News Updates

Odisha Lawyers' Strike: BCI Suspends Licenses Of 14 More Advocates; Police Arrests 17 Lawyers

Continuing stringent action against the protesting lawyers of Sambalpur, the Bar Council of India (BCI) has suspended the licenses of practice of 14 more advocates on Tuesday. The press release of the BCI stated that the action was taken against them basing upon two First Information Reports (FIRs) dated 12th December, 2022. The BCI, the highest watch-dog of professional ethics...

Former Information Commissioners Express Concerns About Data Protection Bill Amending RTI Act

Former Information Commissioners have expressed concerns about the proposal to amend the Right to Information Act through the Data Protection Bill, as it would result in the complete exemption of personal information from disclosure.Mr. Ratnakar Gaikwad, Former Chief Secretary and CIC Maharashtra, Mr. Rahul Singh, State Information Commissioner Madhya Pradesh, Mr. Yashovardhan Azad,...

'Urgent Need Of A Credible Institutional Arbitration Centre In India': Delhi High Court Rejects Plea Alleging Bias In Composition Of DIAC

Dismissing a public interest litigation challenging the constitutional validity of Section 5 of the New Delhi International Arbitration Centre Act, the Delhi High Court has said that mere involvement and support of the Centre does not by itself raise apprehension of bias and impartiality.The provision provides for constitution of New Delhi International Arbitration Centre with following...

Judges Are Ahead In Carrying Out Paperless Courts; Lawyers Have To Be Brought On Board: Orissa High Court CJ Muralidhar

On Monday, 10 numbers of District Court Digitization Hubs (DCDHs) were virtually inaugurated in Odisha by the Chief Justice of India Dr. Justice DY Chandrachud. The event was attended by the Chief Justice of the Orissa High Court Dr. Justice S. Muralidhar, other puisne Judges of the High Court and Judicial Officers of the State. While speaking on the occasion, Justice Muralidhar...

Are Stray Dogs Roaming In HC Premises Its Residents? Bombay HC Contempt Notice To Lawyer Seeking Designated Location Within HC To Feed Strays

Observing that a lawyer's letter seeking a designated place within the Bombay High Court premises in Nagpur to feed dogs was for "publicity" in a sub-judice matter, the High Court issued a contempt notice against Advocate Ankita Kamlesh Shah and the civic officer who acted on her request. A division bench of Justices Sunil Shukre and M.W. Chandwani passed the order in 2006 ongoing PIL...

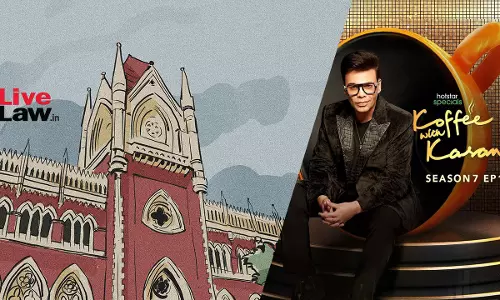

"Seeks Publicity": Calcutta High Court Dismisses PIL Against Talk Show 'Koffee With Karan' Over Alleged Racism & Obscenity

The Calcutta High Court recently dismissed a public interest litigation filed against talk show "Koffee with Karan", alleging that it contains vulgar language and promotes racism and obscenity. The Court noted that the petitioner had herself not watched the show and that the sole motive behind filing such petition was to gain 'publicity.' The petitioner had sought institution...

Whether Victims Of Sexual Offences Required To Be Impleaded As Party-Respondent In Bails And Appeals? Delhi High Court Asks Registry To Clarify

The Delhi High Court has asked its Registry to clarify whether there is any judicial decision or practice directions that require impleadment of victims or prosecutrix as a respondent in bails or criminal appeals relating to sexual offences under the IPC or POCSO Act. Justice Anup Jairam Bhambhani said the identity of victim or prosecutrix is supposed to be protected and kept confidential in...

Personal Liberty Cannot Be Curtailed On Mere Suspicion And Half-Baked Investigation: Madras HC Grants Bail To PMLA Accused

While allowing the bail plea of a man charged under the Prevention of Money Laundering Act, the Madras High Court reiterated that personal liberty could not be arbitrarily taken away unless in accordance with law.It is a settled law that the right of personal liberty and individual freedom, which is probably the most cherished, is not in any manner, arbitrarily to be taken away from anybody...

Orissa High Court Weekly Round-Up: 5 December-11 December, 2022

Nominal Index: 1. Bijaya Manjari Satpathy v. State of Orissa & Ors., 2022 LiveLaw (Ori) 158 2. Project Officer, Bharatpur Open Cast Project of Mahanadi Coalfields Ltd. v. Darsani Kumar Sahoo & Anr., 2022 LiveLaw (Ori) 159 3. Kalandi Charan Barik v. State of Odisha & Ors., 2022 LiveLaw (Ori) 160 4. JB v. State of Odisha & Ors., 2022...

After Participating In The Arbitral Proceedings Without Any Protest, Can't Object To Jurisdiction Later : MP High Court

The Madhya Pradesh High Court has held that a party which has participated in the arbitration proceedings without any protest or challenge as to the jurisdiction of the tribunal cannot for the first time challenge the jurisdiction of the tribunal under Section 37 of the A&C Act. The bench of Justice S.A. Dharmadhikari held that an issue as to non-jurisdiction of...

Venue Restriction Provision Contained In Section 42 of A&C Act, Not Applicable To Proceedings Seeking Enforcement Of Award: Delhi High Court

The Delhi High Court has reiterated that Section 42 of the Arbitration and Conciliation Act, 1996 (A&C Act) would have no application to proceedings seeking enforcement of arbitral award. The bench of Justice Yashwant Varma noted that execution application is neither an "arbitral proceeding" within the meaning of Section 42 of the A&C Act, nor is it a subsequent...

Employer Cannot Retain Performance Bank Guarantee After Acknowledging Of Due Performance: Delhi High Court

The High Court of Delhi has held that the employer cannot withhold the performance bank guarantee after acknowledgement of the due performance of the contract by the contractor. The bench of Justice V. Kameshwar Rao held that the employer cannot also withhold the performance bank guarantee merely for securing the amount of its counter-claims. Facts The parties entered into...