News Updates

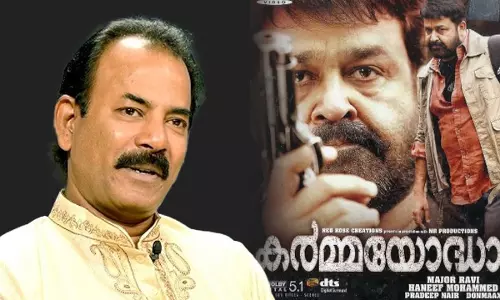

'Karmayodha' Film Plagiarism: Kerala Court Orders Major Ravi & Makers To Pay ₹30L To Scriptwriter Regi Mathew

The Commercial Court, Kottayam recently passed a judgment against Major Ravi and Mohammed Haneef, who are the director and producer of the 2012 Mohanlal-starrer movie 'Karmayodha', to pay a compensation of Rs. 30 lakhs to scriptwriter Regi Mathew.Sri. Manish D. A., Principal Sub-Judge, decided the suit preferred by Regi Mathew seeking permanent prohibitory injunction, declaration, damages and...

Delhi Court Acquits Social Activist Shabnam Hashmi In COVID Lockdown Protest Case

A Delhi court has acquitted social activist Shabnam Hashmi and another woman, Seema Joshi, in a case alleging violation of COVID-19 lockdown norms during a protest in Dwarka in October 2020. JMFC Divya Yadav of Dwarka Courts said that the prosecution failed to prove the charges beyond reasonable doubt.The FIR was registered at Dwarka South police station for the offences under Sections 269,...

CCI Approves Coinbase Deal To Buy Minority Stake In CoinDCX Parent

The Competition Commission of India (CCI) on Tuesday approved Coinbase Global Inc.'s proposal to acquire a minority stake in DCX Global Limited, the holding company behind the CoinDCX cryptocurrency exchange in India. Coinbase, a US-based cryptocurrency exchange operating in over 100 countries, has recently entered the Indian market. DCX Global Limited, incorporated in Mauritius, owns...

Goa Nightclub Fire: Delhi Court Grants Two Days Transit Remand Of Owners Saurabh, Gaurav Luthra

A Delhi Court on Tuesday granted two days transit remand of Saurabh and Gaurav Luthra, owners of Birch by Romeo Lane nightclub in Goa which caught fire and killed atleast 25 people.The duo was produced by the Goa Police before Judicial Magistrate Twinkle Chawla in the Patiala House Courts. The police sought transit remand of three days.The Court directed the police to provide medicines to...

Why Delhi Court Dismissed ED's Complaint Against Rahul Gandhi, Sonia Gandhi In National Herald Case

A Delhi Court has refused to take cognizance of Enforcement Directorate's money laundering complaint in the National Herald case allegedly involving Congress leaders Rahul Gandhi and Sonia Gandhi. Special Judge Vishal Gogne of Rouse Avenue Courts passed the order dismissing the prosecution complaint, which is equivalent to a chargesheet. Here are reasons why the Court did so. Money...

No Move Yet On Another ₹140-Crore Rights Issue: Aakash Tells NCLAT Amid Dispute With Byju's

Aakash Educational Services Ltd told the National Company Law Appellate Tribunal (NCLAT), Chennai on Monday that it has not yet initiated any process for a second tranche of its rights issue to raise about Rs 140 crore and that, if it decides to do so, Think and Learn Pvt Ltd will be given all statutory notices along with an extended period of at least 30 days. The submission was made when...

NCLT Mumbai Sanctions Vedanta Demerger Plan

The National Company Law Tribunal (NCLT) at Mumbai on Tuesday sanctioned Vedanta Ltd's demerger, approving the restructuring scheme under which the metal and mining conglomerate will split its businesses into separate sector focused entities. The order was pronounced by a bench comprising Judicial Member Nilesh Sharma and Technical Member Charanjeet Singh. "From the material on record,...

Delhi Court Denies Anticipatory Bail To Law Graduate In Fake LLB Degree Case, Cites 'Syndicate' Operating In Delhi Bar Council

A Delhi Court has denied anticipatory bail to a law graduate accused of obtaining enrolment with the Bar Council of Delhi (BCD) on the basis of a fake LLB degree and marksheet.Additional Sessions Judge Shunali Gupta of Saket Courts said that the allegations against J Vasanthan were serious in nature and that the suspension order issued by BCD said that verification of his LLB Degree...

Centre Projects ₹47,700 Crore Revenue Loss Amid GST Rate-Rationalisation

The Centre has estimated a Net Negative Revenue loss of ₹ 47,700 crore due to GST rate-rationalisation. However, it was clarified that shift from 28% to the 40% tax bracket were projected to account for an additional revenue of approximately ₹45,570 Crore. The Finance Ministry in response to whether a Group of Ministers were to be constituted by the GST Council to address the...

Last National Lok Adalat Of 2025 In Gujarat Disposes Off Over 5 Lakh Cases, Awards ₹1379 Crore

The last National Lok Adalat of 2025 was organized on December 13 across Gujarat under the aegis of National Legal Service Authority (NALSA), which disposed off over 5 Lakh cases and passed awards amounting to Rs. 1379.6 Crores. Gujarat High Court Chief Justice Sunita Agarwal who is also the Patron-in-Chief of Gujarat State Legal Service Authority (GSLSA) and Senior Most High Court Judge...

National Herald Case: Delhi Court Refuses To Take Cognizance Of ED's Complaint Against Rahul Gandhi, Sonia Gandhi

A Delhi Court on Tuesday refused to take cognizance of Enforcement Directorate's money laundering complaint in the National Herald case allegedly involving Congress leaders Rahul Gandhi and Sonia Gandhi. Special Judge Vishal Gogne of Rouse Avenue Courts pronounced the order.The court held that the prosecution complaint filed by the Enforcement Directorate (ED) against the Gandhis was...

Man Attempts Suicide By Setting Himself On Fire Outside Bombay High Court, Sustains 55% Burn Injuries

A regular Monday afternoon outside the Gate No. 4 of the Bombay High Court witnessed chaotic scenes after suddenly 53-year-old man started sloganeering against an advocate and the Collector of Kankavli city and soon poured petrol on his person and set himself ablaze.The Police personnel stationed in the High Court, rushed to help the man identified as Prakash Sawant and somehow managed to...