News Updates

Miserable State Of Affairs Prevalent In Delhi At Elementary Education Level: High Court Directs Schools To Ensure Admissions Under EWS Quota

Observing that a "miserable state of affairs" is prevalent in the national capital as far as implementation of Right to Education Act, 2009 at elementary education level is concerned, the Delhi High Court on Friday directed all schools to ensure that no child belonging to Economically Weaker Section (EWS) under the enactment is denied admission or treated with a conduct that is unwelcoming...

A Person Cannot Be Subjected To Rigors Of Externment By Relying On Same Cases, Violative Of Article 19: Bombay High Court

The Bombay High Court has said that subjecting a person to externment by relying upon the same cases, which were also subject matter of the previous orders of externment, is violative of Article 19 of Constitution.Quashing an a third order of externment passed by the Deputy Commissioner of Police, Nashik, Justice Prakash Naik observed that the externing authority relied on same cases that...

DCPCR Moves High Court Seeking CBI Probe Into Alleged Sexual Assault On 6-Yr-Old, Accuses Delhi Police Of Conducting 'Biased' Investigation

Delhi Commission for Protection of Child Rights (DCPCR) has moved Delhi High Court seeking re-investigation by Central Bureau of Investigation (CBI) into a 2018 case of alleged penetrative sexual assault on a 6-year-old girl, who later died at the hospital during treatment.The plea filed through Advocate R.H.A. Sikander argues that the Delhi Police conducted "shoddy, perfunctory and...

Loan Agreement Provides For Change Of Interest Rate ; No "Unfair Trade Practice" :NCDRC

The National Consumer Disputes Redressal Commission (NCDRC) bench comprising Mr. Dinesh Singh as Presiding Member and Justice Karuna Nand Bajpayee as Member disposed of an appeal that arose out of a consumer complaint filed by an individual(complainant/respondent) accusing ICICI bank (appellant) of unfair trade practices. This complaint was initially filed before the District Commission,...

Orissa High Court Criticizes Special Judge For Unnecessary Citations, Says Precedents Cannot Be Applied Mechanically

The Orissa High Court has criticised a Special NDPS Judge for mechanical reference to numerous case laws, without there being any relevance of those authorities to the facts and circumstances of the case at hand. While disapproving the manner in which the Special Judge appreciated the evidence on record, a Single Judge Bench of Justice Sashikanta Mishra observed, "Reading of the...

'Ongoing Parliamentary Session Cannot Stand In Way': Calcutta HC Issues Arrest Warrant On MHRD Joint Secretary For Evading Personal Appearance

The Calcutta High Court has issued an arrest warrant against the Joint Secretary of the Union Ministry of Human Resource Development for failing to make personal appearance in the case regarding the affiliation of Dr. B. R. Ambedkar Institute of Technology (DBRAIT). The Court had sought the stand of the Centre in the issue on affidavit twice before. The Circuit Bench of Justices Rajasekhar...

Accused Under SC/ST Act Cannot Directly Move High Court For Anticipatory Bail, Must Approach Special Courts First: Punjab & Haryana HC

The Punjab and Haryana High Court has ruled that an accused under the Scheduled Castes and the Scheduled Tribes (Prevention of Atrocities) Act, 1989 is first required to approach the Special Court for anticipatory bail as the high court's original jurisdiction under Section 438 CrPC in such cases stands excluded.Dismissing an anticipatory bail plea of an accused who had directly approached...

May Not Be Possible To Use Garian Land For Rehabilitation Of Those Affected By Koyna Dam Project: Bombay High Court

The Bombay High Court on Thursday observed that Gairan land cannot be allotted for private purposes and it may not be possible to use them for rehabilitation of project-affected persons of Koyna Dam in Satara district.A division bench of Acting Chief Justice S. V. Gangapurwala and Justice Santosh Chapalgaonkar was responding to suggestions of the amicus curiae in a suo motu PIL. According to...

S.33(5) POCSO Act | Child Witness Can Be Recalled For Just Decision Of Case; Bar On Special Courts Not Absolute: Kerala High Court

The Kerala High Court on Monday observed that the statutory bar imposed on Special Courts by Section 33(5) of the Protection of Children from Sexual Offences Act, 2012 (hereinafter referred to as 'POCSO Act') to ensure that a child is not repeatedly called to to testify in the court is not absolute. Justice Kauser Edappagath observed,"The bar under Section 33(5) of POCSO Act is not absolute....

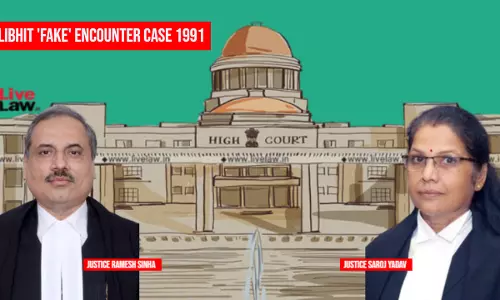

Pilibhit 'Fake' Encounter 1991| Police Can't Kill Accused Merely Because He Is A Dreaded Criminal: Allahabad High Court

While convicting 43 Uttar Police Personnel under Section 304 Part I IPC in connection with the 1991 Pilibhit Encounter case, the Allahabad High Court today sternly remarked that the police officers can't kill an accused merely because he/she is a dreaded criminal."It is not the duty of the police officers to kill the accused merely because he/she is a dreaded criminal. Undoubtedly, the...

Person Driving Vehicle Rashly With 'Knowledge' That It Would Cause Death By Accident Can Be Prosecuted U/S 304 (II) IPC: Calcutta High Court

The Calcutta High Court on Wednesday declined to quash proceedings under Section 304 Part II of the Indian Penal Code (IPC) in a motor accident case finding that the case was still at its investigation stage and that it was likely that the petitioner had "knowledge" that his reckless driving would lead to a fatal accident. Justice Bibek Chaudhuri pointed out that it was found from the...

Pilibhit Encounter 1991| "They Exceeded Power Given By Law": Allahabad High Court Convicts 43 Cops U/S 304 Part I IPC

The Allahabad High Court today convicted 43 Uttar Police Personnel under Section 304 Part I IPC in connection with the 1991 Pilibhit Encounter case wherein 10 Sikhs were killed treating them to be terrorists in an alleged fake encounter."It is not the duty of the police officers to kill the accused merely because he/she is a dreaded criminal. Undoubtedly, the police have to arrest the accused...