Bombay HC Dismisses IIT Bombay's Appeal Against Payment Of Gratuity To Contract Workers

Shreya Shekhar

9 Oct 2024 12:31 PM IST

Next Story

9 Oct 2024 12:31 PM IST

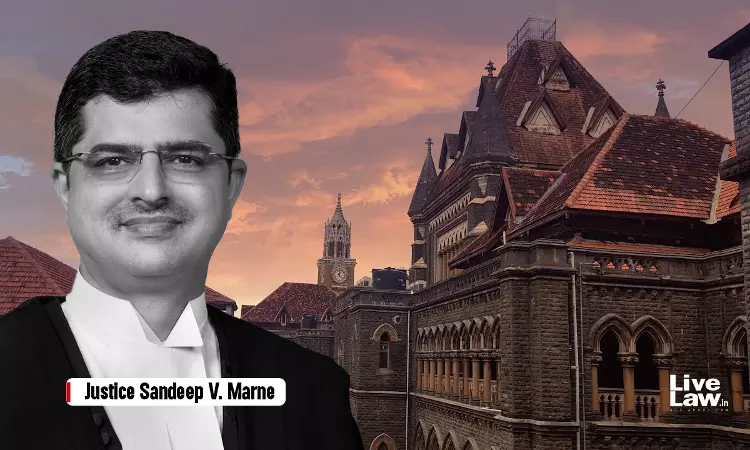

On 4th October, a Single Bench of the Bombay High Court comprising of Justice Sandeep V. Marne heard a petition filed by Indian Institute of Technology, Bombay (“IIT Bombay”) challenging the order passed by Assistant Labour Commissioner (“Central”) acting as Controlling Authority under the Payment of Gratuity Act 1972, (“PG Act”), later then upheld by the Appellate Authority....