orissa High Court. Justice D. Dash, Chairman and the members of the Record Room Digitization Centre (RRDC) Committee of the High Court were present on the occasion. The...

Delhi High Court Rejects Fourth Bail Plea Of Man Accused Of Pelting Stones At Police During Northeast Delhi Riots

The Delhi High Court has rejected the fourth bail plea of a man accused of assaulting and pelting stones at police personnel during the 2020 North-East Delhi riots.Justice Poonam A. Bamba denied bail to one Sadiq alias Sahil who was arrested on April 14, 2020. His first bail plea was dismissed as withdrawn in September 2020. Thereafter, he was denied bail by High Court and trial court...

Difference Of Opinion Between LG & Chief Minister On Jasmine Shah's Removal As DDCD Chairperson; Matter Referred To President, Delhi HC Told

The Delhi High Court on Tuesday was informed that the matter regarding removal of Dialogue and Development Commission of Delhi (DDCD) Vice Chairperson Jasmine Shah from the post has been referred for a decision by President of India, due to the difference of opinion between Lieutenant Governor Vinai Kumar Saxena and Chief Minister Arvind Kejriwal. The submission was made in a preliminary...

UP Govt Seeks 1-Day Time To File Reply On 'Triple Test' Query: Allahabad HC Extends Stay On Issuance Of ULB Polls Notification

The Uttar Pradesh Government today sought 1 day time to file its reply to the query raised by the Allahabad High Court on Monday whether, in the process of reserving the seats for the purpose of Urban Local Bodies' election, the State Government completed the 'Triple Test' formalities as mandated by the Supreme Court.Granting one day time to the UP Government, the bench of Justice Devendra...

![[Gujarat Riots Case] High Court Adjourns Hearing Of Teesta Setalvads Regular Bail Plea In State Police FIR To January 4 [Gujarat Riots Case] High Court Adjourns Hearing Of Teesta Setalvads Regular Bail Plea In State Police FIR To January 4](https://www.livelaw.in/h-upload/2022/12/13/500x300_449019-gujarat-high-court-teesta-setalvad.webp)