News Updates

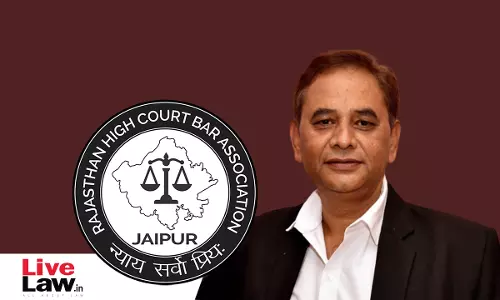

Advocate Mahendra Shandilya Elected As President Of Rajasthan High Court Bar Association

Advocate Mahendra Shandilya has won the election for the post of President of Rajasthan High Court Bar Association as per results declared recently. The total number of votes cast were 4494 on elections which took place on Friday. Shandilya won the election for the presidential post by a margin of 542 Votes, securing 1621 votes out, defeating his nearest contender Prahlad Sharma,...

Right To Be Forgotten | Kerala High Court Says Legislature Alone Competent To Enumerate Grounds But Till Then Courts Can Decide On Case-To-Case Basis

Observing that legislature alone is competent to enumerate grounds for claiming right to be forgotten and carve out exceptions to the claims of such a right, the Kerala High Court on Thursday said in the absence of legislation, the court may have to recognise the right and direct removal of such content available online on a case-to-case basis.The division bench Justice A. Muhamed Mustaque...

Moratorium Under Companies Act, 2013, Parties Cannot Be Referred To Arbitration: Delhi High Court

The Delhi High Court has ruled that the moratorium granted by the National Company Law Appellate Tribunal (NCLAT), staying the institution of suits and proceedings against the Corporate Debtor, after the resolution process is initiated against it under Sections 241 and 242 of the Companies Act, 2013, is akin to an order of moratorium passed under Section 14 of the Insolvency and...

NCLT Delhi Imposes Cost Of Rs. 1 Lakh On Suspended Director

The National Company Law Tribunal ("NCLT"), New Delhi Bench, comprising of Shri Bachu Venkat Balaram Das (Judicial Member) and Shri L.N. Gupta (Technical Member), while adjudicating an application filed in Indian Bank (Erstwhile Allahabad Bank) v Nimitaya Hotel & Resorts Pvt. Ltd., has imposed a cost of Rs. 1 Lakh upon the Suspended Director of Corporate Debtor...

Coal Transportation From Pitheads Of Mines To Railway Sidings Not "Mining Of Mineral": CESTAT

The Delhi Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has held that the coal transported from the pitheads of the mines to the railway sidings would be classified under the head "transport of goods by road" service, and the activity does not involve any taxable service in relation to "mining of minerals."The two-member bench headed by Justice Dilip Gupta...

Raula Gundi Is A Chewing Tobacco Without Lime Tube, Attracts 28% GST: AAR

The Orissa Authority for Advance Ruling (AAR) has held that "Raula Gundi," which is "chewing tobacco without lime tubes," attracts 28% GST with a 160% Compensation Cess.The two members of the bench, G.K. Pati and P.K. Mohanty have observed that "Raula Gundi," i.e., chewable gundi, is "chewing tobacco," the principal or predominant ingredient of which is tobacco.The applicant is in the business...

Consider Publicizing Crowdfunding Platform For Rare Diseases On TV, Radio To Attract More Voluntary Donations: Delhi High Court To Centre

The Delhi High Court has asked the Central Government's Ministry of Health and Family Welfare to consider publicizing crowdfunding for treatment of rare diseases through television, radio or any other media platform in order to attract more voluntary donations from the public. Observing that the efforts made so far have not yielded much results as the issue of rare diseases has not gained...

Tax deposited During Search Not Voluntary: Delhi High Court Directs GST Dept. To Return Rs.1.80 Crores With Interest

The Delhi High Court has directed the GST department to return the amount of Rs. 1.80 crores along with 6% interest as the recovery of tax made during the search was not voluntary.The division bench of Justice Rajiv Shakdher and Justice Tara Vitasta Ganju has observed that no recovery of tax should be made during search, inspection, or investigation unless it is voluntary.The...

Age At The Time Of Commission Of Offence Has To Be Taken And Not When The Proceedings Initiated: Delhi High Court

The Delhi High Court upheld the prosecution for an undisclosed foreign bank account, observing that the age at the time of the offense must be taken into account, not when the proceedings were initiated.The single judge bench of Justice Suresh Kumar Kait has relied on the decision of the Delhi High Court in the case of Pradip Burman vs. Income Tax Office, in which it was held...

'In Ideal Society, Girls & Women Must Be Able To Walk On Streets At Any Point Of Time': Kerala High Court

The Kerala High Court on Thursday said that in an ideal society, girls and women must be able to walk on the streets at any point of time, be that day or night. However, it said such an atmosphere will require the security systems to be as advanced.Observing that concerns of parents could not brushed aside just because the children had attained age of majority, Justice Devan Ramachandran said...

Technical Consideration Cannot Come In The Way Of Substantial Justice: Bombay High Condones ITR-filing Delay

The Bombay High Court has condoned a year-long delay in filing the Income Tax Return (ITR) over "genuine hardships."The division bench of Justice Dhiraj Singh Thakur and Justice Abhay Ahuja has observed that technical considerations cannot come in the way of substantial justice. It is neither an allegation of malafide nor an allegation that the delay has been deliberate.The petitioner/assessee...

Delhi High Court Grants Interim Protection Against Retrospective Denial Of Concessional Rate Of Customs Duty To Solar Units

The Delhi High Court has granted interim protection against the retrospective denial of the vested right of the benefit of concessional rate of duty under project import regulations granted to solar power developers.The Division Bench of Justice Rajiv Shakdher and Justice Tara Vitasta Ganju have directed the customs authorities to refrain from taking any precipitative steps at the time of...